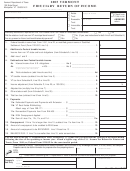

PARTNERSHIP WITH NONRESIDENT OR CORPORATE PARTNERS

FORM

NEBRASKA SCHEDULE I — Apportionment of Income

1065N

nebraska

NEBRASKA SCHEDULE ELP — Income Reported to Partners by Electing Large Partnership

department

• If you use this schedule, read instructions

of revenue

Name as Shown on Form 1065N

Nebraska Identification Number

25 —

NEBRASKA SCHEDULE I — Apportionment of Income

• See instructions

1 Nebraska adjusted income (line 5, Form 1065N)....................................................................................................

1

.

2 Nebraska apportionment factor (line 15 below)..............................................................

2

3 Income apportioned to Nebraska (line 1 multiplied by line 2). Enter here and on line 6, Form 1065N ..................

3

NEBRASKA

APPORTIONMENT

APPORTIONMENT FACTORS

TOTAL

NEBRASKA

FACTOR

Sales or Gross Receipts

4 Sales or gross receipts less returns and allowances ...............

4

5 Sales delivered or shipped to purchasers in Nebraska:

a Shipped from outside Nebraska ..................................................................................

5 a

b Shipped from within Nebraska.....................................................................................

5 b

6 Sales shipped from Nebraska to the U.S. government....................................................

6

7 Ordinary income (loss) from other partnerships, etc. ...............

7

8 Interest on sales of tangible property .......................................

8

9 Gross rents...............................................................................

9

10 Net farm profit (loss)................................................................. 10

11 Net gain on sales of intangible property................................... 11

12 Gross receipts from sales of tangible personal and real

property not included above ..................................................... 12

13 Other income (attach schedule) ................................................ 13

14 TOTAL SALES OR GROSS RECEIPTS................................... 14

15 Nebraska apportionment factor (divide line 14, NEBRASKA column, by line 14, TOTAL column, calculate

.

to five decimal places and round to four). Enter here and on line 2 above............................................................. 15

NEBRASKA SCHEDULE ELP — Income Reported to Partners by Electing Large Partnership Filing Federal Form 1065-B

• See instructions

1 Taxable income (loss) from passive activities..........................................................................................................

1

2 Taxable income (loss) from other activities .............................................................................................................. 2

3 Net capital gain (loss) from passive activities........................................................................................................... 3

4 Net capital gain (loss) from other activities............................................................................................................... 4

5 Guaranteed payments.............................................................................................................................................. 5

6 Income from discharge of indebtedness .................................................................................................................. 6

7 Add: Tax exempt state and local bond interest (from non-Nebraska sources) ......................................................... 7

8 Subtract: Income from U.S. government obligations (see instructions) .................................................................... 8

9 Other (attach schedule)............................................................................................................................................ 9

10 Total of lines 1 through 9 (enter here and on line 5, Form 1065N)........................................................................... 10

1

1 2

2 3

3 4

4