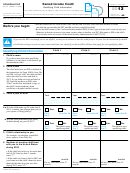

SCHEDULE M

OMB No. 1545-0074

Making Work Pay and Government

(Form 1040A or 1040)

2009

Retiree Credits

Attachment

Department of the Treasury

Attach to Form 1040A, 1040, or 1040NR.

See separate instructions.

166

(99)

Sequence No.

Internal Revenue Service

Name(s) shown on return

Your social security number

1a

Important: See the instructions if you can be claimed as someone else’s dependent, you have a net loss

from a business, your wages include pay for work performed while an inmate in a penal institution, or you

are filing Form 1040NR, 2555, or 2555-EZ. Residents of Puerto Rico or American Samoa, see Pub. 570.

Do you (and your spouse if filing jointly) have 2009 wages of more than $6,451 ($12,903 if

married filing jointly)?

Yes. Skip lines 1a through 3. Enter $400 ($800 if married filing jointly) on line 4 and go to line 5.

1a

No. Enter your earned income (see instructions)

b

Nontaxable combat pay included on

1b

line 1a (see instructions)

2

2

Multiply line 1a by 6.2% (.062)

3

3

Enter $400 ($800 if married filing jointly)

4

4

Enter the smaller of line 2 or line 3 (unless you checked “Yes” on line 1a)

5

5

Enter the amount from Form 1040, line 38*, or Form 1040A, line 22

6

6

Enter $75,000 ($150,000 if married filing jointly)

7

Is the amount on line 5 more than the amount on line 6?

No. Skip line 8. Enter the amount from line 4 on line 9 below.

7

Yes. Subtract line 6 from line 5

8

8

Multiply line 7 by 2% (.02)

9

9

Subtract line 8 from line 4. If zero or less, enter -0-

10

Did you (or your spouse, if filing jointly) receive an economic recovery payment in 2009? You

may have received this payment if you received social security benefits, supplemental security

income, railroad retirement benefits, or veterans disability compensation or pension benefits (see

instructions).

No. Enter -0- on line 10 and go to line 11.

10

Yes. Enter the total of the payments received by you (and your spouse, if filing

jointly). Do not enter more than $250 ($500 if married filing jointly)

11

Did you (or your spouse, if filing jointly) receive a pension or annuity in 2009 for services performed

as an employee of the U.S. Government or any U.S. state or local government from work not

covered by social security? Do not include any pension or annuity reported on Form W-2.

No. Enter -0- on line 11 and go to line 12.

Yes.

If you checked “No” on line 10, enter $250 ($500 if married filing jointly

and the answer on line 11 is “Yes” for both spouses)

11

If you checked “Yes” on line 10, enter -0- (exception: enter $250 if filing

jointly and the spouse who received the pension or annuity did not receive

an economic recovery payment described on line 10)

12

12

Add lines 10 and 11

13

13

Subtract line 12 from line 9. If zero or less, enter -0-

14

Making work pay and government retiree credits. Add lines 11 and 13. Enter the result here

14

and on Form 1040, line 63; Form 1040A, line 40; or Form 1040NR, line 60

*If you are filing Form 2555, 2555-EZ, or 4563 or you are excluding income from Puerto Rico, see instructions.

For Paperwork Reduction Act Notice, see Form 1040A, 1040, or

Schedule M (Form 1040A or 1040) 2009

Cat. No. 52903Q

1040NR instructions.

1

1 2

2