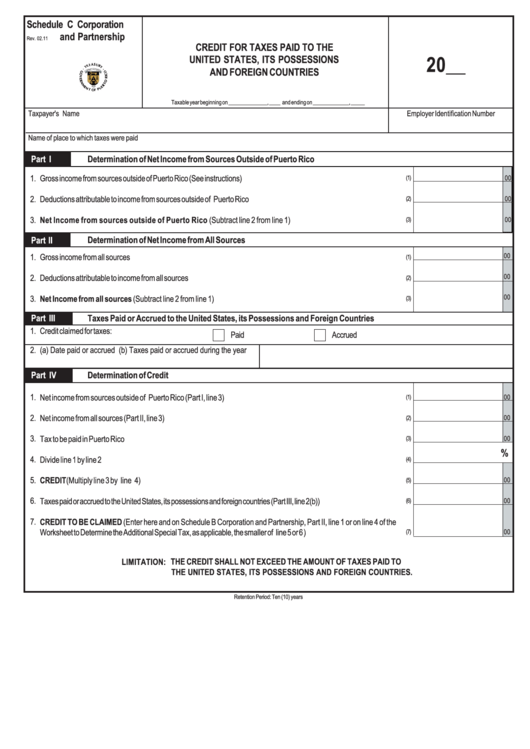

Schedule C Corporation And Partnership - Credit For Taxes Paid To The United States, Its Possessions And Foreign Countries

ADVERTISEMENT

Schedule C Corporation

ff

and Partnership

Rev. 02.11

CREDIT FOR TAXES PAID TO THE

20__

UNITED STATES, ITS POSSESSIONS

AND FOREIGN COUNTRIES

Taxable year beginning on ______________, ____ and ending on _____________, _____

Employer Identification Number

Taxpayer's Name

Name of place to which taxes were paid

Part I

Determination of Net Income from Sources Outside of Puerto Rico

1.

Gross income from sources outside of Puerto Rico (See instructions) ................................................................................

00

(1)

2.

Deductions attributable to income from sources outside of Puerto Rico ............................................................................

00

(2)

Net Income from sources outside of Puerto Rico (Subtract line 2 from line 1) .....................................................

3.

(3)

00

Part II

Determination of Net Income from All Sources

00

1.

Gross income from all sources ..........................................................................................................................................

(1)

00

2.

Deductions attributable to income from all sources ...........................................................................................................

(2)

00

3.

Net Income from all sources (Subtract line 2 from line 1) ............................................................................................

(3)

Part III

Taxes Paid or Accrued to the United States, its Possessions and Foreign Countries

1.

Credit claimed for taxes:

Paid

Accrued

2.

(a) Date paid or accrued

(b) Taxes paid or accrued during the year

Part IV

Determination of Credit

1.

Net income from sources outside of Puerto Rico (Part I, line 3) ........................................................................................

00

(1)

2.

Net income from all sources (Part II, line 3) .......................................................................................................................

00

(2)

3.

Tax to be paid in Puerto Rico ...........................................................................................................................................

00

(3)

%

4.

Divide line 1 by line 2 ......................................................................................................................................................

(4)

f

5.

CREDIT (Multiply line 3 by line 4) ..................................................................................................................................

00

(5)

6.

Taxes paid or accrued to the United States, its possessions and foreign countries (Part III, line 2(b)) ......................................

00

(6)

7.

CREDIT TO BE CLAIMED (Enter here and on Schedule B Corporation and Partnership, Part II, line 1 or on line 4 of the

Worksheet to Determine the Additional Special Tax, as applicable, the smaller of line 5 or 6 ) ................................................

00

(7)

LIMITATION: THE CREDIT SHALL NOT EXCEED THE AMOUNT OF TAXES PAID TO

THE UNITED STATES, ITS POSSESSIONS AND FOREIGN COUNTRIES.

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1