Form R2 - Individual City Of Pickerington Income Tax Return - 1999

ADVERTISEMENT

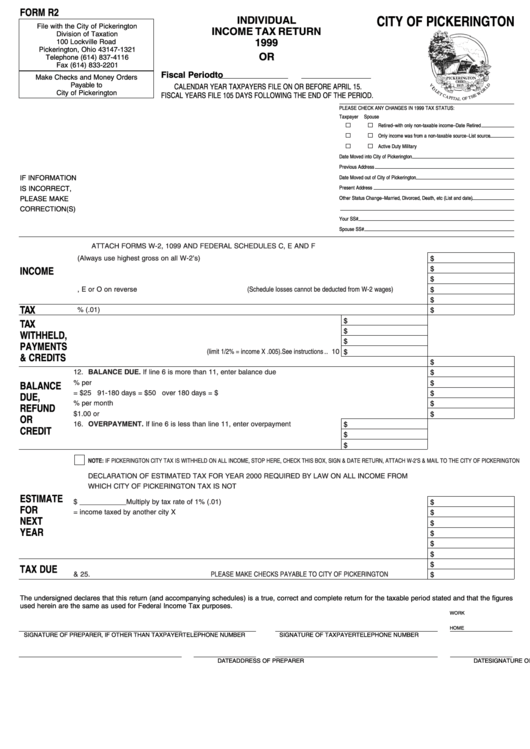

FORM R2

INDIVIDUAL

CITY OF PICKERINGTON

File with the City of Pickerington

INCOME TAX RETURN

Division of Taxation

1999

100 Lockville Road

Pickerington, Ohio 43147-1321

OR

Telephone (614) 837-4116

Fax (614) 833-2201

Fiscal Period

to

Make Checks and Money Orders

Payable to

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 15.

City of Pickerington

FISCAL YEARS FILE 105 DAYS FOLLOWING THE END OF THE PERIOD.

PLEASE CHECK ANY CHANGES IN 1999 TAX STATUS:

Taxpayer

Spouse

Retired–with only non-taxable income–Date Retired

Only income was from a non-taxable source–List source

Active Duty Military

Date Moved into City of Pickerington

Previous Address

IF INFORMATION

Date Moved out of City of Pickerington

IS INCORRECT,

Present Address

PLEASE MAKE

Other Status Change–Married, Divorced, Death, etc (List and date)

CORRECTION(S)

Your SS#

Spouse SS#

ATTACH FORMS W-2, 1099 AND FEDERAL SCHEDULES C, E AND F

1. Total W-2 wages. (Always use highest gross on all W-2’s) ..............................................................................

1

$

2. Adjustments. From Schedule A1 on reverse....................................................................................................

2

$

INCOME

3. TAXABLE WAGES. SUBTRACT LINE 2 FROM LINE 1 ..................................................................................

3

$

4. Other income. From schedule C, E or O on reverse (Schedule losses cannot be deducted from W-2 wages) ..........

4

$

5. TOTAL INCOME. ADD LINES 3 AND 4 ..........................................................................................................

5

$

TAX

6. PICKERINGTON INCOME TAX. MULTIPLY LINE 5 BY 1% (.01) ..................................................................

6

$

7. Pickerington income tax withheld. From W-2 or Worksheet A on reverse. ........

7

$

TAX

8. Prior year credits ................................................................................................

8

$

WITHHELD,

9. Estimated payments............................................................................................

9

$

PAYMENTS

10. Credit for income taxed by other cities (limit 1/2% = income X .005). See instructions.. 10

$

& CREDITS

11. TOTAL PAYMENTS AND CREDITS. ADD LINES 7 THROUGH 10 ................................................................11

$

12. BALANCE DUE. If line 6 is more than 11, enter balance due here ..............................................................12

$

13. Penalty. 1-1/2% per month ..............................................................................................................................13

$

BALANCE

13a. Late Filing Fee. 1-90 days = $25 91-180 days = $50 over 180 days = $100..............................................13a

$

DUE,

14. Interest. 1-1/2% per month ..............................................................................................................................14

$

REFUND

15. Total due. If $1.00 or more. Carry to line 25 below..........................................................................................15

$

OR

16. OVERPAYMENT. If line 6 is less than line 11, enter overpayment here ............ 16

$

CREDIT

17. AMOUNT FROM LINE 16 TO BE REFUNDED .................................................. 17

$

18. AMOUNT FROM LINE 16 TO BE CREDITED TO NEXT YEAR ........................ 18

$

NOTE: IF PICKERINGTON CITY TAX IS WITHHELD ON ALL INCOME, STOP HERE, CHECK THIS BOX, SIGN & DATE RETURN, ATTACH W-2‘S & MAIL TO THE CITY OF PICKERINGTON

DECLARATION OF ESTIMATED TAX FOR YEAR 2000 REQUIRED BY LAW ON ALL INCOME FROM

WHICH CITY OF PICKERINGTON TAX IS NOT WITHHELD. PENALTY FOR NON-COMPLIANCE.

ESTIMATE

19. Total income subject to tax $ ____________ Multiply by tax rate of 1% (.01) .............................................. 19

$

FOR

20. Subtract resident credit = income taxed by another city X .005 ...................................................................... 20

$

NEXT

21. Balance of city income tax declared. Subtract line 20 from line 19 ................................................................ 21

$

YEAR

22. Less credits. Enter line 18 from above ............................................................................................................ 22

$

23. Net estimated tax due. Subtract line 22 from line 21 ...................................................................................... 23

$

24. First half estimate payment. Enter 1/2 of line 23 ............................................................................................ 24

$

25. Enter balance due from line 15 above ............................................................................................................ 25

$

TAX DUE

26. TOTAL TAX DUE. ADD LINES 24 & 25. PLEASE MAKE CHECKS PAYABLE TO CITY OF PICKERINGTON .............. 26

$

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures

used herein are the same as used for Federal Income Tax purposes.

WORK

HOME

SIGNATURE OF PREPARER, IF OTHER THAN TAXPAYER

TELEPHONE NUMBER

SIGNATURE OF TAXPAYER

TELEPHONE NUMBER

ADDRESS OF PREPARER

DATE

SIGNATURE OF SPOUSE (IF JOINT RETURN)

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2