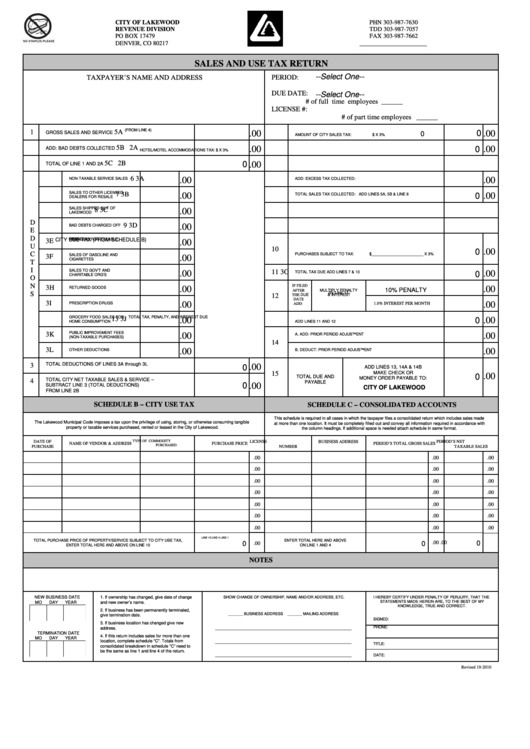

PHN 303-987-7630

CITY OF LAKEWOOD

REVENUE DIVISION

TDD 303-987-7057

PO BOX 17479

FAX 303-987-7662

DENVER, CO 80217

SALES AND USE TAX RETURN

--Select One--

TAXPAYER’S NAME AND ADDRESS

PERIOD:

DUE DATE:

--Select One--

# of full time employees ______

LICENSE #:

# of part time employees ______

(FROM LINE 4)

1

5A

.00

0

.00

GROSS SALES AND SERVICE

0

AMOUNT OF CITY SALES TAX:

$

X 3%

2A

5B

.00

0

.00

ADD: BAD DEBTS COLLECTED

HOTEL/MOTEL ACCOMMODATIONS TAX: $

X 3%

2B

5C

0

.00

TOTAL OF LINE 1 AND 2A

3A

6

.00

.00

NON-TAXABLE SERVICE SALES

ADD: EXCESS TAX COLLECTED:

SALES TO OTHER LICENSED

3B

7

.00

0

.00

TOTAL SALES TAX COLLECTED: ADD LINES 5A, 5B & LINE 6

DEALERS FOR RESALE

SALES SHIPPED OUT OF

3C

8

.00

LAKEWOOD

D

3D

9

.00

BAD DEBTS CHARGED OFF

E

D

TRADE-INS FOR TAXABLE

CITY USE TAX (FROM SCHEDULE B)

3E

.00

RESALE

U

10

0

.00

C

PURCHASES SUBJECT TO TAX:

$_________________________ X 3%

SALES OF GASOLINE AND

3F

.00

CIGARETTES

T

I

SALES TO GOV’T AND

3G

11

.00

.00

TOTAL TAX DUE ADD LINES 7 & 10

0

CHARITABLE ORG’S

O

N

IF FILED

3H

.00

.00

RETURNED GOODS

10% PENALTY

AFTER

MULTIPLY PENALTY

S

12

THE DUE

& INTEREST

DATE

BY LINE 11

3I

PRESCRIPTION DRUGS

.00

1.0% INTEREST PER MONTH

.00

ADD:

GROCERY FOOD SALES FOR

TOTAL TAX, PENALTY, AND INTEREST DUE

3J

13

.00

0

.00

HOME CONSUMPTION

ADD LINES 11 AND 12

PUBLIC IMPROVEMENT FEES

3K

.00

A. ADD: PRIOR PERIOD ADJUSTMENT

.00

(NON-TAXABLE PURCHASES)

14

3L

OTHER DEDUCTIONS

.00

B. DEDUCT: PRIOR PERIOD ADJUSTMENT

.00

TOTAL DEDUCTIONS OF LINES 3A through 3L

3

.00

0

ADD LINES 13, 14A & 14B

MAKE CHECK OR

15

.00

0

TOTAL DUE AND

MONEY ORDER PAYABLE TO:

TOTAL CITY NET TAXABLE SALES & SERVICE –

4

PAYABLE

0

.00

SUBTRACT LINE 3 (TOTAL DEDUCTIONS)

CITY OF LAKEWOOD

FROM LINE 2B

SCHEDULE B – CITY USE TAX

SCHEDULE C – CONSOLIDATED ACCOUNTS

This schedule is required in all cases in which the taxpayer files a consolidated return which includes sales made

The Lakewood Municipal Code imposes a tax upon the privilege of using, storing, or otherwise consuming tangible

at more than one location. It must be completely filled out and convey all information required in accordance with

property or taxable services purchased, rented or leased in the City of Lakewood.

the column headings. If additional space is needed attach schedule in same format.

TYPE OF COMMODITY

DATE OF

LICENSE

PERIOD’S NET

NAME OF VENDOR & ADDRESS

PURCHASE PRICE

BUSINESS ADDRESS

PERIOD’S TOTAL GROSS SALES

PURCHASED

PURCHASE

NUMBER

TAXABLE SALES

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

LINE 10

LINE 1

LINE 4

TOTAL PURCHASE PRICE OF PROPERTY/SERVICE SUBJECT TO CITY USE TAX,

ENTER TOTAL HERE AND ABOVE

0

0

0

.00

.00

.00

ENTER TOTAL HERE AND ABOVE ON LINE 10

ON LINE 1 AND 4

NOTES

NEW BUSINESS DATE

1. If ownership has changed, give date of change

SHOW CHANGE OF OWNERSHIP, NAME AND/OR ADDRESS, ETC.

I HEREBY CERTIFY UNDER PENALTY OF PERJURY, THAT THE

STATEMENTS MADE HEREIN ARE, TO THE BEST OF MY

MO

DAY

YEAR

and new owner’s name.

KNOWLEDGE, TRUE AND CORRECT.

2. If business has been permanently terminated,

_______ BUSINESS ADDRESS

_______ MAILING ADDRESS

give termination date.

SIGNED:

3. If business location has changed give new

address.

_______________________________________________________________________

PHONE:

TERMINATION DATE

4. If this return includes sales for more than one

MO

DAY

YEAR

location, complete schedule “C”. Totals from

_______________________________________________________________________

TITLE:

consolidated breakdown in schedule “C” need to

be the same as line 1 and line 4 of the return.

DATE:

_______________________________________________________________________

Revised 10-2010

PRINT FORM

CLEAR FORM

1

1