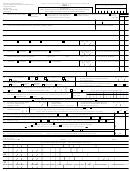

Each Question Must Be Answered Completely

REG-1 (pg. 2)

1. a. Will you collect New Jersey Sales Tax and/or pay Use Tax? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

GIVE EXACT DATE YOU EXPECT TO MAKE FIRST SALE ___________/__________/__________

Month

Day

Year

b. Will you need to make exempt purchases for your inventory or to produce your product? . . . . . . . . . . . . . . . . . .

Yes

No

c. Is your business located in (check applicable box(es)):

Atlantic City

Salem County

North Wildwood

Wildwood Crest

Wildwood

2. a. Will you be paying wages, salaries or commissions to employees working in New Jersey and/or

to New Jersey residents working outside New Jersey? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

GIVE DATE OF FIRST WAGE OR SALARY PAYMENT ___________/__________/__________

Month

Day

Year

b. Will you be the payer of pension or annuity income to New Jersey residents? . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

c. Will you be holding legalized games of chance in New Jersey (as defined in Chapter 47 - Rules of

Legalized Games of Chance) where proceeds from any one prize exceed $1,000? . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Note: NJ Lottery Proceeds not included

3. Do you intend to sell cigarettes? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Note: If yes, complete the REG-L form in this booklet and return with your completed REG-1.

To obtain a cigarette retail or vending machine license complete the CM-100 in this booklet.

4. a. Are you a distributor or wholesaler of tobacco products other than cigarettes? . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

b. Are you a retailer subject to the compensating use tax as defined under the Tobacco Products Wholesale

Sales and Use Tax? (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

5. Are you a manufacturer, wholesaler, distributor or retailer of “litter-generating products”? If your annual

retail sales of litter-generating products is less than $250,000 you are EXEMPT from this tax. (See Instructions) . .

Yes

No

6. Are you an owner or operator of a sanitary landfill facility or a solid waste facility in New Jersey? . . . . . . . . . . . . . .

Yes

No

IF YES, indicate D.E.P. Facility # and type (See instructions) _____________________________________

7. a. Do you operate a facility that has the total combined capacity to store 200,000 gallons or more of

petroleum products? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

b. Do you operate a facility that has the total combined capacity to store 20,000 gallons

(equals 167,043 pounds) of hazardous chemicals? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

c. Do you store petroleum products or hazardous chemicals at a public storage terminal? . . . . . . . . . . . . . . . . . . .

Yes

No

Name of terminal ___________________________________________________________________________

8. a. Will you be involved with the sale or transport of motor fuels and/or petroleum? . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Note:

If yes, complete the REG-L form in this booklet and return with your completed REG-1. To obtain

a motor fuels retail or transport license complete and return the CM-100 in this booklet.

b. Will your company be engaged in the refining and/or distributing of petroleum products for distribution in

this State or the importing of petroleum products into New Jersey for consumption in New Jersey? . . . . . . . . . . .

Yes

No

c. Will your business activity require you to issue a Direct Payment Permit in lieu of payment of the Petroleum

Products Gross Receipts Tax on your purchases of petroleum products? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

9. If you are a Limited Liability Company, indicate which return you file with the Internal Revenue Service.

Federal Form 1065

Federal Form 1120

10. List any other New Jersey State taxes for which this business may be eligible (see instructions).

___________________________________________________________________________________________________________

11. Type of business:

1. Manufacturer

2. Service

3. Wholesale

4. Construction

5. Retail

6. Government

Principal product or service _____________________________________________________________________________________

- 12 -

1

1 2

2