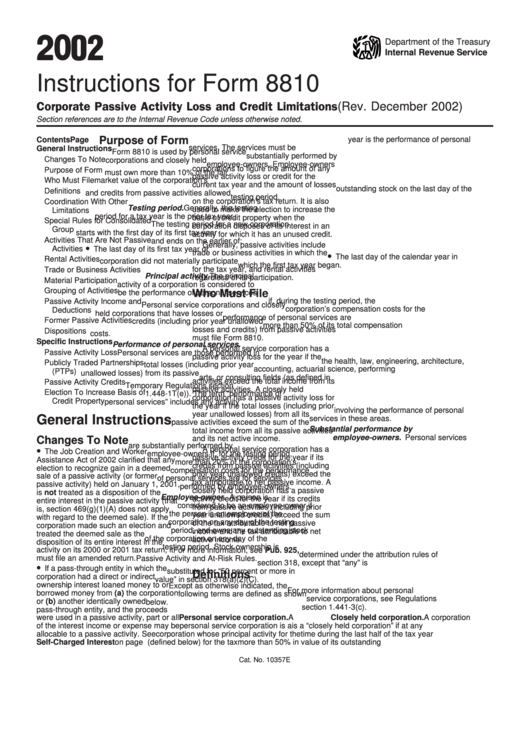

Instructions For Form 8810 - Corporate Passive Activity Loss And Credit Limitations - 2002

ADVERTISEMENT

02

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 8810

(Rev. December 2002)

Corporate Passive Activity Loss and Credit Limitations

Section references are to the Internal Revenue Code unless otherwise noted.

Purpose of Form

year is the performance of personal

Contents

Page

services. The services must be

General Instructions . . . . . . . . . . . . . 1

Form 8810 is used by personal service

substantially performed by

Changes To Note . . . . . . . . . . . . . . 1

corporations and closely held

employee-owners. Employee-owners

corporations to figure the amount of any

Purpose of Form . . . . . . . . . . . . . . . 1

must own more than 10% of the fair

passive activity loss or credit for the

Who Must File . . . . . . . . . . . . . . . . 1

market value of the corporation’s

current tax year and the amount of losses

outstanding stock on the last day of the

Definitions . . . . . . . . . . . . . . . . . . . 1

and credits from passive activities allowed

testing period.

on the corporation’s tax return. It is also

Coordination With Other

Testing period. Generally, the testing

used to make the election to increase the

Limitations . . . . . . . . . . . . . . . . . 2

period for a tax year is the prior tax year.

basis of credit property when the

Special Rules for Consolidated

The testing period for a new corporation

corporation disposes of its interest in an

Group . . . . . . . . . . . . . . . . . . . . . 2

starts with the first day of its first tax year

activity for which it has an unused credit.

Activities That Are Not Passive

and ends on the earlier of:

Generally, passive activities include

•

Activities . . . . . . . . . . . . . . . . . . . 2

The last day of its first tax year or

trade or business activities in which the

•

The last day of the calendar year in

Rental Activities . . . . . . . . . . . . . . . 2

corporation did not materially participate

which the first tax year began.

for the tax year, and rental activities

Trade or Business Activities . . . . . . . 3

Principal activity. The principal

regardless of its participation.

Material Participation . . . . . . . . . . . . 3

activity of a corporation is considered to

Grouping of Activities . . . . . . . . . . . 4

Who Must File

be the performance of personal services

if, during the testing period, the

Passive Activity Income and

Personal service corporations and closely

corporation’s compensation costs for the

Deductions . . . . . . . . . . . . . . . . . 5

held corporations that have losses or

performance of personal services are

Former Passive Activities . . . . . . . . . 6

credits (including prior year unallowed

more than 50% of its total compensation

losses and credits) from passive activities

Dispositions . . . . . . . . . . . . . . . . . . 6

costs.

must file Form 8810.

Specific Instructions . . . . . . . . . . . . 7

Performance of personal services.

A personal service corporation has a

Passive Activity Loss . . . . . . . . . . . . 8

Personal services are those performed in

passive activity loss for the year if the

the health, law, engineering, architecture,

Publicly Traded Partnerships

total losses (including prior year

accounting, actuarial science, performing

(PTPs) . . . . . . . . . . . . . . . . . . . 10

unallowed losses) from its passive

arts, or consulting fields (as defined in

activities exceed the total income from its

Passive Activity Credits . . . . . . . . . 10

Temporary Regulations section

passive activities. A closely held

Election To Increase Basis of

1.448-1T(e)). The term “performance of

corporation has a passive activity loss for

Credit Property . . . . . . . . . . . . . 12

personal services” includes any activity

the year if the total losses (including prior

involving the performance of personal

year unallowed losses) from all its

General Instructions

services in these areas.

passive activities exceed the sum of the

Substantial performance by

total income from all its passive activities

employee-owners. Personal services

Changes To Note

and its net active income.

are substantially performed by

•

A personal service corporation has a

The Job Creation and Worker

employee-owners if, for the testing period,

passive activity credit for the year if its

Assistance Act of 2002 clarified that any

more than 20% of the corporation’s

credits from passive activities (including

election to recognize gain in a deemed

compensation costs for the performance

prior year unallowed credits) exceed the

sale of a passive activity (or former

of personal services are for services

tax attributable to net passive income. A

passive activity) held on January 1, 2001,

performed by employee-owners.

closely held corporation has a passive

is not treated as a disposition of the

Employee-owner. A person is

activity credit for the year if its credits

entire interest in the passive activity (that

considered to be an employee-owner if

from passive activities (including prior

is, section 469(g)(1)(A) does not apply

the person is an employee of the

year unallowed credits) exceed the sum

with regard to the deemed sale). If the

corporation on any day of the testing

of the tax attributable to net passive

corporation made such an election and

period, and owns any outstanding stock

income and the tax attributable to net

treated the deemed sale as the

of the corporation on any day of the

active income.

disposition of its entire interest in the

testing period. Stock ownership is

activity on its 2000 or 2001 tax return, it

For more information, see Pub. 925,

determined under the attribution rules of

must file an amended return.

Passive Activity and At-Risk Rules.

section 318, except that “any” is

•

If a pass-through entity in which the

substituted for “50 percent or more in

Definitions

corporation had a direct or indirect

value” in section 318(a)(2)(C).

ownership interest loaned money to or

Except as otherwise indicated, the

For more information about personal

borrowed money from (a) the corporation

following terms are defined as shown

service corporations, see Regulations

or (b) another identically owned

below.

section 1.441-3(c).

pass-through entity, and the proceeds

were used in a passive activity, part or all

Personal service corporation. A

Closely held corporation. A corporation

of the interest income or expense may be

personal service corporation is a

is a “closely held corporation” if at any

allocable to a passive activity. See

corporation whose principal activity for the

time during the last half of the tax year

Self-Charged Interest on page 5.

testing period (defined below) for the tax

more than 50% in value of its outstanding

Cat. No. 10357E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12