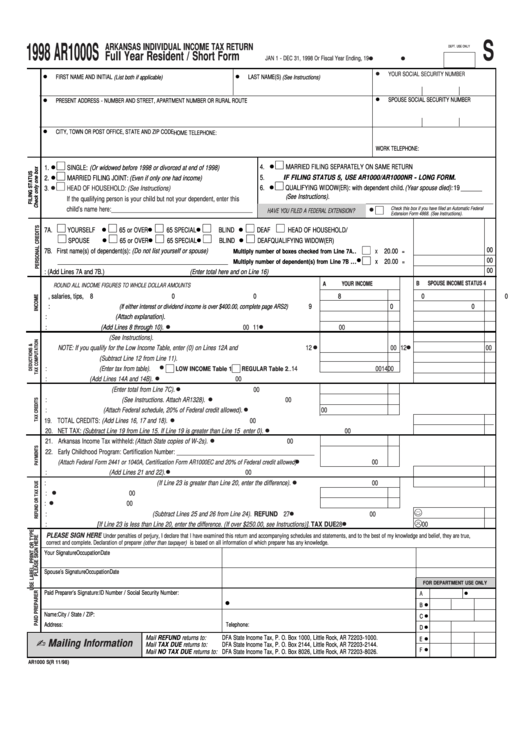

S

1998 AR1000S

ARKANSAS INDIVIDUAL INCOME TAX RETURN

DEPT. USE ONLY

Full Year Resident / Short Form

JAN 1 - DEC 31, 1998 Or Fiscal Year Ending

, 19

YOUR SOCIAL SECURITY NUMBER

FIRST NAME AND INITIAL (List both if applicable)

LAST NAME(S) (See Instructions)

SPOUSE SOCIAL SECURITY NUMBER

PRESENT ADDRESS - NUMBER AND STREET, APARTMENT NUMBER OR RURAL ROUTE

CITY, TOWN OR POST OFFICE, STATE AND ZIP CODE

HOME TELEPHONE:

WORK TELEPHONE:

4.

MARRIED FILING SEPARATELY ON SAME RETURN

01.

SINGLE: (Or widowed before 1998 or divorced at end of 1998)

5.

IF FILING STATUS 5, USE AR1000/AR1000NR - LONG FORM.

02.

MARRIED FILING JOINT: (Even if only one had income)

6

QUALIFYING WIDOW(ER): with dependent child. (Year spouse died): 19 ______

03

HEAD OF HOUSEHOLD: (See Instructions)

.

.

See Instructions).

(

If the qualifying person is your child but not your dependent, enter this

child’s name here: ________________________________________

Check this box if you have filed an Automatic Federal

HAVE YOU FILED A FEDERAL EXTENSION?

Extension Form 4868. (See Instructions).

7A.

YOURSELF

65 or OVER

65 SPECIAL

BLIND

DEAF

HEAD OF HOUSEHOLD/

SPOUSE

65 or OVER

65 SPECIAL

BLIND

DEAF

QUALIFYING WIDOW(ER)

00

7B

First name(s) of dependent(s): (Do not list yourself or spouse)

x

020.00

.

Multiply number of boxes checked from Line 7A..

=

00

x 020.00

_______________________________________________________

Multiply number of dependent(s) from Line 7B ...

=

00

7C. TOTAL PERSONAL CREDITS: (Add Lines 7A and 7B.) (Enter total here and on Line 16) .................................................................................. 7C

YOUR INCOME

B

SPOUSE INCOME STATUS 4

A

ROUND ALL INCOME FIGURES TO WHOLE DOLLAR AMOUNTS

08. Wages, salaries, tips, etc........................................................................................................................ 08

00 08

00

09. Interest/dividend income: (If either interest or dividend income is over $400.00, complete page ARS2) ........... 09

00 09

00

10. Miscellaneous Income: (Attach explanation). ........................................................................................ 10

00 10

00

11. TOTAL INCOME: (Add Lines 8 through 10). ......................................................................................... 11

00 11

00

12. Standard Deduction. (See Instructions). ................................................................................................

NOTE: If you qualify for the Low Income Table, enter (0) on Lines 12A and 12B. ................................. 12

00 12

00

13. Taxable Income. (Subtract Line 12 from Line 11). ................................................................................ 13

00 13

00

14. Select Tax Table: (Enter tax from table).

.. 14

00 14

00

LOW INCOME Table 1

REGULAR Table 2

15. TOTAL TAX: (Add Lines 14A and 14B). ............................................................................................................................................................. 15

00

16. Personal Tax Credits. (Enter total from Line 7C). .................................................................................. 16

00

17. Working Taxpayer Credit: (See Instructions. Attach AR1328). ............................................................. 17

00

18. Child Care Credit: (Attach Federal schedule, 20% of Federal credit allowed). ...................................... 18

00

TOTAL CREDITS: (Add Lines 16, 17 and 18). ................................................................................................................................................... 19

19

.

00

20

NET TAX: (Subtract Line 19 from Line 15. If Line 19 is greater than Line 15 enter 0). ..................................................................................... 20

00

.

21

Arkansas Income Tax withheld: (Attach State copies of W-2s). ............................................................ 21

00

.

22

Early Childhood Program: Certification Number: _______________________________________

.

(Attach Federal Form 2441 or 1040A, Certification Form AR1000EC and 20% of Federal credit allowed) . ..... 22

00

23. TOTAL PAYMENTS: (Add Lines 21 and 22). .................................................................................................................................................... 23

00

24. AMOUNT OF OVERPAYMENT REFUND: (If Line 23 is greater than Line 20, enter the difference). ................................................................... 24

00

25. Amount to be contributed to AR Disaster Relief Fund: ......................................................................... 25

00

26. Amount to be contributed to the U.S. Olympic Fund: ............................................................................ 26

00

27. AMOUNT TO BE REFUNDED TO YOU: (Subtract Lines 25 and 26 from Line 24). ............................................................................REFUND 27

00

28. AMOUNT DUE: [If Line 23 is less than Line 20, enter the difference. (If over $250.00, see Instructions)]. .......................................TAX DUE 28

00

PLEASE SIGN HERE

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true,

correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your Signature

Occupation

Date

Spouse’s Signature

Occupation

Date

FOR DEPARTMENT USE ONLY

Paid Preparer’s Signature:

ID Number / Social Security Number:

A

B

Name:

City / State / ZIP:

C

Address:

Telephone:

D

Mail REFUND returns to:

DFA State Income Tax, P. O. Box 1000, Little Rock, AR 72203-1000.

E

Mailing Information

Mail TAX DUE returns to:

DFA State Income Tax, P. O. Box 2144, Little Rock, AR 72203-2144.

F

Mail NO TAX DUE returns to: DFA State Income Tax, P. O. Box 8026, Little Rock, AR 72203-8026.

AR1000 S(R 11/98)

1

1 2

2