Instructions For Form Cn 51-02 - Articles Of Incorporation For A Not-For-Profit Corporation

ADVERTISEMENT

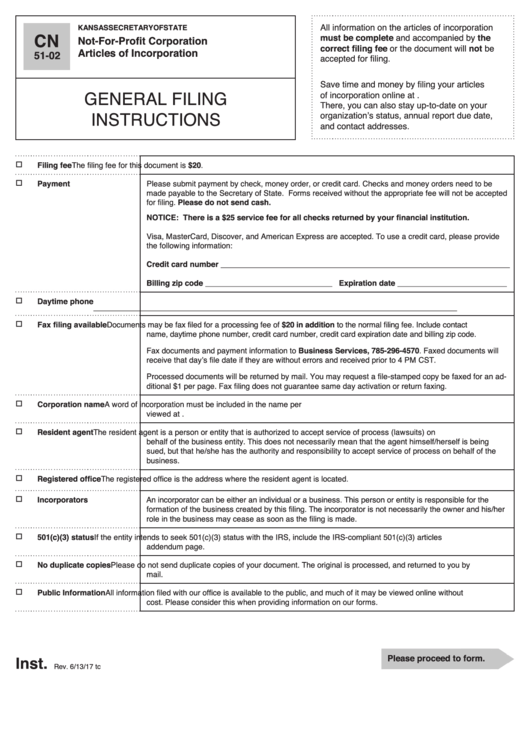

All information on the articles of incorporation

kansas secretary of state

CN

must be complete and accompanied by the

Not-For-Profit Corporation

correct filing fee or the document will not be

Articles of Incorporation

51-02

accepted for filing.

Save time and money by filing your articles

GENERAL FILING

of incorporation online at

There, you can also stay up-to-date on your

INSTRUCTIONS

organization’s status, annual report due date,

and contact addresses.

Filing fee

The filing fee for this document is $20.

o

Payment

Please submit payment by check, money order, or credit card. Checks and money orders need to be

o

made payable to the Secretary of State. Forms received without the appropriate fee will not be accepted

for filing. Please do not send cash.

NOTICE: There is a $25 service fee for all checks returned by your financial institution.

Visa, MasterCard, Discover, and American Express are accepted. To use a credit card, please provide

the following information:

Credit card number __________________________________________________________________

Billing zip code _____________________________ Expiration date _________________________

Daytime phone

o

___________________________________________________________________________________

Fax filing available

Documents may be fax filed for a processing fee of $20 in addition to the normal filing fee. Include contact

o

name, daytime phone number, credit card number, credit card expiration date and billing zip code.

Fax documents and payment information to Business Services, 785-296-4570. Faxed documents will

receive that day’s file date if they are without errors and received prior to 4 PM CST.

Processed documents will be returned by mail. You may request a file-stamped copy be faxed for an ad-

ditional $1 per page. Fax filing does not guarantee same day activation or return faxing.

Corporation name

A word of incorporation must be included in the name per K.S.A. 17-6002. Kansas statutes can be re-

o

viewed at

Resident agent

The resident agent is a person or entity that is authorized to accept service of process (lawsuits) on

o

behalf of the business entity. This does not necessarily mean that the agent himself/herself is being

sued, but that he/she has the authority and responsibility to accept service of process on behalf of the

business.

Registered office

The registered office is the address where the resident agent is located.

o

Incorporators

An incorporator can be either an individual or a business. This person or entity is responsible for the

o

formation of the business created by this filing. The incorporator is not necessarily the owner and his/her

role in the business may cease as soon as the filing is made.

501(c)(3) status

If the entity intends to seek 501(c)(3) status with the IRS, include the IRS-compliant 501(c)(3) articles

o

addendum page.

No duplicate copies

Please do not send duplicate copies of your document. The original is processed, and returned to you by

o

mail.

Public Information

All information filed with our office is available to the public, and much of it may be viewed online without

o

cost. Please consider this when providing information on our forms.

Inst.

Please proceed to form.

K.S.A. 17-6002

Rev. 6/13/17 tc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2