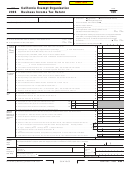

Form 109 Draft - California Exempt Organization Business Income Tax Return - 2010 Page 3

ADVERTISEMENT

Schedule A Cost of Goods Sold and/or Operations. Method of inventory valuation (specify) _______________________________________________

00

1 Inventory at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

Purchases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

Cost of labor. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a Additional IRC Section 263A costs. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

a

00

00

b Other costs. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b

00

Total. Add line 1 through line 4b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

00

7 Cost of goods sold and/or operations. Subtract line 6 from line 5. Enter here and on Side 2, Part I, line 2 . . . . . . . . . . . . .

7

Do the rules of IRC Section 263A (with respect to property produced or acquired for resale) apply to this organization? Yes No

Schedule B Tax Credits. Do not complete if you must file Schedule P (100 or 541). Do not claim the New Jobs Credit on Schedule B.

00

1 Enter credit name__________________________code no.__________ . . . . . .

1

00

Enter credit name__________________________code no.__________ . . . . . .

Enter credit name__________________________code no.__________ . . . . . .

00

00

Total. Add line 1 through line 3. Enter here and on Side 1, line 11c

Schedule K Add-On Taxes or Recapture of Tax. See instructions.

1

Interest computation under the look-back method for completed long-term contracts. Attach form FTB 3834 . . . . . . . .

1

00

00

Interest on tax attributable to installment: a Sales of certain timeshares or residential lots. . . . . . . . . . . . . . . . . . . . .

a

00

b Method for non-dealer installment obligations . . . . . . . . . . . . . . . . . . . .

b

00

IRC Section 197(f)(9)(B)(ii) election to recognize gain on the disposition of intangibles. . . . . . . . . . . . . . . . . . . . . . . . .

00

Credit recapture. Credit name___________________________________________. . . . . . . . . . . . . . . . . . . . . . . . . . .

00

Total. Combine the amounts on line 1 through line 4. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

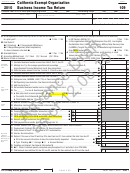

Schedule R Apportionment Formula Worksheet

Use only for unrelated trade or business amounts

(a) Total within and

(b) Total within California

(c) Percent within

outside California

California (b) ÷ (a)

1

Property factor: See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Payroll factor: Wages and other compensation of employees . . . . . . . . . . . . . . . . . . . . . . .

Sales factor: Gross sales and/or receipts less returns and allowances . . . . . . . . . . . . . . . .

Multiply the factor on line 3, column (c) by 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total percentage: Add the percentages in column (c), line 1, line 2, and line 4. . . . . . . . . .

6

Average apportionment percentage: Divide the factor on line 5 by 4 and enter the

result here and on Form 109, Side 1, line 2. See instructions for exceptions. . . . . . . . . . . .

Schedule C Rental Income from Real Property and Personal Property Leased with Real Property

For rental income from debt-financed property, use Schedule D, R&TC Section 23701g, Section 23701i, and Section 23701n organizations. See instructions for exceptions.

1 Description of property

Rent received

Percentage of rent attributable

or accrued

to personal property

%

%

%

Complete if any item in column 3 is more than 50%, or for any item

Complete if any item in column 3 is more than 10%, but not more than 50%

if the rent is determined on the basis of profit or income

(a) Deductions directly connected

(b) Income includible, column 2

(a) Gross income reportable,

(b) Deductions directly connected with

(c) Net income includible, column 5(a)

(attach schedule)

less column 4(a)

column 2 x column 3

personal property (attach schedule)

less column 5(b)

Add columns 4(b) and column 5(c). Enter here and on Side 2, Part I, line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form 109

2010 Side

3643103

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5