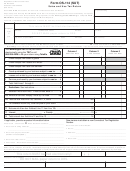

Form Os-114 (But) - Sales And Use Tax Return - 2014 Page 2

ADVERTISEMENT

See Form O-88, Instructions for Form OS-114 Sales and Use Tax Return, before completing.

Column 1

Column 2

Deductions

6.35% Tax Rate

7.0 % Tax Rate

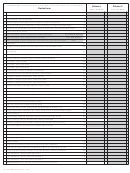

15 Sales for resale - sales of goods

15

16 Sales for resale - leases and rentals

16

17 Sales for resale - labor and services

17

18 All newspapers and subscription sales of magazines and puzzle magazines

18

19 Trucks with GVW rating over 26,000 lbs. or used exclusively for carriage of interstate freight

19

21 Food for human consumption, food sold in vending machines, items purchased with food stamps

21

23 Sale of fuel for motor vehicles

23

For Utility & Heating

24 Sales of electricity, gas, and heating fuel for residential dwellings

24

Fuel Companies

25 Sales of electricity - $150 monthly charge per business

25

Only

26 Sales of electricity, gas, and heating fuel for manufacturing or agricultural production

26

27 Aviation fuel

27

29 Tangible personal property to persons issued a Farmer Tax Exemption Permit

29

30 Machinery, its replacement, repair, component and enhancement parts, materials, tools, and fuel for

manufacturing

30

31 Machinery, materials, tools, and equipment used in commercial printing process or publishing

31

32 Vessels, machinery, materials, tools, and fuel for commercial fi shing

32

33 Out-of-state - sales of goods

33

34 Out-of-state - leases and rentals

34

35 Out-of-state - labor and services

35

36 Motor vehicles or vessels purchased by nonresidents

36

37 Prescription medicines and diabetic equipment - sales of goods

37

39 Charitable or religious organizations - sales of goods

39

40 Charitable or religious organizations - leases and rentals

40

41 Charitable or religious organizations - labor and services

41

42 Federal, Connecticut, or municipal agencies - sales of goods

42

43 Federal, Connecticut, or municipal agencies - leases and rentals

43

44 Federal, Connecticut, or municipal agencies - labor and services

44

45 Items certifi ed for air or water pollution abatement - sales, leases, and rentals of goods

45

47 Nontaxable labor and services

47

48 Services between wholly owned business entities

48

50 Trade-ins of all like-kind tangible personal property

50

52 Taxed goods returned within 90 days at the rate listed above in Columns 1 or 2

52

56 Oxygen, blood plasma, prostheses, etc. - sales, leases, rentals, or repair services of goods

56

63 Funeral expenses

63

69 Repair services, repair and replacement parts for aircraft, and certain aircraft

69

71 Certain machinery under the Manufacturing Recovery Act of 1992

71

72 Machinery, equipment, tools, supplies, and fuel used in the biotechnology industry

72

73 Repair and maintenance services and fabrication labor to vessels

73

74 Computer and data processing services at 1% (See instructions, Form 0-88.)

74

75 Renovation and repair services to residential real property

75

77 Sales of qualifying items to direct payment permit holders

77

78 Sales of college textbooks

78

79 Sales tax holiday

79

81 Residential weatherization products and compact fl uorescent light bulbs

81

82 Motor vehicles sold to active duty nonresident members of the armed forces at 4.5%

82

83 For cigarette dealers only: Purchases of cigarettes taxed by a stamper or distributor

83

A Other Adjustments - sales of goods (Describe:

) A

B Other Adjustments - leases and rentals (Describe:

) B

C Other Adjustments - labor and services (Describe:

) C

Total Deductions: Enter here and on Line 8 on the front of this return.

OS-114 (BUT) Back (Rev. 01/14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2