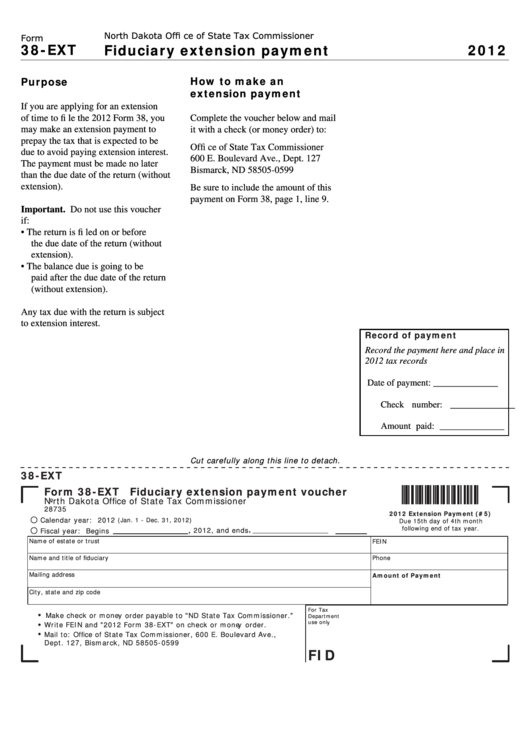

Form 38-Ext - Fiduciary Extension Payment - 2012

ADVERTISEMENT

North Dakota Offi ce of State Tax Commissioner

Form

38-EXT

Fiduciary extension payment

2012

How to make an

Purpose

extension payment

If you are applying for an extension

of time to fi le the 2012 Form 38, you

Complete the voucher below and mail

may make an extension payment to

it with a check (or money order) to:

prepay the tax that is expected to be

Offi ce of State Tax Commissioner

due to avoid paying extension interest.

600 E. Boulevard Ave., Dept. 127

The payment must be made no later

Bismarck, ND 58505-0599

than the due date of the return (without

extension).

Be sure to include the amount of this

payment on Form 38, page 1, line 9.

Important. Do not use this voucher

if:

• The return is fi led on or before

the due date of the return (without

extension).

• The balance due is going to be

paid after the due date of the return

(without extension).

Any tax due with the return is subject

to extension interest.

Record of payment

Record the payment here and place in

2012 tax records

Date of payment: ______________

Check number: ______________

Amount paid: ______________

Cut carefully along this line to detach.

38-EXT

Form 38-EXT Fiduciary extension payment voucher

North Dakota Office of State Tax Commissioner

28735

2012 Extension Payment (#5)

Calendar year: 2012

(Jan. 1 - Dec. 31, 2012)

Due 15th day of 4th month

following end of tax year.

2012, and ends

Fiscal year: Begins

,

,

Name of estate or trust

FEIN

Name and title of fiduciary

Phone

Mailing address

Amount of Payment

City, state and zip code

For Tax

Make check or money order payable to "ND State Tax Commissioner."

•

Department

use only

Write FEIN and "2012 Form 38-EXT" on check or money order.

•

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Ave.,

•

Dept. 127, Bismarck, ND 58505-0599

FID

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1