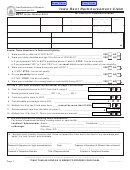

Worksheet for line 6

2004 TOTAL YEARLY HOUSEHOLD INCOME

“Household income” includes the income of the claimant, the claimant’s spouse

and monetary contributions received from other persons living with the claimant.

Use Whole DOLLARS Only

0 0

,

A. Wages, salaries, tips, etc. ________________________________________

.

0 0

,

B. Rent subsidy/utilities assistance ____________________________________

.

0 0

,

C. Title 19 Benefits for housing only (see instructions) ____________________

.

0 0

,

D. Social Security income received in 2004 __________________________

.

0 0

,

E. Disability income for 2004 _____________________________________

.

0 0

,

F. All pensions and annuities from 2004 _____________________________

.

0 0

,

G. Interest and dividend income from 2004 __________________________

.

H. Profit from business and/or farming and capital gains

0 0

,

if less than zero, enter 0 (see instructions) ________________________

.

0 0

,

I. Actual money received from others living with you in 2004 (see instructions)

.

0 0

,

J. Other income (read instructions before making this entry) ____________

.

0 0

,

0

K. ADD amounts on lines A-J, enter here and on Line 6 Side 1 _____________

.

This is your total household income

REIMBURSEMENT RATE TABLE FOR LINE 11

If your total household income from Line K above is:

$ 0.00

-

9,290.99 -------- enter 1.00 on Line 11, Side 1

9,291

-

10,383.99 -------- enter 0.85 on Line 11, Side 1

10,384

-

11,476.99 -------- enter 0.70 on Line 11, Side 1

11,477

-

13,662.99 -------- enter 0.50 on Line 11, Side 1

13,663

-

15,848.99 -------- enter 0.35 on Line 11, Side 1

15,849

-

18,034.99 -------- enter 0.25 on Line 11, Side 1

18,035 or greater ------------------- no reimbursement allowed

For assistance in completing this form, call 1-800-367-3388 or 515/281-3114.

Where’s my refund check?

Call 1-800-572-3944 or 515/281-4966

You must provide claimant’s Social Security Number

and date of birth when calling

Mail this form to:

I

D

R

OWA

EPARTMENT OF

EVENUE

R

R

P

ENT

EIMBURSEMENT

ROCESSING

PO B

10459

OX

D

M

IA 50306-0459

ES

OINES

Claims must be filed no later than June 1, 2005, unless the Director of Revenue

has granted an extension of the time to file through December 31, 2006.

Side 2

54-130b (11/17/04)

1

1 2

2