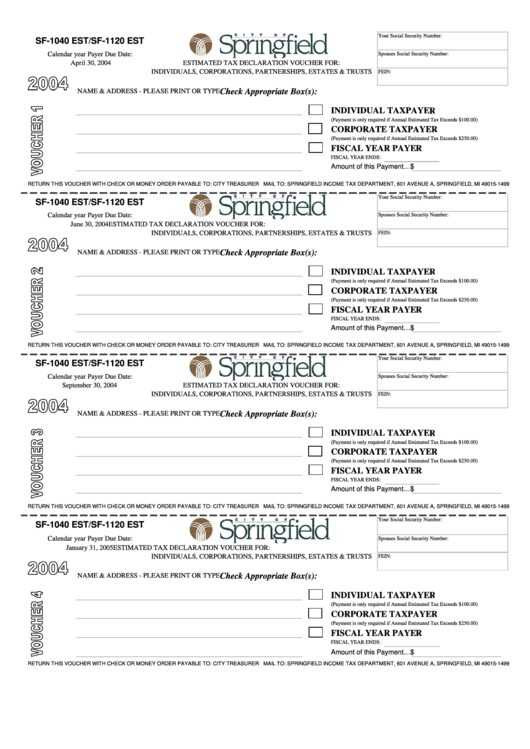

Form Sf-1040 Est/sf-1120 Est - Estimated Tax Declaration Voucher For Individuals, Corporations, Partnerships, Estates & Trusts - Springfield Income Tax Department - 2004

ADVERTISEMENT

Your Social Security Number:

SF-1040 EST/SF-1120 EST

Calendar year Payer Due Date:

Spouses Social Security Number:

April 30, 2004

ESTIMATED TAX DECLARATION VOUCHER FOR:

INDIVIDUALS, CORPORATIONS, PARTNERSHIPS, ESTATES & TRUSTS

FEIN:

Check Appropriate Box(s):

NAME & ADDRESS - PLEASE PRINT OR TYPE

INDIVIDUAL TAXPAYER

(Payment is only required if Annual Estimated Tax Exceeds $100.00)

CORPORATE TAXPAYER

(Payment is only required if Annual Estimated Tax Exceeds $250.00)

FISCAL YEAR PAYER

FISCAL YEAR ENDS:

Amount of this Payment…$

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: CITY TREASURER MAIL TO: SPRINGFIELD INCOME TAX DEPARTMENT, 601 AVENUE A, SPRINGFIELD, MI 49015-1499

Your Social Security Number:

SF-1040 EST/SF-1120 EST

Calendar year Payer Due Date:

Spouses Social Security Number:

June 30, 2004

ESTIMATED TAX DECLARATION VOUCHER FOR:

INDIVIDUALS, CORPORATIONS, PARTNERSHIPS, ESTATES & TRUSTS

FEIN:

NAME & ADDRESS - PLEASE PRINT OR TYPE

Check Appropriate Box(s):

INDIVIDUAL TAXPAYER

(Payment is only required if Annual Estimated Tax Exceeds $100.00)

CORPORATE TAXPAYER

(Payment is only required if Annual Estimated Tax Exceeds $250.00)

FISCAL YEAR PAYER

FISCAL YEAR ENDS:

Amount of this Payment…$

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: CITY TREASURER MAIL TO: SPRINGFIELD INCOME TAX DEPARTMENT, 601 AVENUE A, SPRINGFIELD, MI 49015-1499

Your Social Security Number:

SF-1040 EST/SF-1120 EST

Calendar year Payer Due Date:

Spouses Social Security Number:

September 30, 2004

ESTIMATED TAX DECLARATION VOUCHER FOR:

INDIVIDUALS, CORPORATIONS, PARTNERSHIPS, ESTATES & TRUSTS

FEIN:

NAME & ADDRESS - PLEASE PRINT OR TYPE

Check Appropriate Box(s):

INDIVIDUAL TAXPAYER

(Payment is only required if Annual Estimated Tax Exceeds $100.00)

CORPORATE TAXPAYER

(Payment is only required if Annual Estimated Tax Exceeds $250.00)

FISCAL YEAR PAYER

FISCAL YEAR ENDS:

Amount of this Payment…$

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: CITY TREASURER MAIL TO: SPRINGFIELD INCOME TAX DEPARTMENT, 601 AVENUE A, SPRINGFIELD, MI 49015-1499

Your Social Security Number:

SF-1040 EST/SF-1120 EST

Calendar year Payer Due Date:

Spouses Social Security Number:

January 31, 2005

ESTIMATED TAX DECLARATION VOUCHER FOR:

INDIVIDUALS, CORPORATIONS, PARTNERSHIPS, ESTATES & TRUSTS

FEIN:

NAME & ADDRESS - PLEASE PRINT OR TYPE

Check Appropriate Box(s):

INDIVIDUAL TAXPAYER

(Payment is only required if Annual Estimated Tax Exceeds $100.00)

CORPORATE TAXPAYER

(Payment is only required if Annual Estimated Tax Exceeds $250.00)

FISCAL YEAR PAYER

FISCAL YEAR ENDS:

Amount of this Payment…$

RETURN THIS VOUCHER WITH CHECK OR MONEY ORDER PAYABLE TO: CITY TREASURER MAIL TO: SPRINGFIELD INCOME TAX DEPARTMENT, 601 AVENUE A, SPRINGFIELD, MI 49015-1499

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1