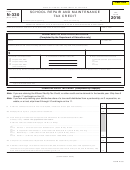

FORM N-314

(REV. 2003)

PAGE 2

PART II — COMPUTATION OF TAX CREDIT FOR COSTS INCURRED AFTER JUNE 30, 2003, BUT BEFORE JANUARY 1, 2006

Note: If you are only claiming the tax credit from a flow-through entity, start on line 14.

13. Enter the qualifying construction or renovation costs incurred during the taxable year after 6/30/03

for qualified hotel facility(ies) located in Hawaii ..................................................................................................

13

14. Flow through of qualifying costs incurred after 6/30/03 received from other entities, if any. Check box below.

Name and Federal Employer I.D. No. of entity

____________________________________________________________________________________

o

a S corporation shareholder — enter total from Schedule K-1 (Form N-35), line 12l(2)................................

o

b Partner — enter total from Schedule K-1 (Form N-20), line 22b ................................................................

o

c Beneficiary — enter total from Schedule K-1 (Form N-40), line 10 (after 6/30/03 costs)............................

o

d Member — enter total from Form N-314, Part III, line 21. ..........................................................................

14

15. Add lines 13 and 14 and enter result here. This represents the total qualifying construction or renovation

costs incurred during the taxable year after 6/30/03 for qualified hotel facility(ies) located in Hawaii.

For N-20, N-35, N-40 filers, stop here and see instructions before proceeding to line 16. .................................

15

16. Tax credit percentage ........................................................................................................................................

16

4%

17. Hotel Construction and Remodeling Tax Credit — Multiply line 15 by line 16 and enter result here and on

Schedule CR, line 16; or enter the estate’s or trust’s share on Form N-40, Schedule F,

line 3 (rounded to the nearest dollar for individual taxpayers) ............................................................................

17

PART III - OWNER-MEMBER’S SHARE OF QUALIFYING COSTS

18. Owner-member’s name _________________________________________________________________

19. Owner-member’s identification number _____________________________________________________

20. Owner-member’s share of qualifying construction or renovation costs incurred before 7/1/03 ........................

20

21. Owner-member’s share of qualifying construction or renovation costs incurred after 6/30/03 .........................

21

CAUTION:

The receipt of this form by an owner-member (member) of an association of apartment owners or a timeshare owners association

does not imply that the member qualifies for the Hotel Construction and Remodeling Tax Credit. The member must be subject to

Hawaii’s net income tax and transient accommodations tax on income received from hotel operations of the constructed or

renovated property to claim the credit on the member’s Hawaii income tax return.

SEE SEPARATE INSTRUCTIONS

1

1 2

2