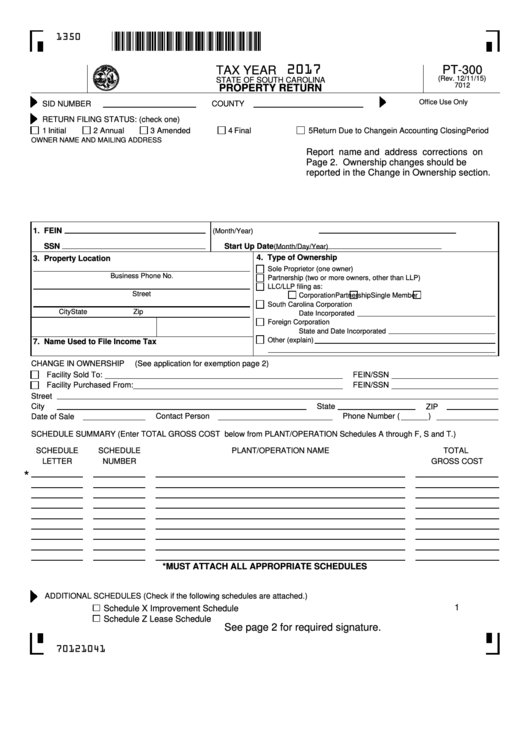

Form Pt-300 - Property Return - 2017

ADVERTISEMENT

1350

2017

PT-300

TAX YEAR

(Rev. 12/11/15)

STATE OF SOUTH CAROLINA

7012

PROPERTY RETURN

Office Use Only

SID NUMBER

COUNTY

RETURN FILING STATUS: (check one)

1 Initial

2 Annual

3 Amended

4 Final

5 Return Due to Change in Accounting Closing Period

OWNER NAME AND MAILING ADDRESS

Report name and address corrections on

Page 2. Ownership changes should be

reported in the Change in Ownership section.

1. FEIN

2. Accounting Closing Date

(Month/Year)

SSN

Start Up Date

(Month/Day/Year)

4. Type of Ownership

3. Property Location

Sole Proprietor (one owner)

Business Phone No.

Partnership (two or more owners, other than LLP)

LLC/LLP filing as:

Street

Corporation

Partnership

Single Member

South Carolina Corporation

City

State

Zip

Date Incorporated

Foreign Corporation

5. Contact Person

6. Contact Phone No.

State and Date Incorporated

Other (explain)

7. Name Used to File Income Tax

CHANGE IN OWNERSHIP

(See application for exemption page 2)

Facility Sold To:

FEIN/SSN

Facility Purchased From:

FEIN/SSN

Street

City

State

ZIP

Contact Person

Phone Number (

)

Date of Sale

SCHEDULE SUMMARY (Enter TOTAL GROSS COST below from PLANT/OPERATION Schedules A through F, S and T.)

SCHEDULE

SCHEDULE

PLANT/OPERATION NAME

TOTAL

LETTER

NUMBER

GROSS COST

*

*MUST ATTACH ALL APPROPRIATE SCHEDULES

ADDITIONAL SCHEDULES (Check if the following schedules are attached.)

1

Schedule X Improvement Schedule

Schedule Z Lease Schedule

See page 2 for required signature.

70121041

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2