Instructon For A Form Wh-432 (2002)

ADVERTISEMENT

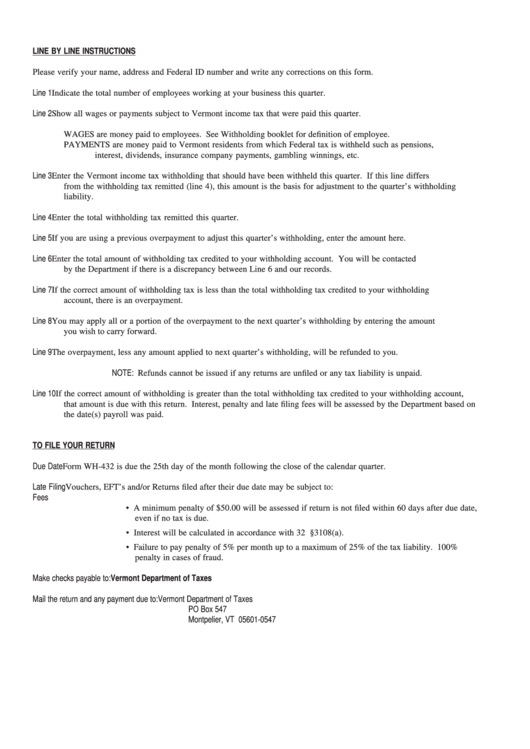

LINE BY LINE INSTRUCTIONS

Please verify your name, address and Federal ID number and write any corrections on this form.

Line 1

Indicate the total number of employees working at your business this quarter.

Line 2

Show all wages or payments subject to Vermont income tax that were paid this quarter.

WAGES are money paid to employees. See Withholding booklet for definition of employee.

PAYMENTS are money paid to Vermont residents from which Federal tax is withheld such as pensions,

interest, dividends, insurance company payments, gambling winnings, etc.

Line 3

Enter the Vermont income tax withholding that should have been withheld this quarter. If this line differs

from the withholding tax remitted (line 4), this amount is the basis for adjustment to the quarter’s withholding

liability.

Line 4

Enter the total withholding tax remitted this quarter.

Line 5

If you are using a previous overpayment to adjust this quarter’s withholding, enter the amount here.

Line 6

Enter the total amount of withholding tax credited to your withholding account. You will be contacted

by the Department if there is a discrepancy between Line 6 and our records.

Line 7

If the correct amount of withholding tax is less than the total withholding tax credited to your withholding

account, there is an overpayment.

Line 8

You may apply all or a portion of the overpayment to the next quarter’s withholding by entering the amount

you wish to carry forward.

Line 9

The overpayment, less any amount applied to next quarter’s withholding, will be refunded to you.

NOTE: Refunds cannot be issued if any returns are unfiled or any tax liability is unpaid.

Line 10 If the correct amount of withholding is greater than the total withholding tax credited to your withholding account,

that amount is due with this return. Interest, penalty and late filing fees will be assessed by the Department based on

the date(s) payroll was paid.

TO FILE YOUR RETURN

Due Date

Form WH-432 is due the 25th day of the month following the close of the calendar quarter.

Late Filing

Vouchers, EFT’s and/or Returns filed after their due date may be subject to:

Fees

• A minimum penalty of $50.00 will be assessed if return is not filed within 60 days after due date,

even if no tax is due.

• Interest will be calculated in accordance with 32 V.S.A. §3108(a).

• Failure to pay penalty of 5% per month up to a maximum of 25% of the tax liability. 100%

penalty in cases of fraud.

Make checks payable to:

Vermont Department of Taxes

Mail the return and any payment due to:

Vermont Department of Taxes

PO Box 547

Montpelier, VT 05601-0547

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1