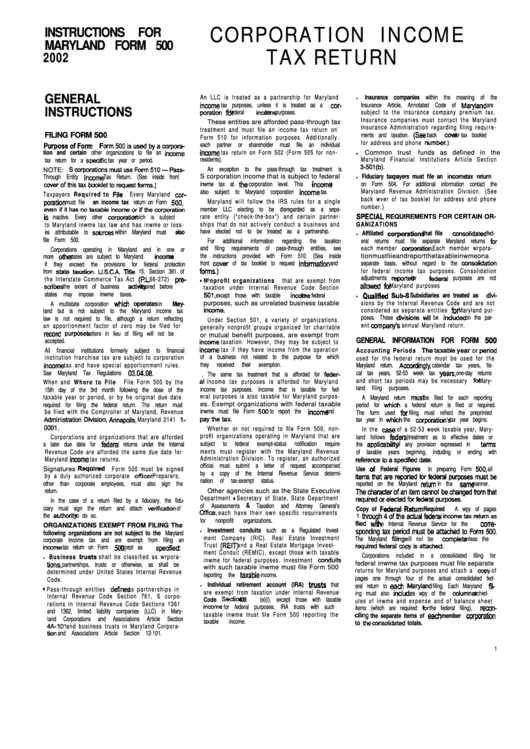

Instructions For Maryland Form 500 - Corporation Income Tax Return - 2002

ADVERTISEMENT

CORPORATION INCOME

PwposaofForm

Forrn5OOisusedbyacorpom-

wverofthistaxbooklettorequestforms.)

poration must file an income tax return on Form 500,

evenifithasnotaxableinwmeorifthewrporation

Is inactive. Every other wrporation

taxatbn.

U.S.C.A.

Tti 15, Section 381 of

scdbes

opemtes

record

purposes.

income tax and have special apportionment rules.

;$i;istration Division, Annapolis,

income tax return on Form 500, except as specified:

tions.

* Pass-through entities defined as partnerships in

4A-101 and business trusts in Maryland Corpora-

tlon

income

poration

for federal income

income tax return on Form 502 (Form 505 for non-

fomls.)

- N o n p r o f i t o r g a n i z a t i o n s that are exempt from

501,

income.

income

income tax if they have income from the operation

a’l income tax purposes is afforded for Maryland

PaYtheW.

Oftice, each have their own specific requirements

trusts

income

3-501(b).

SPEClAL

allowed

tbr Maryland purposes

Qualii

Sub-S Subsidiaries are treated as diti

will be induded

referencetoaspedfieddaie.

itemsthaarerepcHedforfederal~mustbe

Thechara&rofanitemcannotbechangedfromthat

raqulredordectedforfederalpurposes.

inwrnetaxretumas

filed with the Internal Revenue Service for the wrre-

Spdllk3XpMiOdiTWStbe-tOFOtl?l500.

KX@edfedeIZll~isat&&Xi.

dling the separate items of each member corpxhn

INSTRUCTIONS FOR

MARYLAND FORM 500

TAX RETURN

2002

GENERAL

An LLC is treated as a partnership for Maryland

Insurance companies within the meaning of the

l

tax purposes, unless it is treated as a wr-

Insurance Article, Annotated Code of Maryland

are

INSTRUCTIONS

tax purposes.

subject to the insurance company premium tax.

Insurance companies must contact the Maryland

These entities are afforded pass-through tax

Insurance Administration regarding filing require-

treatment and must file an income tax return on

FILING FORM 500

ments and taxation. (See

back cover

of tax booklet

Form 510 for information purposes. Additionally.

for address and phone number.)

each partner or shareholder must file an individual

tion and certain other organizations to file an income

Common trust funds as defined in the

l

residents).

Maryland Financial Institutions Article Section

tax return for a specific

tax year or period.

An exception to the pass-through tax treatment is

NOTE: SwrpomtionsmustuseForm510-Pass-

S corporation income that is subject to federal

Fiduciary taxpayers must file an inccme tax return

Through Entity Income

Tax Return. (See inside front

l

inwme tax at the

corporation level. This income

is

on Form 504. For additional information contact the

Maryland Revenue Administration Division. (See

also subject to Maryland corporation income

tax.

Taxpayers Required to Fila

Every Maryland wr-

back wver of tax booklet for address and phone

Maryland will follow the IRS rules for a single

number.)

member LLC electing to be disregarded as a sepa-

rate entity (“check-the-box”) and certain partner-

REQUIREMENTS FOR CERTAIN OR-

which is subject

ships that do not actively conduct a business and

GANIZATIONS

to Maryland inwme tax law and has inwme or loss-

have elected not to be treated as a partnership.

es attributable to scurces

within Maryland must also

Affiliated corpomtions

that file wnsdidated

fed-

l

file Form 500.

For

additional

information

regarding

the

taxation

eral returns must file separate Maryland returns fbr

and filing requirements of pass-through entities, see

each member corporation.

Each member wrpora-

Corporations operating in Maryland and in one or

the instructions provided with Form 510. (Sea inside

tionmustfiieandreportthetaxableinwmeona

more other

states are subject to Maryland income

tax

front wver of tax booklet to request infwmation

and

separate basis, without regard to the wnsoliiation

if they exceed the provisions for federal protection

for federal income tax purposes. Consolidation

from data

adjustments raported

for fed-1

purposes are not

the Interstate Commerce Tax Act (RL. 66-272) pre-

the extent of business activity

required before

taxation under Internal Revenue Code Section

states may impose inwme taxes.

except those with taxable income

for federal

l

purposes, such as unrelated business taxable

sions by the Internal Revenue Code and are not

A multistate corporation which

in Mary-

considered as separate entities for Maryland pur-

land but is not subject to the Maryland income tax

poses. These dlvlslons

on the par-

law is not required to file, although a return reflecting

Under Section 501, a variety of organizations.

ent compaws annual Maryland return.

an apportionment factor of zero may be filed for

generally nonprofit groups organized for charitable

Letters in lieu of filing will not be

or mutual benefit purposes, are exempt from

GENERAL INFORMATION FOR FORM 500

accepted.

taxation. However, they may be subject to

All financial institutions formerly subject to financial

Accounting Periods The taxable year or period

of a business not related to the purpose for which

institution franchise tax are subject to corporation

used for the federal return must be used for the

they

received

their

exemption.

Maryland return. Accordingly,

calendar tax years, fis-

Sae Maryland Tax Regulations 03.04.06.

cal tax years, 52-53 week tax years,

one-day returns

The same tax treatment that is afforded for fader-

and short tax periods may be necessary for Mary-

When and W h e r e t o F i l e

File Form 500 by the

land filing purposes.

income tax purposes. Income that is taxable for fed-

15th day of the 3rd month following the dose of the

eral purposes is also taxable for Maryland purpos-

taxable year or period, or by he original due date

A Maryland return must

be filed for each reporting

es. Exempt organizations with federal taxable

required for filing the federal return. The return must

period for whll a federal return is filed or required.

inwme must file Form 500 to report the income

and

be filed with the Comptroller of Maryland, Revenue

The form used for

filing must reflect the preprinted

Maryland 2141 l-

tax year in which the corporation’s

tax year begins.

Whether or not required to file Form 500, non-

In the casa of a 52-53 week taxable year, Mary-

profit organizations operating in Maryland that are

Corporations and organizations that are afforded

land follows faderal

treatment as to effective dates or

subject

to

federal

exempt-status

notification

require-

a later due date for fed-1

returns under the Internal

the applicabisty

of any provision expressed in terms

ments must register with the Maryland Revenue

Revenue Code are afforded the same due date for

of taxable years begiming, induding or ending with

Administration Division. To register, an authorized

Maryland income tax returns.

official must submit a letter of request accompanied

Signatures Reqoired

Form 500 must be signed

Use of Federal Figures

In preparing Form 500, all

by a copy of the Internal Revenue Service determi-

by a duly authorized corporate ofticer.

Preparers,

nation

of

tax-exempt

status.

other than corporate employees, must also sign the

reported on the Maryland Mum

In tha sama

manner.

return.

Other agencies such as the State Executive

Department - Secretary of State, State Department

In the case of a return filed by a fiduciary, the fidu-

of

Assessments 8

Taxation and Attorney General’s

ciary must sign the return and attach veritication

of

Copy of Federal Return Required

A wpy of pages

the authority

to do so.

1 through4oftheactualfaderal

for

nonprofit

organizations.

ORGANIZATIONS EXEMPT FROM FILING The

Investment conduits such as a Regulated Invest-

l

following organizations are not subject to the Maryland

ment Company (RIC). Real Estate Investment

The Maryland filiig

will no! be wmpiete

unless the

corporate income tax and are exempt from filing an

Trust (REIT) and a Real Estate Mortgage Invest-

ment Conduit (REMIC), except those with taxable

Corporations included in a consolidated filing for

Business trusts shall be classified as wrpora-

l

inwme for federal purposes. Investment conduits

federal inwme tax purposes must file separate

partnerships, trusts or otherwise, as shall be

with such taxable inwme must file Form 500

returns for Maryland purposes and attach a wpy of

determined under United States Internal Revenue

reporting the taxable

income.

pages one through four of the actual consolidated fed-

Code.

Individual retirement account (IRA)

that

eral return to each Maryland

filing. Each Maryland fiC

l

are exempt from taxation under Internal Revenue

ing must also indude

a wpy of the wlumnar

sched-

Internal Revenue Code Section 761, S corpo-

Code Sectlon 408 (e)(l), except those with taxable

ules of inwme and expense and of balance sheet

rations in Internal Revenue Code Sections 1361

for federal purposes. IRA trusts with such

items (which are required ;br the federal filing), rewn-

and 1362, limited liability companies (LLC) in Mary-

taxable inwme must file Form 500 reporting the

land

Corporations

and

Associations

Article

Section

taxable

income.

to the consolIltad

totals.

and Associations Article Section 12-101.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6