Form C-8000g Draft - Sbt Statutory Exemption/business Income Averaging - 2007

ADVERTISEMENT

Michigan Department of Treasury

Draft - 07/27/07

2007

(Rev. 7-07)

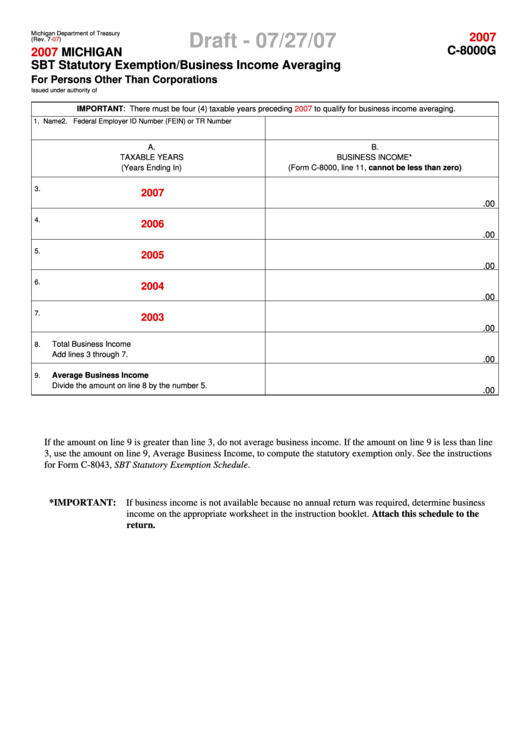

C-8000G

2007

MICHIGAN

SBT Statutory Exemption/Business Income Averaging

For Persons Other Than Corporations

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

IMPORTANT: There must be four (4) taxable years preceding

2007

to qualify for business income averaging.

1. Name

2. Federal Employer ID Number (FEIN) or TR Number

A.

B.

TAXABLE YEARS

BUSINESS INCOME*

(Years Ending In)

(Form C-8000, line 11, cannot be less than zero)

3.

2007

.00

4.

2006

.00

5.

2005

.00

6.

2004

.00

7.

2003

.00

Total Business Income

8.

Add lines 3 through 7.

.00

Average Business Income

9.

Divide the amount on line 8 by the number 5.

.00

If the amount on line 9 is greater than line 3, do not average business income. If the amount on line 9 is less than line

3, use the amount on line 9, Average Business Income, to compute the statutory exemption only. See the instructions

for Form C-8043, SBT Statutory Exemption Schedule.

*IMPORTANT:

If business income is not available because no annual return was required, determine business

income on the appropriate worksheet in the instruction booklet. Attach this schedule to the

return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1