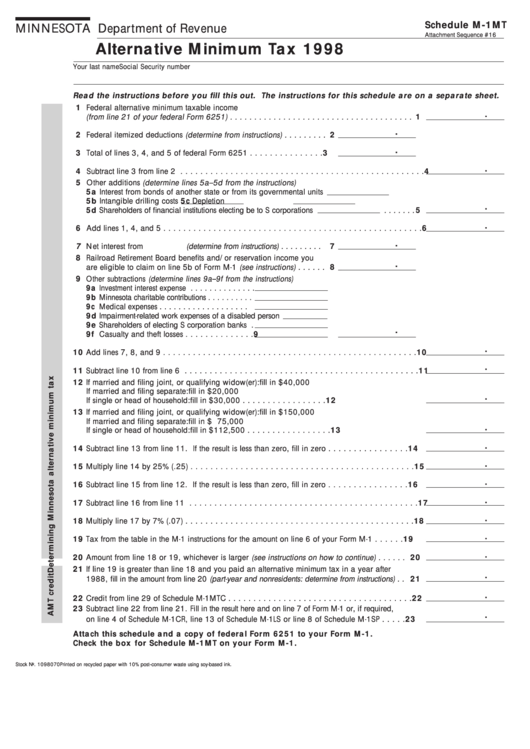

Schedule M-1MT

MINNESOTA Department of Revenue

Attachment Sequence #16

Alternative Minimum Tax 1998

Your last name

Social Security number

Read the instructions before you fill this out. The instructions for this schedule are on a separate sheet.

1 Federal alternative minimum taxable income

.

(from line 21 of your federal Form 6251) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.

2 Federal itemized deductions (determine from instructions) . . . . . . . . . 2

.

3 Total of lines 3, 4, and 5 of federal Form 6251 . . . . . . . . . . . . . . . 3

.

4 Subtract line 3 from line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Other additions (determine lines 5a–5d from the instructions)

5a Interest from bonds of another state or from its governmental units

5b Intangible drilling costs

5c Depletion

.

5d Shareholders of financial institutions electing be to S corporations

. . . . . . . 5

.

6 Add lines 1, 4, and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

.

7 Net interest from U.S. bonds (determine from instructions) . . . . . . . . . 7

8 Railroad Retirement Board benefits and/or reservation income you

.

are eligible to claim on line 5b of Form M-1 (see instructions) . . . . . . 8

9 Other subtractions (determine lines 9a–9f from the instructions)

9a Investment interest expense . . . . . . . . . . . . . .

9b Minnesota charitable contributions . . . . . . . . . .

9c Medical expenses . . . . . . . . . . . . . . . . . . .

9d Impairment-related work expenses of a disabled person

9e Shareholders of electing S corporation banks .

.

9f Casualty and theft losses . . . . . . . . . . . . . .

9

.

10 Add lines 7, 8, and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.

11 Subtract line 10 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 If married and filing joint, or qualifying widow(er):

fill in $40,000

If married and filing separate:

fill in $20,000

.

If single or head of household:

fill in $30,000 . . . . . . . . . . . . . . . . . 12

13 If married and filing joint, or qualifying widow(er): fill in $150,000

If married and filing separate:

fill in $ 75,000

.

If single or head of household:

fill in $112,500 . . . . . . . . . . . . . . . . . 13

.

14 Subtract line 13 from line 11. If the result is less than zero, fill in zero . . . . . . . . . . . . . . . . 14

.

15 Multiply line 14 by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

.

16 Subtract line 15 from line 12. If the result is less than zero, fill in zero . . . . . . . . . . . . . . . . 16

.

17 Subtract line 16 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

.

18 Multiply line 17 by 7% (.07) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

.

19 Tax from the table in the M-1 instructions for the amount on line 6 of your Form M-1 . . . . . . 19

.

20 Amount from line 18 or 19, whichever is larger (see instructions on how to continue) . . . . . . 20

21 If line 19 is greater than line 18 and you paid an alternative minimum tax in a year after

.

1988, fill in the amount from line 20 (part-year and nonresidents: determine from instructions) . . 21

.

22 Credit from line 29 of Schedule M-1MTC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Subtract line 22 from line 21. Fill in the result here and on line 7 of Form M-1 or, if required,

.

on line 4 of Schedule M-1CR, line 13 of Schedule M-1LS or line 8 of Schedule M-1SP . . . . . 23

Attach this schedule and a copy of federal Form 6251 to your Form M-1.

Check the box for Schedule M-1MT on your Form M-1.

Stock No. 1098070

Printed on recycled paper with 10% post--consumer waste using soy-based ink.

1

1