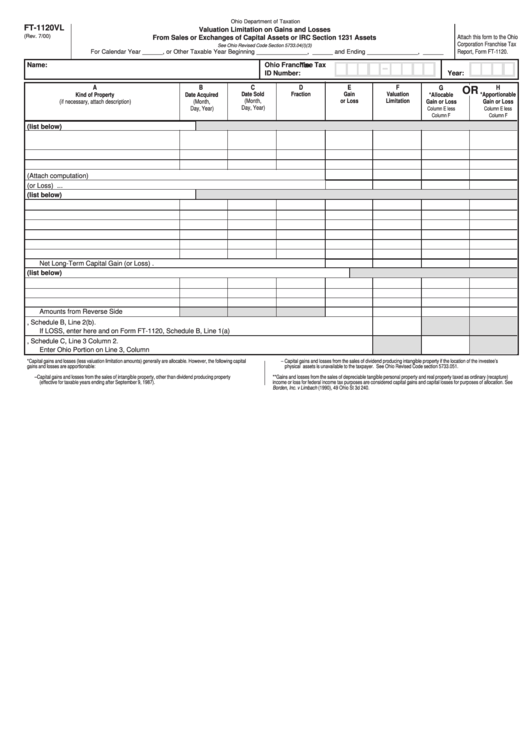

Form Ft-1120vl - Valuation Limitation On Gains And Losses From Sales Or Exchanges Of Capital Assets Or Irc Section 1231 Assets

ADVERTISEMENT

Ohio Department of Taxation

FT-1120VL

Valuation Limitation on Gains and Losses

(Rev. 7/00)

Attach this form to the Ohio

From Sales or Exchanges of Capital Assets or IRC Section 1231 Assets

Corporation Franchise Tax

See Ohio Revised Code Section 5733.04(I)(3)

For Calendar Year ______, or Other Taxable Year Beginning _______________, ______ and Ending _______________, ______

Report, Form FT-1120.

Name:

Ohio Franchise Tax

Tax

ID Number:

Year:

A

B

C

D

E

F

G

H

OR

Date Sold

Fraction

Gain

Valuation

Kind of Property

Date Acquired

*Allocable

*Apportionable

(Month,

or Loss

Limitation

(if necessary, attach description)

(Month,

Gain or Loss

Gain or Loss

Day, Year)

Day, Year)

Column E less

Column E less

Column F

Column F

1. Short-Term Capital Gains and Losses (list below)

2. Unused Capital Loss Carryover (Attach computation) ....................................................................

3. Net Short-Term Capital Gain (or Loss) ...........................................................................................

4. Long-Term Capital Gains and Losses (list below)

Net Long-Term Capital Gain (or Loss) ............................................................................................

5. Gains and Losses from the Sale or Exchange of Property Used in a Trade or Business (list below)

Amounts from Reverse Side

6. Total Valuation Limitation. If GAIN enter here and on Form FT-1120, Schedule B, Line 2(b).

If LOSS, enter here and on Form FT-1120, Schedule B, Line 1(a) .........................................................................

7. Total Allocable Gain or Loss. Enter here and on Form FT-1120, Schedule C, Line 3 Column 2.

Enter Ohio Portion on Line 3, Column 1 .................................................................................................................

*Capital gains and losses (less valuation limitation amounts) generally are allocable. However, the following capital

– Capital gains and losses from the sales of dividend producing intangible property if the location of the investee’s

gains and losses are apportionable:

physical assets is unavailable to the taxpayer. See Ohio Revised Code section 5733.051.

– Capital gains and losses from the sales of intangible property, other than dividend producing property

**Gains and losses from the sales of depreciable tangible personal property and real property taxed as ordinary (recapture)

(effective for taxable years ending after September 9, 1987).

income or loss for federal income tax purposes are considered capital gains and capital losses for purposes of allocation. See

Borden, Inc. v Limbach (1990), 49 Ohio St 3d 240.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2