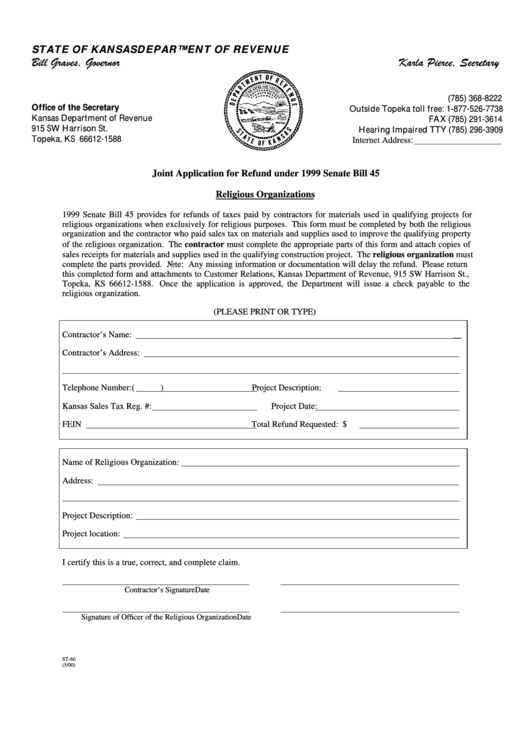

Form St-60 - Joint Application For Refund Under 1999 Senate Bill 45

ADVERTISEMENT

STATE OF KANSAS

DEPARTMENT OF REVENUE

(785) 368-8222

Office of the Secretary

Outside Topeka toll free: 1-877-526-7738

Kansas Department of Revenue

FAX (785) 291-3614

915 SW Harrison St.

Hearing Impaired TTY (785) 296-3909

Topeka, KS 66612-1588

Internet Address:

Joint Application for Refund under 1999 Senate Bill 45

Religious Organizations

1999 Senate Bill 45 provides for refunds of taxes paid by contractors for materials used in qualifying projects for

religious organizations when exclusively for religious purposes. This form must be completed by both the religious

organization and the contractor who paid sales tax on materials and supplies used to improve the qualifying property

of the religious organization. The contractor must complete the appropriate parts of this form and attach copies of

sales receipts for materials and supplies used in the qualifying construction project. The religious organization must

complete the parts provided. Note: Any missing information or documentation will delay the refund. Please return

this completed form and attachments to Customer Relations, Kansas Department of Revenue, 915 SW Harrison St.,

Topeka, KS 66612-1588. Once the application is approved, the Department will issue a check payable to the

religious organization.

(PLEASE PRINT OR TYPE)

Contractor’s Name:

__

Contractor’s Address:

Telephone Number: (

)

Project Description:

Kansas Sales Tax Reg. #:

Project Date:

FEIN

Total Refund Requested: $

Name of Religious Organization:

Address:

Project Description:

Project location:

I certify this is a true, correct, and complete claim.

Contractor’s Signature

Date

Signature of Officer of the Religious Organization

Date

ST-60

(5/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1