Print and Reset Form

Reset Form

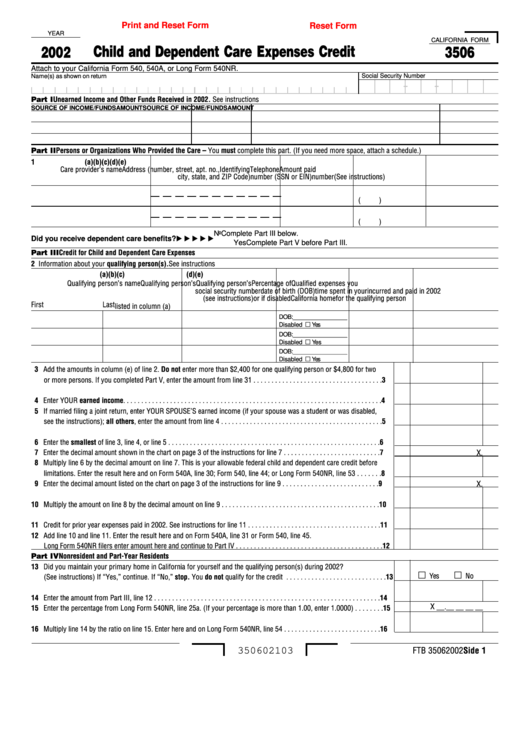

YEAR

CALIFORNIA FORM

Child and Dependent Care Expenses Credit

2002

3506

Attach to your California Form 540, 540A, or Long Form 540NR.

Name(s) as shown on return

Social Security Number

-

-

Part I

Unearned Income and Other Funds Received in 2002. See instructions

SOURCE OF INCOME/FUNDS

AMOUNT

SOURCE OF INCOME/FUNDS

AMOUNT

Part II Persons or Organizations Who Provided the Care – You must complete this part. (If you need more space, attach a schedule.)

1

(a)

(b)

(c)

(d)

(e)

Care provider’s name

Address (number, street, apt. no.,

Identifying

Telephone

Amount paid

city, state, and ZIP Code)

number (SSN or EIN)

number

(See instructions)

(

)

(

)

No Complete Part III below.

Did you receive dependent care benefits?

Yes Complete Part V before Part III.

Part III Credit for Child and Dependent Care Expenses

2 Information about your qualifying person(s). See instructions

(a)

(b)

(c)

(d)

(e)

Qualifying person’s name

Qualifying person’s

Qualifying person’s

Percentage of

Qualified expenses you

social security number

date of birth (DOB)

time spent in your

incurred and paid in 2002

(see instructions)

or if disabled

California home

for the qualifying person

First

Last

listed in column (a)

DOB:_________________

Disabled

Yes

DOB:_________________

Disabled

Yes

DOB:_________________

Disabled

Yes

3 Add the amounts in column (e) of line 2. Do not enter more than $2,400 for one qualifying person or $4,800 for two

or more persons. If you completed Part V, enter the amount from line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Enter YOUR earned income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5 If married filing a joint return, enter YOUR SPOUSE’S earned income (if your spouse was a student or was disabled,

see the instructions); all others, enter the amount from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Enter the smallest of line 3, line 4, or line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7 Enter the decimal amount shown in the chart on page 3 of the instructions for line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

X.

8 Multiply line 6 by the decimal amount on line 7. This is your allowable federal child and dependent care credit before

limitations. Enter the result here and on Form 540A, line 30; Form 540, line 44; or Long Form 540NR, line 53 . . . . . . .

8

9 Enter the decimal amount listed on the chart on page 3 of the instructions for line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

X.

10 Multiply the amount on line 8 by the decimal amount on line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Credit for prior year expenses paid in 2002. See instructions for line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12 Add line 10 and line 11. Enter the result here and on Form 540A, line 31 or Form 540, line 45.

Long Form 540NR filers enter amount here and continue to Part IV . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Part IV Nonresident and Part-Year Residents

13 Did you maintain your primary home in California for yourself and the qualifying person(s) during 2002?

Yes

No

(See instructions) If “Yes,” continue. If “No,” stop. You do not qualify for the credit . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Enter the amount from Part III, line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

X __.__ __ __ __

15 Enter the percentage from Long Form 540NR, line 25a. (If your percentage is more than 1.00, enter 1.0000) . . . . . . . .

15

16 Multiply line 14 by the ratio on line 15. Enter here and on Long Form 540NR, line 54 . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

350602103

FTB 3506 2002 Side 1

1

1 2

2