Individual Income Tax Return Instructions - City Of Lebanon - 2005

ADVERTISEMENT

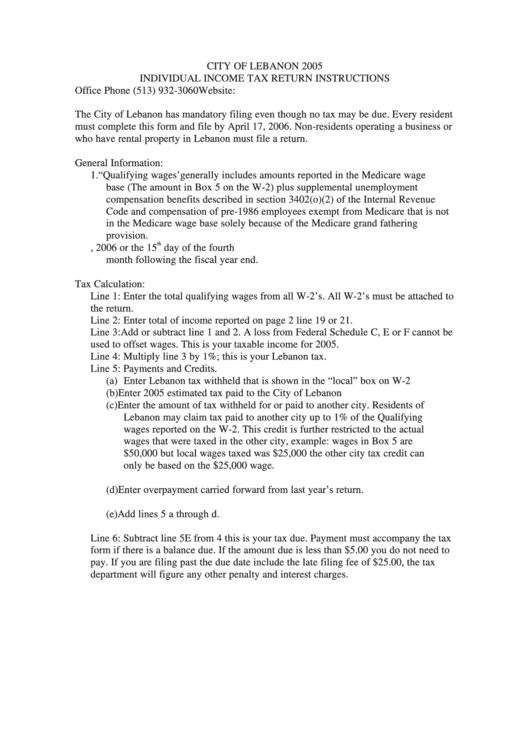

CITY OF LEBANON 2005

INDIVIDUAL INCOME TAX RETURN INSTRUCTIONS

Office Phone (513) 932-3060

Website:

The City of Lebanon has mandatory filing even though no tax may be due. Every resident

must complete this form and file by April 17, 2006. Non-residents operating a business or

who have rental property in Lebanon must file a return.

General Information:

1. “Qualifying wages’ generally includes amounts reported in the Medicare wage

base (The amount in Box 5 on the W-2) plus supplemental unemployment

compensation benefits described in section 3402(o)(2) of the Internal Revenue

Code and compensation of pre-1986 employees exempt from Medicare that is not

in the Medicare wage base solely because of the Medicare grand fathering

provision.

th

2. The due date for filing this return is April 17, 2006 or the 15

day of the fourth

month following the fiscal year end.

Tax Calculation:

Line 1: Enter the total qualifying wages from all W-2’s. All W-2’s must be attached to

the return.

Line 2: Enter total of income reported on page 2 line 19 or 21.

Line 3: Add or subtract line 1 and 2. A loss from Federal Schedule C, E or F cannot be

used to offset wages. This is your taxable income for 2005.

Line 4: Multiply line 3 by 1%; this is your Lebanon tax.

Line 5: Payments and Credits.

(a) Enter Lebanon tax withheld that is shown in the “local” box on W-2

(b) Enter 2005 estimated tax paid to the City of Lebanon

(c) Enter the amount of tax withheld for or paid to another city. Residents of

Lebanon may claim tax paid to another city up to 1% of the Qualifying

wages reported on the W-2. This credit is further restricted to the actual

wages that were taxed in the other city, example: wages in Box 5 are

$50,000 but local wages taxed was $25,000 the other city tax credit can

only be based on the $25,000 wage.

(d) Enter overpayment carried forward from last year’s return.

(e) Add lines 5 a through d.

Line 6: Subtract line 5E from 4 this is your tax due. Payment must accompany the tax

form if there is a balance due. If the amount due is less than $5.00 you do not need to

pay. If you are filing past the due date include the late filing fee of $25.00, the tax

department will figure any other penalty and interest charges.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2