Form Tm - Self-Employment Tax - 2013 Page 5

ADVERTISEMENT

1

1

2

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

8

2

8

8

8

Form

With grid

With grid & data

1

2

3

5

6 7 8 9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

4

82

3

3

For office use only

4

4

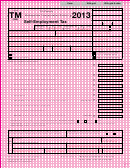

FORM

2013

TM

Tri-County

Date received

5

5

•

Metropolitan Transportation District

6

6

•

•

Payment

7

7

•

(230)

8

8

Self-Employment Tax

1

2

3

9

9

•

•

•

10

10

X

If you have previously

Name change

Fiscal year

Fiscal year

/

/

/ /

Mo

Day

Year

Mo

Day

Year

11

11

•

•

filed a return, indicate if:

beginning:

ending:

XX X X X X X X

XX X X X X X X

X

Address change

12

12

Last name (if an individual filing)

First name and initial

Social Security number (SSN)

13

13

•

•

X X X X X X X X X X X X X X X X X X X X X X X X 1 2 3 - 4 5 - 6 7 8 9

X X X X X X X X X X X X X X X X X X X X

14

14

Partnership name (if a partnership filing)

Federal employer identification number (FEIN)

15

15

X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X

1 2 - 3 4 5 6 7 8 9

16

16

Business address

Oregon business identification number (BIN)

17

17

•

X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X

1 2 3 4 5 6 7 8 - 9

18

18

City

State

ZIP code

County

Telephone

19

19

X X X X X X X X X X X X X X X X X X X X X X X X X

X X X X X - X X X X X X X X X X X X X X X X X X X X X - X X X - X X X X

20

20

•

Did you file Form TM for 2012?

X

An extension has been filed

21

21

•

X

Yes

X

This is an amended return

22

22

•

X

No (if No, give reason) ________________________________________________________________________

X

Utility or telecommunications

23

23

24

24

Include your payment with this return.

25

25

•

X X X X X X X X X X X X X X X X

1. Self-employment earnings from federal Schedule SE or Partnership Form 1065 .....................

1

26

26

27

27

%

2. Apportionment percentage ..............................................................................................................2

X X X X X X X X X X X X X X X

28

28

29

29

•

3. Net self-employment earnings. Multiply line 1 by line 2 .............................................................

3

X X X X X X X X X X X X X X X X

30

30

31

31

•

4. Less: Exclusion. Not more than $400 per taxpayer ...................................................................

4

X X X X X X X X X X X X X X X X

32

32

33

33

•

5. Net earnings subject to transit district tax. Line 3 minus line 4 .................................................

5

X X X X X X X X X X X X X X X X

34

34

35

35

•

6. Net tax. Multiply the amount on line 5 by 0.007137 ...................................................................

6

X X X X X X X X X X X X X X X X

36

36

37

37

•

7. Prepayments ..............................................................................................................................

7

X X X X X X X X X X X X X X X X

38

38

39

39

•

8. TAX TO PAY. Is line 6 more than line 7? If so, line 6 minus line 7 ........................TAX TO PAY

8

X X X X X X X X X X X X X X X X

40

40

41

41

9. Penalty and interest for filing or paying late .....................................................................................9

X X X X X X X X X X X X X X X X

42

42

43

43

10. Total amount due. Line 8 plus line 9 ...............................................................................................10

X X X X X X X X X X X X X X X X

44

44

45

45

•

11. REFUND. Is line 7 more than line 6? If so, line 7 minus line 6 .................................. REFUND

11

X X X X X X X X X X X X X X X X

46

46

47

47

X

X

X

Individuals: Attach a copy of your federal Schedule SE. Business activity:

Sales

Services

Other: ____________________

48

48

Partnerships: Attach a schedule listing each partner’s name, Social Security number, partnership earnings, and exclusion.

49

49

Apportioning? Attach a copy of TSE-AP.

50

50

51

51

Yes

No

Under penalty of false swearing, I declare that the information in

I authorize the Department of Revenue

52

52

X

X

this return and any attachments is true, correct, and complete.

to discuss this return with this preparer.

53

53

54

54

Your signature

Date

55

55

/ /

X

XX X X X X X X

SIGN

56

56

HERE

Signature of preparer other than taxpayer

Address of preparer

57

57

X

X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X

58

58

License No.

Telephone

City

State

ZIP code

59

59

•

X X X - X X X - X X X X

X X X X X X X X X X X X X X X X X X X X X

X X

X X X X X - X X X X

X X X X X X X X X X X X X X X X

60

60

Do NOT attach your TM self-employment tax return to your Oregon income tax return, or any other form.

61

61

Make check or money order payable to:

Mail your return to: TMSE, Oregon Department of Revenue

62

62

PO Box 14003, Salem OR 97309-2502

Oregon Department of Revenue

63

63

Rev. 10-13) Draft 3 082913

150-555-001 (

64

64

65

65

8

8

8

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

8

1

2

3

5

6 7 8 9

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

0

4

82

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5