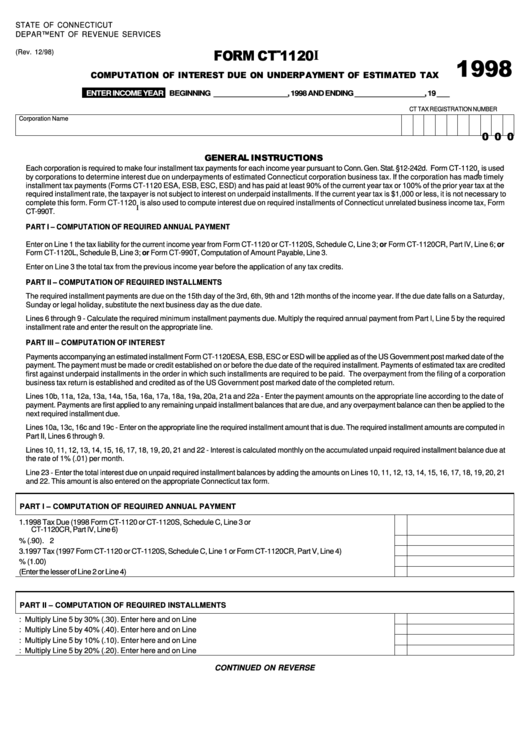

Form Ct-1120i - Computation Of Interest Due On Underpayment Of Estimated Tax - 1998

ADVERTISEMENT

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/98)

ENTER INCOME YEAR

BEGINNING __________________, 1998 AND ENDING _________________, 19 ___

CT TAX REGISTRATION NUMBER

Corporation Name

Each corporation is required to make four installment tax payments for each income year pursuant to Conn. Gen. Stat. §12-242d. Form CT-1120 is used

by corporations to determine interest due on underpayments of estimated Connecticut corporation business tax. If the corporation has made timely

installment tax payments (Forms CT-1120 ESA, ESB, ESC, ESD) and has paid at least 90% of the current year tax or 100% of the prior year tax at the

required installment rate, the taxpayer is not subject to interest on underpaid installments. If the current year tax is $1,000 or less, it is not necessary to

complete this form. Form CT-1120 is also used to compute interest due on required installments of Connecticut unrelated business income tax, Form

CT-990T.

PART I – COMPUTATION OF REQUIRED ANNUAL PAYMENT

Enter on Line 1 the tax liability for the current income year from Form CT-1120 or CT-1120S, Schedule C, Line 3; or Form CT-1120CR, Part IV, Line 6; or

Form CT-1120L, Schedule B, Line 3; or Form CT-990T, Computation of Amount Payable, Line 3.

Enter on Line 3 the total tax from the previous income year before the application of any tax credits.

PART II – COMPUTATION OF REQUIRED INSTALLMENTS

The required installment payments are due on the 15th day of the 3rd, 6th, 9th and 12th months of the income year. If the due date falls on a Saturday,

Sunday or legal holiday, substitute the next business day as the due date.

Lines 6 through 9 - Calculate the required minimum installment payments due. Multiply the required annual payment from Part I, Line 5 by the required

installment rate and enter the result on the appropriate line.

PART III – COMPUTATION OF INTEREST

Payments accompanying an estimated installment Form CT-1120ESA, ESB, ESC or ESD will be applied as of the US Government post marked date of the

payment. The payment must be made or credit established on or before the due date of the required installment. Payments of estimated tax are credited

first against underpaid installments in the order in which such installments are required to be paid. The overpayment from the filing of a corporation

business tax return is established and credited as of the US Government post marked date of the completed return.

Lines 10b, 11a, 12a, 13a, 14a, 15a, 16a, 17a, 18a, 19a, 20a, 21a and 22a - Enter the payment amounts on the appropriate line according to the date of

payment. Payments are first applied to any remaining unpaid installment balances that are due, and any overpayment balance can then be applied to the

next required installment due.

Lines 10a, 13c, 16c and 19c - Enter on the appropriate line the required installment amount that is due. The required installment amounts are computed in

Part II, Lines 6 through 9.

Lines 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21 and 22 - Interest is calculated monthly on the accumulated unpaid required installment balance due at

the rate of 1% (.01) per month.

Line 23 - Enter the total interest due on unpaid required installment balances by adding the amounts on Lines 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21

and 22. This amount is also entered on the appropriate Connecticut tax form.

PART I – COMPUTATION OF REQUIRED ANNUAL PAYMENT

1. 1998 Tax Due (1998 Form CT-1120 or CT-1120S, Schedule C, Line 3 or

CT-1120CR, Part IV, Line 6) ................................................................................................................................. 1

2. Multiply Line 1 by 90% (.90) ................................................................................................................................ 2

3. 1997 Tax (1997 Form CT-1120 or CT-1120S, Schedule C, Line 1 or Form CT-1120CR, Part V, Line 4) .................... 3

4. Multiply Line 3 by 100% (1.00) ............................................................................................................................ 4

5. REQUIRED ANNUAL PAYMENT (Enter the lesser of Line 2 or Line 4) ..................................................................... 5

PART II – COMPUTATION OF REQUIRED INSTALLMENTS

6. FIRST REQUIRED INSTALLMENT: Multiply Line 5 by 30% (.30). Enter here and on Line 10a ....................... 6

7. SECOND REQUIRED INSTALLMENT: Multiply Line 5 by 40% (.40). Enter here and on Line 13c ................... 7

8. THIRD REQUIRED INSTALLMENT: Multiply Line 5 by 10% (.10). Enter here and on Line 16c ...................... 8

9. FOURTH REQUIRED INSTALLMENT: Multiply Line 5 by 20% (.20). Enter here and on Line 19c ................... 9

CONTINUED ON REVERSE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1