Sales Tax On Sales And Services - City Of Kiana

ADVERTISEMENT

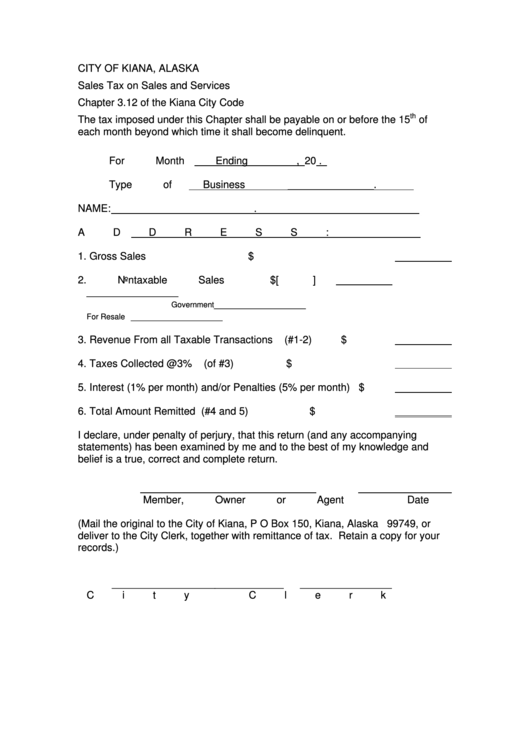

CITY OF KIANA, ALASKA

Sales Tax on Sales and Services

Chapter 3.12 of the Kiana City Code

th

The tax imposed under this Chapter shall be payable on or before the 15

of

each month beyond which time it shall become delinquent.

For Month Ending

, 20

.

Type of Business

_______________.

NAME:

________________.

ADDRESS:

.

1.

Gross Sales

$

2.

Nontaxable Sales

$[

]

________________

i.e. Exempt

________________

Government

________________

For Resale

3.

Revenue From all Taxable Transactions

(#1-2)

$

4.

Taxes Collected @3%

(of #3)

$

5.

Interest (1% per month) and/or Penalties (5% per month)

$

6.

Total Amount Remitted (#4 and 5)

$

I declare, under penalty of perjury, that this return (and any accompanying

statements) has been examined by me and to the best of my knowledge and

belief is a true, correct and complete return.

Member, Owner or Agent

Date

(Mail the original to the City of Kiana, P O Box 150, Kiana, Alaska 99749, or

deliver to the City Clerk, together with remittance of tax. Retain a copy for your

records.)

______________________________

________________

City Clerk

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1