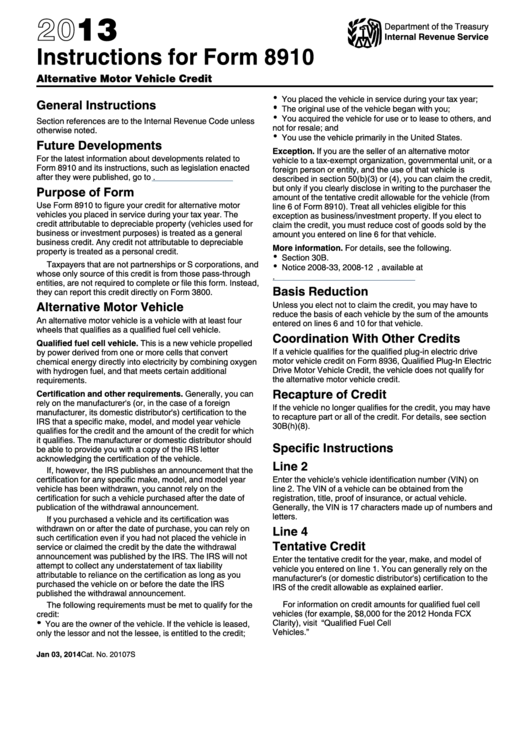

Instructions For Form 8910 - Alternative Motor Vehicle Credit - 2013

ADVERTISEMENT

2013

Department of the Treasury

Internal Revenue Service

Instructions for Form 8910

Alternative Motor Vehicle Credit

You placed the vehicle in service during your tax year;

General Instructions

The original use of the vehicle began with you;

You acquired the vehicle for use or to lease to others, and

Section references are to the Internal Revenue Code unless

not for resale; and

otherwise noted.

You use the vehicle primarily in the United States.

Future Developments

Exception. If you are the seller of an alternative motor

For the latest information about developments related to

vehicle to a tax-exempt organization, governmental unit, or a

Form 8910 and its instructions, such as legislation enacted

foreign person or entity, and the use of that vehicle is

after they were published, go to

described in section 50(b)(3) or (4), you can claim the credit,

but only if you clearly disclose in writing to the purchaser the

Purpose of Form

amount of the tentative credit allowable for the vehicle (from

Use Form 8910 to figure your credit for alternative motor

line 6 of Form 8910). Treat all vehicles eligible for this

vehicles you placed in service during your tax year. The

exception as business/investment property. If you elect to

credit attributable to depreciable property (vehicles used for

claim the credit, you must reduce cost of goods sold by the

business or investment purposes) is treated as a general

amount you entered on line 6 for that vehicle.

business credit. Any credit not attributable to depreciable

More information. For details, see the following.

property is treated as a personal credit.

Section 30B.

Taxpayers that are not partnerships or S corporations, and

Notice 2008-33, 2008-12 I.R.B. 642, available at

whose only source of this credit is from those pass-through

entities, are not required to complete or file this form. Instead,

Basis Reduction

they can report this credit directly on Form 3800.

Alternative Motor Vehicle

Unless you elect not to claim the credit, you may have to

reduce the basis of each vehicle by the sum of the amounts

An alternative motor vehicle is a vehicle with at least four

entered on lines 6 and 10 for that vehicle.

wheels that qualifies as a qualified fuel cell vehicle.

Coordination With Other Credits

Qualified fuel cell vehicle. This is a new vehicle propelled

If a vehicle qualifies for the qualified plug-in electric drive

by power derived from one or more cells that convert

motor vehicle credit on Form 8936, Qualified Plug-In Electric

chemical energy directly into electricity by combining oxygen

Drive Motor Vehicle Credit, the vehicle does not qualify for

with hydrogen fuel, and that meets certain additional

the alternative motor vehicle credit.

requirements.

Recapture of Credit

Certification and other requirements. Generally, you can

rely on the manufacturer's (or, in the case of a foreign

If the vehicle no longer qualifies for the credit, you may have

manufacturer, its domestic distributor's) certification to the

to recapture part or all of the credit. For details, see section

IRS that a specific make, model, and model year vehicle

30B(h)(8).

qualifies for the credit and the amount of the credit for which

it qualifies. The manufacturer or domestic distributor should

Specific Instructions

be able to provide you with a copy of the IRS letter

acknowledging the certification of the vehicle.

Line 2

If, however, the IRS publishes an announcement that the

certification for any specific make, model, and model year

Enter the vehicle's vehicle identification number (VIN) on

line 2. The VIN of a vehicle can be obtained from the

vehicle has been withdrawn, you cannot rely on the

certification for such a vehicle purchased after the date of

registration, title, proof of insurance, or actual vehicle.

publication of the withdrawal announcement.

Generally, the VIN is 17 characters made up of numbers and

letters.

If you purchased a vehicle and its certification was

withdrawn on or after the date of purchase, you can rely on

Line 4

such certification even if you had not placed the vehicle in

Tentative Credit

service or claimed the credit by the date the withdrawal

announcement was published by the IRS. The IRS will not

Enter the tentative credit for the year, make, and model of

attempt to collect any understatement of tax liability

vehicle you entered on line 1. You can generally rely on the

attributable to reliance on the certification as long as you

manufacturer's (or domestic distributor's) certification to the

purchased the vehicle on or before the date the IRS

IRS of the credit allowable as explained earlier.

published the withdrawal announcement.

For information on credit amounts for qualified fuel cell

The following requirements must be met to qualify for the

vehicles (for example, $8,000 for the 2012 Honda FCX

credit:

Clarity), visit IRS.gov and search for “Qualified Fuel Cell

You are the owner of the vehicle. If the vehicle is leased,

Vehicles.”

only the lessor and not the lessee, is entitled to the credit;

Jan 03, 2014

Cat. No. 20107S

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2