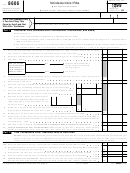

Form 8606 - Nondeductible Iras - 1999 Page 2

ADVERTISEMENT

2

Form 8606 (1999)

Page

Part III

Distributions From Roth IRAs

There is a worksheet on page 6 of the instructions to help you keep track of your contributions, distributions, and

year-end balances in your Roth IRA. You may need these amounts in future years.

17

17

Enter the total Roth IRA distributions (withdrawals) you received in 1999. Do not include rollovers

18

a

Enter your basis in your Roth IRA contributions for 1998. See page 6 of

18a

the instructions

b

Enter your Roth IRA contributions for 1999, including those made for 1999

from January 1, 2000, through April 17, 2000. Do not include rollovers or

18b

amounts converted from traditional IRAs

c

Recharacterizations of 1999 contributions to or from Roth IRAs. See

18c

page 6 of the instructions

18d

d Combine lines 18a through 18c

19

19

Subtract line 18d from line 17. If zero or less, enter -0- and do not complete the rest of Part III

Note: If you converted amounts from traditional IRAs to Roth IRAs in 1998 and elected to report the

taxable income over 4 years, go to line 20a; otherwise, skip to line 21.

20a Subtract the amount from your 1998 Form 8606, line 17, from the amount

20a

on line 16 of that form and enter the result

b Enter the amount, if any, from your 1998

20b

Form 8606, line 22

c Enter the 1999 taxable portion of your 1998

Roth IRA conversion. See page 7 of the

instructions. Be sure to include this amount

20c

on line 27

20d

d

Add lines 20b and 20c

20e

e

Subtract line 20d from line 20a. If zero or less, enter -0-

21

21

Enter the smaller of line 19 or line 20e. If line 20e is blank, enter -0-

22

22

Subtract line 21 from line 19. If zero, skip lines 23 through 26 and go to line 27

23

Enter your basis in your Roth IRA conversions for 1998. See page 7 of

23

the instructions

24

24

Enter the amount, if any, from line 14c of this form

25

25

Add lines 23 and 24

26

26

Subtract line 25 from line 19. If zero or less, enter -0-

27

Taxable amount. Add lines 20c, 21, and 26. Enter the total here and include this amount in the total

27

on Form 1040, line 15b; Form 1040A, line 10b; or Form 1040NR, line 16b

Note: You may be subject to an additional 10% tax. See page 7 of the instructions for details.

Part IV

Distributions From Education (Ed) IRAs

Caution: For 1999, a beneficiary can receive total contributions to Ed IRAs of up to $500. See page 7 of the instructions if

contributions exceeded $500.

28

28

Enter the total Ed IRA distributions (withdrawals) you received in 1999. Do not include rollovers

29

Do you elect to waive the exclusion from income for Ed IRA distributions? If you check “No” and

exclude from income any portion of an Ed IRA distribution, no Hope or lifetime learning credit will be

allowed for your 1999 qualified tuition and related expenses.

29

Yes. Enter -0-.

No.

Enter your qualified higher education expenses for 1999.

30

Taxable amount. Is line 28 equal to or less than line 29?

Yes. Enter -0-; none of your Ed IRA distributions are taxable for 1999. But you should

complete the worksheet on page 7 of the instructions to figure your basis in your

Ed IRAs. You may need to know your basis in future years.

30

No.

See the worksheet on page 7 of the instructions for the amount to enter. Also include

this amount in the total on Form 1040, line 15b; Form 1040A, line 10b; or Form

1040NR, line 16b.

Note: If you have a taxable amount on line 30, you may be subject to an additional 10% tax. See

page 8 of the instructions for details, including exceptions to the additional tax.

Under penalties of perjury, I declare that I have examined this form, including accompanying attachments, and to the best of my

Sign Here Only if You

knowledge and belief, it is true, correct, and complete.

Are Filing This Form

by Itself and Not With

Your Tax Return

Your signature

Date

8606

Form

(1999)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2