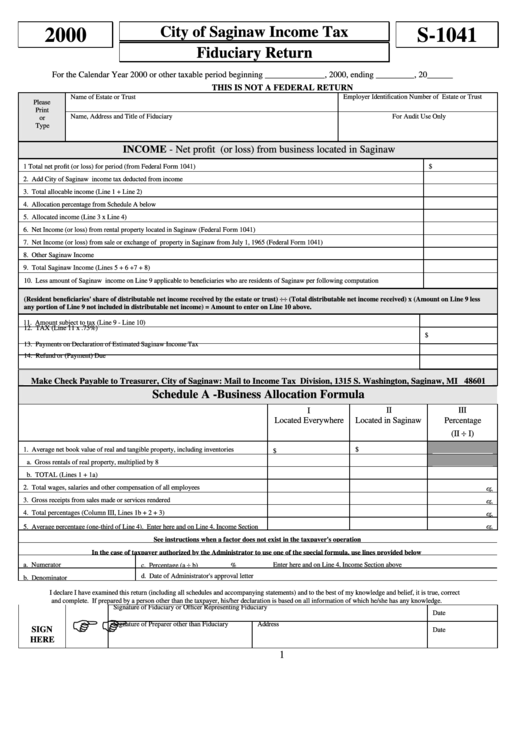

Form S-1041 - City Of Saginaw Income Tax Fiduciary Return - 2000

ADVERTISEMENT

City of Saginaw Income Tax

2000

S-1041

Fiduciary Return

For the Calendar Year 2000 or other taxable period beginning ______________, 2000, ending _________, 20______

THIS IS NOT A FEDERAL RETURN

Name of Estate or Trust

Employer Identification Number of Estate or Trust

Please

Print

Name, Address and Title of Fiduciary

For Audit Use Only

or

Type

INCOME - Net profit (or loss) from business located in Saginaw

1 Total net profit (or loss) for period (from Federal Form 1041)

$

2. Add City of Saginaw income tax deducted from income

3. Total allocable income (Line 1 + Line 2)

4. Allocation percentage from Schedule A below

5. Allocated income (Line 3 x Line 4)

6. Net Income (or loss) from rental property located in Saginaw (Federal Form 1041)

7. Net Income (or loss) from sale or exchange of property in Saginaw from July 1, 1965 (Federal Form 1041)

8. Other Saginaw Income

9. Total Saginaw Income (Lines 5 + 6 +7 + 8)

10. Less amount of Saginaw income on Line 9 applicable to beneficiaries who are residents of Saginaw per following computation

(Resident beneficiaries' share of distributable net income received by the estate or trust) ÷ ÷ (Total distributable net income received) x (Amount on Line 9 less

any portion of Line 9 not included in distributable net income) = Amount to enter on Line 10 above.

11. Amount subject to tax (Line 9 - Line 10)

12. TAX (Line 11 x .75%)

$

13. Payments on Declaration of Estimated Saginaw Income Tax

14. Refund or (Payment) Due

Make Check Payable to Treasurer, City of Saginaw: Mail to Income Tax Division, 1315 S. Washington, Saginaw, MI 48601

Schedule A -Business Allocation Formula

I

II

III

Located Everywhere

Located in Saginaw

Percentage

(II ÷ I)

1. Average net book value of real and tangible property, including inventories

$

$

a. Gross rentals of real property, multiplied by 8

b. TOTAL (Lines 1 + 1a)

2. Total wages, salaries and other compensation of all employees

%

3. Gross receipts from sales made or services rendered

%

4. Total percentages (Column III, Lines 1b + 2 + 3)

%

5. Average percentage (one-third of Line 4). Enter here and on Line 4, Income Section

%

See instructions when a factor does not exist in the taxpayer's operation

In the case of taxpayer authorized by the Administrator to use one of the special formula, use lines provided below

c. Percentage (a ÷ b)

a. Numerator

Enter here and on Line 4, Income Section above

%

b. Denominator

d. Date of Administrator's approval letter

I declare I have examined this return (including all schedules and accompanying statements) and to the best of my knowledge and belief, it is true, correct

and complete. If prepared by a person other than the taxpayer, his/her declaration is based on all information of which he/she has any knowledge.

F F

Signature of Fiduciary or Officer Representing Fiduciary

Date

SIGN

Signature of Preparer other than Fiduciary

Address

Date

HERE

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2