Form Oa - Domestic Oregon Annual Tax Report - 2000

ADVERTISEMENT

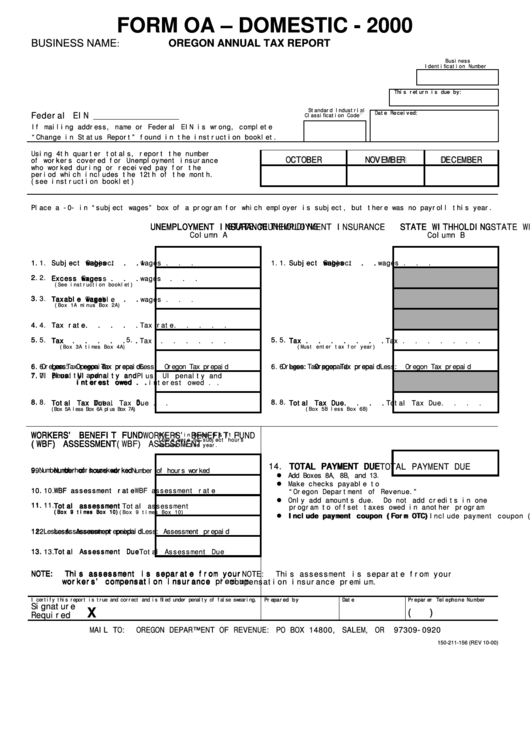

FORM OA – DOMESTIC - 2000

BUSINESS NAME

OREGON ANNUAL TAX REPORT

:

Business

Identification Number

T

T

h

h

i

i

s

s

r

r

e

e

t

t

u

u

r

r

n

n

i

i

s

s

d

d

u

u

e

e

b

b

y

y

:

:

Standard Industrial

D

a

t

e

R

e

c

e

i

v

e

d

:

D

a

t

e

R

e

c

e

i

v

e

d

:

Federal EIN

Classification Code

If mailing address, name or Federal EIN is wrong, complete

“Change in Status Report” found in the instruction booklet.

Using 4th quarter totals, report the number

O

C

T

O

B

E

R

N

O

V

E

M

B

E

R

D

E

C

E

M

B

E

R

O

C

T

O

B

E

R

N

O

V

E

M

B

E

R

D

E

C

E

M

B

E

R

of workers covered for Unemployment insurance

who worked during or received pay for the

period which includes the 12th of the month.

(see instruction booklet)

Place a -0- in “subject wages” box of a program for which employer is subject, but there was no payroll this year.

UNEMPLOYMENT INSURANCE

UNEMPLOYMENT INSURANCE

UNEMPLOYMENT INSURANCE

UNEMPLOYMENT INSURANCE

STATE WITHHOLDING

STATE WITHHOLDING

STATE WITHHOLDING

STATE WITHHOLDING

Column A

Column B

1.

1.

1.

1.

Subject

Subject

Subject

Subject wages .

wages .

wages .

wages .

.

.

.

.

.

.

.

.

1.

1.

1.

1.

Subject

Subject

Subject

Subject wages .

wages .

wages .

wages .

.

.

.

.

.

.

.

.

2.

2.

2.

2.

Excess

Excess wages

wages

.

.

.

.

.

.

Excess

Excess

wages

wages

.

.

.

.

.

.

(See instruction booklet)

3.

3.

3.

3.

Taxable

Taxable

Taxable

Taxable wages .

wages .

wages .

wages .

.

.

.

.

.

.

.

.

(Box 1A minus Box 2A)

4.

4.

4.

4.

Tax rate.

Tax rate.

Tax rate.

Tax rate.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5.

5.

5.

5.

5.

5.

5.

5.

Tax

Tax

.

.

.

.

.

.

.

.

.

.

.

.

Tax .

Tax .

.

.

.

.

.

.

.

.

.

.

.

.

Tax

Tax

.

.

.

.

.

.

.

.

.

.

.

.

Tax .

Tax .

.

.

.

.

.

.

.

.

.

.

.

.

(Box 3A times Box 4A)

(Must enter tax for year)

6.

6.

6.

6.

Less: Oregon Tax prepaid

Less: Oregon Tax prepaid

Less: Oregon Tax prepaid

Less: Oregon Tax prepaid

6.

6.

6.

6.

Less: Oregon Tax prepaid

Less: Oregon Tax prepaid

Less: Oregon Tax prepaid

Less: Oregon Tax prepaid

7.

7.

7.

7.

Plus: UI penalty and

Plus: UI penalty and

Plus: UI penalty and

Plus: UI penalty and

interest owed . .

interest owed . .

interest owed . .

interest owed . .

8.

8.

8.

8.

8.

8.

8.

8.

Total Tax

Total Tax Due .

Due .

.

.

. . . .

Total Tax Due.

Total Tax Due.

.

.

.

.

.

.

Total Tax

Total Tax

Due .

Due .

.

.

. . . .

Total Tax Due.

Total Tax Due.

.

.

.

.

.

.

(Box 5A less Box 6A plus Box 7A)

(Box 5B less Box 6B)

WORKERS’ BENEFIT FUND

WORKERS’ BENEFIT FUND

WORKERS’ BENEFIT FUND

WORKERS’ BENEFIT FUND

Put –0- in Boxes 9 & 11 if

there were no subject hours

(WBF) ASSESSMENT

(WBF) ASSESSMENT

(WBF) ASSESSMENT

(WBF) ASSESSMENT

worked in the year.

14. TOTAL PAYMENT DUE

TOTAL PAYMENT DUE

TOTAL PAYMENT DUE

TOTAL PAYMENT DUE

9 9 9 9

. . . .

Number of hours worked

Number of hours worked

Number of hours worked

Number of hours worked

9 9 9 9

. . . .

Add Boxes 8A, 8B, and 13.

Make checks payable to

10.

10.

10.

10.

WBF assessment rate

WBF assessment rate

WBF assessment rate

WBF assessment rate

“Oregon Department of Revenue.”

Only add amounts due.

Do not add credits in one

11.

11.

11.

11.

Total assessment

Total assessment

Total assessment

Total assessment

program to offset taxes owed in another program

(Box 9 times Box 10)

(Box 9 times Box 10)

(Box 9 times Box 10)

(Box 9 times Box 10)

Include payment coupon (Form OTC)

Include payment coupon (Form OTC)

Include payment coupon (Form OTC)

Include payment coupon (Form OTC)

1 1 1 1

1 1 1 1

2 2 2 2

2 2 2 2

. . . .

. . . .

Less: Assessment prepaid

Less: Assessment prepaid

Less: Assessment prepaid

Less: Assessment prepaid

13.

13.

Total Assessment Due

Total Assessment Due

13.

13.

Total Assessment Due

Total Assessment Due

NOTE:

NOTE:

NOTE:

NOTE:

This assessment is separate from your

This assessment is separate from your

This assessment is separate from your

This assessment is separate from your

workers’ compensation insurance premium.

workers’ compensation insurance premium.

workers’ compensation insurance premium.

workers’ compensation insurance premium.

I certify this report is true and correct and is filed under penalty of false swearing.

P

P

r

r

e

e

p

p

a

a

r

r

e

e

d

d

b

b

y

y

D

D

a

a

t

t

e

e

P

P

r

r

e

e

p

p

a

a

r

r

e

e

r

r

T

T

e

e

l

l

e

e

p

p

h

h

o

o

n

n

e

e

N

N

u

u

m

m

b

b

e

e

r

r

Signature

X

(

)

(

)

Required

MAIL TO:

OREGON DEPARTMENT OF REVENUE: PO BOX 14800, SALEM, OR

97309-0920

150-211-156 (REV 10-00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1