Instructions For Form Ftb 3801-Cr - Passive Activity Credit Limitations - 1999

ADVERTISEMENT

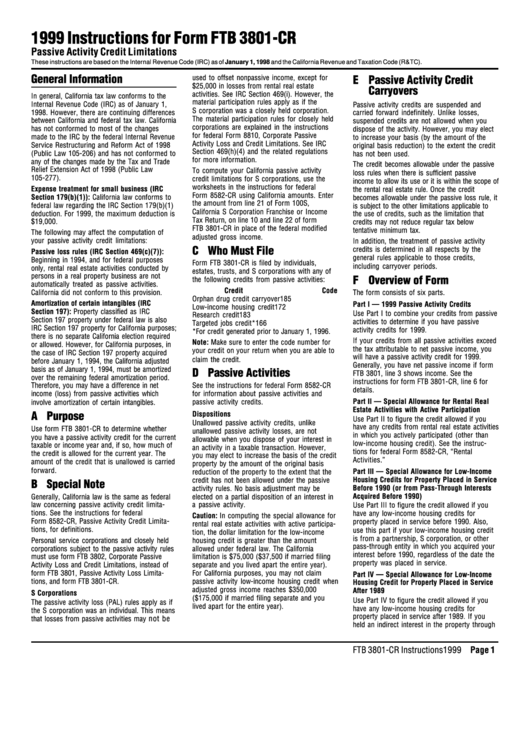

1999 Instructions for Form FTB 3801-CR

Passive Activity Credit Limitations

These instructions are based on the Internal Revenue Code (IRC) as of January 1, 1998 and the California Revenue and Taxation Code (R&TC).

General Information

used to offset nonpassive income, except for

E Passive Activity Credit

$25,000 in losses from rental real estate

Carryovers

activities. See IRC Section 469(i). However, the

In general, California tax law conforms to the

material participation rules apply as if the

Internal Revenue Code (IRC) as of January 1,

Passive activity credits are suspended and

S corporation was a closely held corporation.

1998. However, there are continuing differences

carried forward indefinitely. Unlike losses,

The material participation rules for closely held

between California and federal tax law. California

suspended credits are not allowed when you

corporations are explained in the instructions

has not conformed to most of the changes

dispose of the activity. However, you may elect

for federal Form 8810, Corporate Passive

made to the IRC by the federal Internal Revenue

to increase your basis (by the amount of the

Activity Loss and Credit Limitations. See IRC

Service Restructuring and Reform Act of 1998

original basis reduction) to the extent the credit

Section 469(h)(4) and the related regulations

(Public Law 105-206) and has not conformed to

has not been used.

for more information.

any of the changes made by the Tax and Trade

The credit becomes allowable under the passive

Relief Extension Act of 1998 (Public Law

To compute your California passive activity

loss rules when there is sufficient passive

105-277).

credit limitations for S corporations, use the

income to allow its use or it is within the scope of

worksheets in the instructions for federal

Expense treatment for small business (IRC

the rental real estate rule. Once the credit

Form 8582-CR using California amounts. Enter

Section 179(b)(1)): California law conforms to

becomes allowable under the passive loss rule, it

the amount from line 21 of Form 100S,

federal law regarding the IRC Section 179(b)(1)

is subject to the other limitations applicable to

California S Corporation Franchise or Income

deduction. For 1999, the maximum deduction is

the use of credits, such as the limitation that

Tax Return, on line 10 and line 22 of form

$19,000.

credits may not reduce regular tax below

FTB 3801-CR in place of the federal modified

tentative minimum tax.

The following may affect the computation of

adjusted gross income.

your passive activity credit limitations:

In addition, the treatment of passive activity

C Who Must File

credits is determined in all respects by the

Passive loss rules (IRC Section 469(c)(7)):

general rules applicable to those credits,

Beginning in 1994, and for federal purposes

Form FTB 3801-CR is filed by individuals,

including carryover periods.

only, rental real estate activities conducted by

estates, trusts, and S corporations with any of

persons in a real property business are not

F Overview of Form

the following credits from passive activities:

automatically treated as passive activities.

Credit

Code

California did not conform to this provision.

The form consists of six parts.

Orphan drug credit carryover

185

Amortization of certain intangibles (IRC

Part I — 1999 Passive Activity Credits

Low-income housing credit

172

Section 197): Property classified as IRC

Use Part I to combine your credits from passive

Research credit

183

Section 197 property under federal law is also

activities to determine if you have passive

Targeted jobs credit*

166

IRC Section 197 property for California purposes;

activity credits for 1999.

*For credit generated prior to January 1, 1996.

there is no separate California election required

If your credits from all passive activities exceed

Note: Make sure to enter the code number for

or allowed. However, for California purposes, in

the tax attributable to net passive income, you

your credit on your return when you are able to

the case of IRC Section 197 property acquired

will have a passive activity credit for 1999.

claim the credit.

before January 1, 1994, the California adjusted

Generally, you have net passive income if form

basis as of January 1, 1994, must be amortized

D Passive Activities

FTB 3801, line 3 shows income. See the

over the remaining federal amortization period.

instructions for form FTB 3801-CR, line 6 for

Therefore, you may have a difference in net

See the instructions for federal Form 8582-CR

details.

income (loss) from passive activities which

for information about passive activities and

Part II — Special Allowance for Rental Real

.

passive activity credits.

involve amortization of certain intangibles

Estate Activities with Active Participation

Dispositions

A Purpose

Use Part II to figure the credit allowed if you

Unallowed passive activity credits, unlike

have any credits from rental real estate activities

Use form FTB 3801-CR to determine whether

unallowed passive activity losses, are not

in which you actively participated (other than

you have a passive activity credit for the current

allowable when you dispose of your interest in

low-income housing credit). See the instruc-

taxable or income year and, if so, how much of

an activity in a taxable transaction. However,

tions for federal Form 8582-CR, “Rental

the credit is allowed for the current year. The

you may elect to increase the basis of the credit

Activities.”

amount of the credit that is unallowed is carried

property by the amount of the original basis

forward.

Part III — Special Allowance for Low-Income

reduction of the property to the extent that the

Housing Credits for Property Placed in Service

credit has not been allowed under the passive

B Special Note

Before 1990 (or from Pass-Through Interests

activity rules. No basis adjustment may be

Acquired Before 1990)

Generally, California law is the same as federal

elected on a partial disposition of an interest in

law concerning passive activity credit limita-

a passive activity.

Use Part III to figure the credit allowed if you

tions. See the instructions for federal

have any low-income housing credits for

Caution: In computing the special allowance for

Form 8582-CR, Passive Activity Credit Limita-

property placed in service before 1990. Also,

rental real estate activities with active participa-

tions, for definitions.

use this part if your low-income housing credit

tion, the dollar limitation for the low-income

is from a partnership, S corporation, or other

Personal service corporations and closely held

housing credit is greater than the amount

pass-through entity in which you acquired your

corporations subject to the passive activity rules

allowed under federal law. The California

interest before 1990, regardless of the date the

must use form FTB 3802, Corporate Passive

limitation is $75,000 ($37,500 if married filing

property was placed in service.

Activity Loss and Credit Limitations, instead of

separate and you lived apart the entire year).

form FTB 3801, Passive Activity Loss Limita-

For California purposes, you may not claim

Part IV — Special Allowance for Low-Income

tions, and form FTB 3801-CR.

passive activity low-income housing credit when

Housing Credit for Property Placed in Service

adjusted gross income reaches $350,000

After 1989

S Corporations

($175,000 if married filing separate and you

Use Part IV to figure the credit allowed if you

The passive activity loss (PAL) rules apply as if

lived apart for the entire year).

have any low-income housing credits for

the S corporation was an individual. This means

property placed in service after 1989. If you

that losses from passive activities may

not be

held an indirect interest in the property through

FTB 3801-CR Instructions 1999 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3