Form Br 1040 - Individual Return - City Of Big Rapids Income Tax - 2005

ADVERTISEMENT

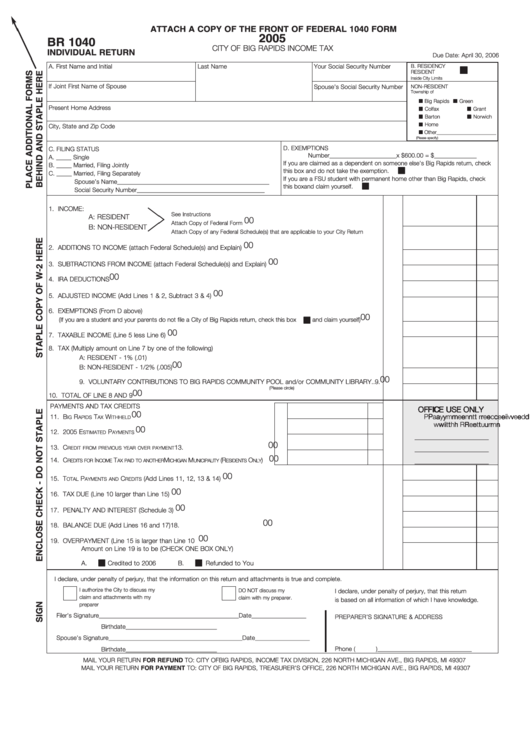

ATTACH A COPY OF THE FRONT OF FEDERAL 1040 FORM

2005

BR 1040

CITY OF BIG RAPIDS INCOME TAX

INDIVIDUAL RETURN

Due Date: April 30, 2006

A. First Name and Initial

Last Name

Your Social Security Number

B. RESIDENCY

RESIDENT

Inside City Limits

If Joint First Name of Spouse

Spouse’s Social Security Number

NON-RESIDENT

Township of

Big Rapids

Green

Present Home Address

Colfax

Grant

Barton

Norwich

Home

City, State and Zip Code

Other_______________________

(Please specify)

D. EXEMPTIONS

C. FILING STATUS

Number______________________x $600.00 = $______________

A. _____ Single

If you are claimed as a dependent on someone else’s Big Rapids return, check

B. _____ Married, Filing Jointly

this box and do not take the exemption.

C. _____ Married, Filing Separately

If you are a FSU student with permanent home other than Big Rapids, check

Spouse’s Name__________________________________________________

this box and claim yourself.

Social Security Number __________________________________________

1. INCOME:

See Instructions

A: RESIDENT

00

......................................................................

1.

Attach Copy of Federal Form

B: NON-RESIDENT

Attach Copy of any Federal Schedule(s) that are applicable to your City Return

00

2. ADDITIONS TO INCOME (attach Federal Schedule(s) and Explain) ..........................................................................

2.

00

3. SUBTRACTIONS FROM INCOME (attach Federal Schedule(s) and Explain)..............................................................

3.

00

4. IRA DEDUCTIONS ....................................................................................................................................................

4.

00

5. ADJUSTED INCOME (Add Lines 1 & 2, Subtract 3 & 4)............................................................................................

5.

6. EXEMPTIONS (From D above)

00

..............

6.

(If you are a student and your parents do not file a City of Big Rapids return, check this box

and claim yourself)

00

7. TAXABLE INCOME (Line 5 less Line 6)......................................................................................................................

7.

8. TAX (Multiply amount on Line 7 by one of the following)

A: RESIDENT - 1% (.01)

00

B: NON-RESIDENT - 1/2% (.005) ................................................................................................................

8.

00

9. VOLUNTARY CONTRIBUTIONS TO BIG RAPIDS COMMUNITY POOL and/or COMMUNITY LIBRARY ..

9.

(Please circle)

00

10. TOTAL OF LINE 8 AND 9........................................................................................................................................

10.

PAYMENTS AND TAX CREDITS

O O F F F F I I C C E E U U S S E E O O N N L L Y Y

00

11. B

R

T

W

.............................................................................. 11.

P P a a y y m m e e n n t t r r e e c c e e i i v v e e d d

IG

APIDS

AX

ITHHELD

w w i i t t h h R R e e t t u u r r n n

00

12. 2005 E

P

............................................................................ 12.

STIMATED

AYMENTS

_____________________

00

13. C

...................................................... 13.

_____________________

REDIT FROM PREVIOUS YEAR OVER PAYMENT

00

14. C

I

T

M

M

(R

O

) .... 14.

_____________________

REDITS FOR

NCOME

AX PAID TO ANOTHER

ICHIGAN

UNICIPALITY

ESIDENTS

NLY

00

15. T

P

C

(Add Lines 11, 12, 13 & 14)........................................................................................

15.

OTAL

AYMENTS AND

REDITS

00

16. TAX DUE (Line 10 larger than Line 15) ....................................................................................................................

16.

00

17. PENALTY AND INTEREST (Schedule 3)..................................................................................................................

17.

00

18. BALANCE DUE (Add Lines 16 and 17) ..................................................................................................................

18.

00

19. OVERPAYMENT (Line 15 is larger than Line 10 ......................................................................................................

19.

Amount on Line 19 is to be (CHECK ONE BOX ONLY)

A.

Credited to 2006

B.

Refunded to You

I declare, under penalty of perjury, that the information on this return and attachments is true and complete.

I authorize the City to discuss my

DO NOT discuss my

I declare, under penalty of perjury, that this return

claim and attachments with my

claim with my preparer.

is based on all information of which I have knowledge.

preparer

Filer’s Signature ______________________________________________ Date __________________

PREPARER’S SIGNATURE & ADDRESS

Birthdate ______________________________

Spouse’s Signature ____________________________________________ Date __________________

Phone (

)_______________________________

Birthdate ______________________________

MAIL YOUR RETURN FOR REFUND TO: CITY OF BIG RAPIDS, INCOME TAX DIVISION, 226 NORTH MICHIGAN AVE., BIG RAPIDS, MI 49307

MAIL YOUR RETURN FOR PAYMENT TO: CITY OF BIG RAPIDS, TREASURER’S OFFICE, 226 NORTH MICHIGAN AVE., BIG RAPIDS, MI 49307

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2