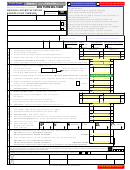

FORM MO-1040B

PAGE 2

STANDARD DEDUCTION AMOUNTS

I

• Married Filing A Combined Return — $7,100

If you or your spouse marked any of the boxes for 65 or over or blind, please see your federal return for your standard deduction amount.

Federal Form

Federal Form

1040EZ

1040EZ

1040A

1040A

1040

1040

Line Number or Amount

Line Number or Amount

$7,100

$7,100

21

21

36

36

MISSOURI ITEMIZED DEDUCTIONS

• You will need to use the Line-by-Line Instructions on page 4.

• Complete only if you itemize deductions on Federal Form 1040, Schedule A.

• Enclose a copy of pages 1 and 2 of your Federal Form 1040 and Federal Form 1040, Schedule A. If you were required to itemize

deductions on your federal return, check here

. (See instructions)

1

00

1. Total federal itemized deductions from Federal Form 1040, Line 36 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

2. 1998 (FICA) — yourself — Social security $

+ Medicare $

. . . .

3

00

3. 1998 (FICA) — spouse — Social security $

+ Medicare $

. . . .

4

00

4. 1998 Railroad retirement tax — yourself (Tier I and Tier II) $

Medicare $

. . . .

5

00

5. 1998 Railroad retirement tax — spouse (Tier I and Tier II) $

Medicare $

. . . .

6

00

6. 1998 Self-employment tax — yourself $

Amount from Federal Form 1040, Line 27 $

Difference . . .

7

00

7. 1998 Self-employment tax — spouse $

Amount from Federal Form 1040, Line 27 $

Difference . . .

8

00

8. Cultural Contributions (DO NOT INCLUDE CASH CONTRIBUTIONS) — see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

9. TOTAL — add Lines 1 through 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

10. State and local income taxes — Review instructions and worksheet below before completing . . . . .

11

00

11. Kansas City and St. Louis earnings taxes included in Line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

00

12. Net state income taxes — see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

13. MISSOURI ITEMIZED DEDUCTIONS — subtract Line 12 from Line 9 (enter here and on front of form, Line 8) . . . . . . . . . . . . . . . . .

NOTE: IF LINE 13 IS LESS THAN YOUR FEDERAL STANDARD DEDUCTION, SEE INSTRUCTIONS.

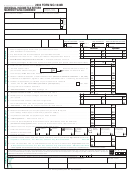

WORKSHEET FOR LINE 10 — STATE AND LOCAL INCOME TAXES — Complete this worksheet only if your federal adjusted gross

income from Federal Form 1040, Line 33 is more than $124,500 ($62,250 if married filing separate). If your federal adjusted gross

income is less than or equal to these amounts, do not complete this worksheet . See the instructions for the amount to enter in

Missouri Itemized Deductions, Line 12, above.

1. Enter amount from Federal Form 1040, Schedule A, Itemized Deduction Worksheet, Line 3 (see page A-6 of

1

00

Federal Schedule A instructions). If $0 or less, enter $0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Enter amount from Federal Form 1040, Schedule A, Itemized Deduction Worksheet, Line 9 (see page A-6 of

2

00

Federal Schedule A instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

3. State and local income taxes from Federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

4. Kansas City and St. Louis earnings taxes included on Federal Form 1040, Schedule A, Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

5. Subtract Line 4 from Line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

6

6. Divide Line 5 by Line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

7. Multiply Line 2 by Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

8. Subtract Line 7 from Line 5. Enter here and on Line 12 above. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1998 TAX TABLE

L

If Line 13 is

If Line 13 is

If Line 13 is

If Line 13 is

If Line 13 is

If Line 13 is

If Line 13 is

But

But

But

But

But

But

But

At

At

less

less

Your

Your

At

less

Your

At

less

Your

At

less

Your

At

less

Your

At

less

Your

least

least

than

than

tax is

tax is

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

0

0

100

100

$ 0

$ 0

1,500

1,500

1,600

1,600

$ 26

$ 26

3,000

3,000

3,100

3,100

62

62

4,500

4,500

4,600

4,600

$109

$109

6,000

6,000

6,100

6,100

$167

$167

7,500

7,500

7,600

7,600

$238

$238

100

100

200

200

2

2

1,600

1,600

1,700

1,700

28

28

3,100

3,100

3,200

3,200

65

65

4,600

4,600

4,700

4,700

113

113

6,100

6,100

6,200

6,200

172

172

7,600

7,600

7,700

7,700

243

243

200

200

300

300

4

4

1,700

1,700

1,800

1,800

30

30

3,200

3,200

3,300

3,300

68

68

4,700

4,700

4,800

4,800

116

116

6,200

6,200

6,300

6,300

176

176

7,700

7,700

7,800

7,800

248

248

300

300

400

400

5

5

1,800

1,800

1,900

1,900

32

32

3,300

3,300

3,400

3,400

71

71

4,800

4,800

4,900

4,900

120

120

6,300

6,300

6,400

6,400

181

181

7,800

7,800

7,900

7,900

253

253

400

400

500

500

7

7

1,900

1,900

2,000

2,000

34

34

3,400

3,400

3,500

3,500

74

74

6,400

6,400

6,500

6,500

185

185

7,900

7,900

8,000

8,000

258

258

4,900

4,900

5,000

5,000

123

123

500

500

600

600

8

8

2,000

2,000

2,100

2,100

36

36

3,500

3,500

3,600

3,600

77

77

5,000

5,000

5,100

5,100

127

127

6,500

6,500

6,600

6,600

190

190

8,000

8,000

8,100

8,100

263

263

600

600

700

700

10

10

2,100

2,100

2,200

2,200

39

39

3,600

3,600

3,700

3,700

80

80

5,100

5,100

5,200

5,200

131

131

6,600

6,600

6,700

6,700

194

194

8,100

8,100

8,200

8,200

268

268

700

700

800

800

11

11

2,200

2,200

2,300

2,300

41

41

6,700

6,700

6,800

6,800

199

199

8,200

8,200

8,300

8,300

274

274

3,700

3,700

3,800

3,800

83

83

5,200

5,200

5,300

5,300

135

135

800

800

900

900

13

13

2,300

2,300

2,400

2,400

44

44

3,800

3,800

3,900

3,900

86

86

5,300

5,300

5,400

5,400

139

139

6,800

6,800

6,900

6,900

203

203

8,300

8,300

8,400

8,400

279

279

900

900

1,000

1,000

14

14

2,400

2,400

2,500

2,500

46

46

3,900

3,900

4,000

4,000

89

89

5,400

5,400

5,500

5,500

143

143

6,900

6,900

7,000

7,000

208

208

8,400

8,400

8,500

8,500

285

285

1,000

1,000

1,100

1,100

16

16

7,000

7,000

7,100

7,100

213

213

2,500

2,500

2,600

2,600

49

49

4,000

4,000

4,100

4,100

92

92

5,500

5,500

5,600

5,600

147

147

8,500

8,500

8,600

8,600

290

290

1,100

1,100

1,200

1,200

18

18

2,600

2,600

2,700

2,700

51

51

4,100

4,100

4,200

4,200

95

95

5,600

5,600

5,700

5,700

151

151

7,100

7,100

7,200

7,200

218

218

8,600

8,600

8,700

8,700

296

296

1,200

1,200

1,300

1,300

20

20

2,700

2,700

2,800

2,800

54

54

4,200

4,200

4,300

4,300

99

99

5,700

5,700

5,800

5,800

155

155

7,200

7,200

7,300

7,300

223

223

8,700

8,700

8,800

8,800

301

301

1,300

1,300

1,400

1,400

22

22

2,800

2,800

2,900

2,900

56

56

4,300

4,300

4,400

4,400

102

102

5,800

5,800

5,900

5,900

159

159

7,300

7,300

7,400

7,400

228

228

8,800

8,800

8,900

8,900

307

307

1,400

1,400

1,500

1,500

24

24

2,900

2,900

3,000

3,000

59

59

4,400

4,400

4,500

4,500

106

106

5,900

5,900

6,000

6,000

163

163

7,400

7,400

7,500

7,500

233

233

8,900

8,900

9,000

9,000

312

312

9,000

9,000

315

315

Round To The Nearest Whole Dollar

Example — If Line 13 is $12,000, the

PLUS 6% of excess

PLUS 6% of excess

tax would be computed as follows:

over $9,000

over $9,000

$315 + $180 (6% of $3,000) = $495

This publication is available upon request in alternative accessible format(s). TDD 1-800-735-2966

MO 860-2843 (11-98)

1

1 2

2 3

3