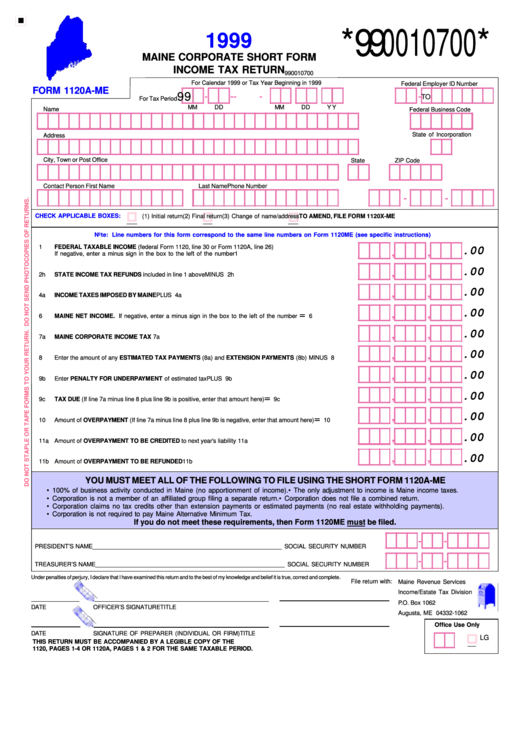

Form 1120a-Me - Maine Corporate Short Form Income Tax Return - 1999

ADVERTISEMENT

*990010700*

1999

MAINE CORPORATE SHORT FORM

INCOME TAX RETURN

990010700

For Calendar 1999 or Tax Year Beginning in 1999

Federal Employer ID Number

FORM 1120A-ME

99

-

-

-

-

-

TO

For Tax Period

MM

DD

MM

DD

Y Y

Name

Federal Business Code

State of Incorporation

Address

City, Town or Post Office

ZIP Code

State

Contact Person First Name

Last Name

Phone Number

-

-

CHECK APPLICABLE BOXES:

(1) Initial return

(2) Final return

(3) Change of name/address

TO AMEND, FILE FORM 1120X-ME

Note: Line numbers for this form correspond to the same line numbers on Form 1120ME (see specific instructions)

1

FEDERAL TAXABLE INCOME (federal Form 1120, line 30 or Form 1120A, line 26)

.00

,

,

If negative, enter a minus sign in the box to the left of the number .................................................................. 1

.00

,

,

2h

STATE INCOME TAX REFUNDS included in line 1 above .................................................................... MINUS 2h

.00

,

,

4a

INCOME TAXES IMPOSED BY MAINE ................................................................................................... PLUS 4a

.00

=

,

,

6

MAINE NET INCOME. If negative, enter a minus sign in the box to the left of the number .....................

6

.00

,

,

7a

MAINE CORPORATE INCOME TAX .................................................................................................................. 7a

.00

,

,

8

Enter the amount of any ESTIMATED TAX PAYMENTS (8a) and EXTENSION PAYMENTS (8b) ........ MINUS 8

.00

,

,

9b

Enter PENALTY FOR UNDERPAYMENT of estimated tax .................................................................... PLUS 9b

.00

,

,

=

9c

TAX DUE (If line 7a minus line 8 plus line 9b is positive, enter that amount here) .......................................

9c

.00

,

,

=

10

Amount of OVERPAYMENT (If line 7a minus line 8 plus line 9b is negative, enter that amount here) .........

10

.00

,

,

11a Amount of OVERPAYMENT TO BE CREDITED to next year’ s liability ............................................................. 11a

.00

,

,

11b Amount of OVERPAYMENT TO BE REFUNDED ............................................................................................. 11b

YOU MUST MEET ALL OF THE FOLLOWING TO FILE USING THE SHORT FORM 1120A-ME

• 100% of business activity conducted in Maine (no apportionment of income).

• The only adjustment to income is Maine income taxes.

• Corporation is not a member of an affiliated group filing a separate return.

• Corporation does not file a combined return.

• Corporation claims no tax credits other than extension payments or estimated payments (no real estate withholding payments).

• Corporation is not required to pay Maine Alternative Minimum Tax.

If you do not meet these requirements, then Form 1120ME must be filed.

-

-

PRESIDENT’ S NAME __________________________________________________________ SOCIAL SECURITY NUMBER

-

-

TREASURER’ S NAME __________________________________________________________ SOCIAL SECURITY NUMBER

.

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is true, correct and complete

File return with:

Maine Revenue Services

Income/Estate Tax Division

P.O. Box 1062

DATE

OFFICER’ S SIGNATURE

TITLE

Augusta, ME 04332-1062

Office Use Only

DATE

SIGNATURE OF PREPARER (INDIVIDUAL OR FIRM)

TITLE

LG

THIS RETURN MUST BE ACCOMPANIED BY A LEGIBLE COPY OF THE U.S. CORPORATION INCOME TAX RETURN FEDERAL FORM

1120, PAGES 1-4 OR 1120A, PAGES 1 & 2 FOR THE SAME TAXABLE PERIOD.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1