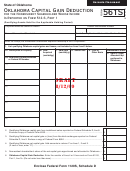

Oklahoma Capital Gain Deduction for Trusts and Estates Filing Form 513NR

Title 68 O.S. Section 2358 and Rule 710:50-15-48

General Information

Taxpayers can deduct qualifying gains receiving capital gain treatment which are included in Federal taxable

income. “Qualifying gains receiving capital treatment” means the amount of net capital gains, as defined under

Internal Revenue Code Section 1222(11). The qualifying gain must result from:

1. the sale of real or tangible personal property located within Oklahoma that has been owned for at least

five uninterrupted years prior to the date of the transaction that gave rise to the capital gain; or

2. the sale of stock or an ownership interest in an Oklahoma company, limited liability company, or part-

nership where such stock or ownership interest has been owned for at least three (two for individuals)

uninterrupted years prior to the date of the sale.

An Oklahoma company, limited liability company or partnership is an entity whose primary headquar-

ters has been located in Oklahoma for at least three uninterrupted years prior to the date of sale.

A capital loss carryover from qualified property reduces the current year gains from eligible property.

Pass-through entities...

Capital gain from qualifying property, as described above, held by a pass-through entity is eligible for the

Oklahoma capital gain deduction, provided the person has been a member of the pass-through entity for an

uninterrupted period of the applicable three (two for individuals) or five years and the pass-through entity has

held the asset for not less than the applicable three (two for individuals) or five uninterrupted years prior to the

date of the transaction that created the capital gain. The type of asset sold, as shown in 1 and 2 above, deter-

mines whether the applicable number of uninterrupted years is three (two for individuals) or five. The pass-

through entity must provide supplemental information to the person identifying the pass-through of qualifying

capital gains.

Installment sales...

Qualifying gains included in Federal taxable income for the current year, which are derived from installment

sales are eligible for exclusion provided the appropriate holding periods are met.

Specific Instructions

Complete this form using the Capital Gains and Losses from the Federal Schedule D that have not

been distributed to the beneficiary(ies). Do not include any portion of the capital gain or loss included in the

income distribution deduction on Form 513NR. The beneficiary will compute the capital gain deduction on their

own income tax return.

Line 1: List qualifying Oklahoma capital gains and losses from the Federal Schedule D, line 6. In Column A,

line A1 enter the description of the property as shown in Federal Column A. On line A2 enter either the Okla-

homa location of the real or tangible personal property sold or the Federal Identification Number of the com-

pany, limited liability company or partnership whose stock or ownership interest was sold. Complete Columns

B through E using the information from the corresponding columns of the Federal Schedule D. In Column F

enter the portion of the capital gain or loss included on Form 513NR, Column A, line 4 but not included in the

income distribution deduction on line 16. In Column G enter the portion of the qualifying Oklahoma capital gain

or loss reported in Column F which was sourced to Oklahoma on Form 513NR, Column B, line 4 but not

included in the income distribution deduction on line 16. Do not include gains and losses reported on Form

561-F lines 2 through 5.

1

1 2

2 3

3