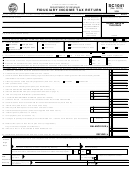

Form 511nr - Oklahoma Income Tax Return - 2001 Page 2

ADVERTISEMENT

2001 Form 511NR • Page 2

00

Adjusted gross income: All Sources (from page 1, line 24) . . . . . . . . . . . . . . . . . . . . . . .

25

25

00

Adjustments to adjusted gross income (511NR Schedule C, line 12) . . . . . . . . . . . . . . . . .

26

26

00

Oklahoma income after adjustments (line 25 minus line 26) . . . . . . . . . . . . . . . . . . . . . . . .

27

27

00

Oklahoma standard or Federal itemized deductions . . . . . . . . .

28

28

00

Exemptions ($1000 x number of exemptions claimed on pg. 1)

29

29

00

Total deductions and exemptions (add lines 28-29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

30

00

Oklahoma taxable income:

METHOD 1

(line 27 minus line 30) . . . . . . . . . . . . . . . . . .

31

31

00

Tax from

Tax Table 1

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

32

00

If line 24 is equal to or larger than line 19, complete line 33. If line 24 is smaller than line 19, see 511NR Schedule D.

Federal income tax deduction: (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

33

33

Oklahoma taxable income:

METHOD 2

(line 31 minus line 33) . . . . . . . . . . . . . . . . . .

00

34

34

Tax from

Tax Table 2

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

35

35

00

Oklahoma Income Tax

36

36

Enter lesser of line 32 or 35 or, if using Farm Income Averaging, total from Form 573, line 42 & check here

00

Oklahoma child care credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37

37

00

Subtract line 37 from line 36 (this is your tax base) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

38

Income percentage: Oklahoma Amount (from line 23)

Federal Amount (from line 24)

39

•

=

a)

b)

%

39

•

00

Multiply line 38 by line 39 (This is your Oklahoma Income Tax) . . . . . . . . . . . . . . . . . . .

40

40

00

Credit for taxes paid to another state (enclose Form 511TX)

. . . . . .

nonresidents do not qualify

41

41

00

Other nonrefundable credits (511CR) List 511CR line number claimed here

42

42

00

Balance (line 40 minus lines 41 and 42) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

43

43

00

00

Oklahoma withholding

. . . .

44

(enclose W-2’s and 1099’s having withholding)

44

00

00

2001 Oklahoma estimated tax payments . .

45

(qualified farmer

)

45

00

00

2001 payment with extension . . . . . . . . . . . . . . . . . . . . . . . . . .

46

46

00

Total payments (add lines 44- 46) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

47

47

Overpayment

00

Overpayment (if line 47 is greater than line 43)

subtract line 43 from line 47

48

48

00

Amount from line 48 to be credited to your 2002 estimated tax . . . . . . . . . . . . . . . . . . . . .

49

49

Donations from your refund:

50

Oklahoma Wildlife Diversity Program

Veterans Affairs Capital Improvement Program

Oklahoma City Bombing Memorial Fund

50a

50c

50E

$2

$5

$ _____

00

$2

$5

$ _____

00

$2

$5

$ _____

00

Low Income Health Care Fund

Oklahoma Breast Cancer Research Program

Oklahoma Organ Donor Education Fund

50b

50d

50f

$2

$5

$ _____

00

$2

$5

$ _____

00

$2

$5

$ _____

00

00

51

Amount to be refunded (line 48 minus lines 49 and 50

-

) . . . . . . . . . . . . . . .

Refund

51

A

F

00

52

Tax Due

Tax due (if line 43 is greater than line 47)

. . . . . . . . .

subtract line 47 from line 43

52

00

53

Donation: Oklahoma organ donor education fund . . . . . .

$2

$5

$______ . . . .

53

00

54

Underpayment of estimated tax . . . . . . . . . . . . . . . (annualized installment method

) . .

54

00

55

Delinquent payment (add penalty of 5% plus interest at 1.25% per month) . . . . . . . .

55

00

56

Total tax, penalty and interest (add lines 52-55) . . . . . . . . . . . . . . . .

Balance Due

56

Direct Deposit Option:

For instructions, please see page 11 in your Tax Packet.

Check the box above

Yes! Please deposit my refund in my

checking account

savings account

if the Tax Commission

may discuss this return

Routing

Account

Number:

Number:

with your tax preparer.

Under penalty of perjury, I declare that the information contained in this document and all attachments are true and correct to the best of my knowledge and belief.

Taxpayer’s signature

Spouse’s signature

Paid Preparer’s signature

Date

Taxpayer’s occupation

Date

Spouse’s occupation

Paid Preparer’s address and phone number

A COPY OF YOUR FEDERAL RETURN MUST BE ENCLOSED.

Paid Preparer’s SSN, EIN or PTIN

Please remit to:

Oklahoma Tax Commission, P.O. 26800, Oklahoma City, OK 73126-0800

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4