Form 574 Draft - Resident/nonresident Allocation - 2016 Page 2

ADVERTISEMENT

Barcode

Placeholder

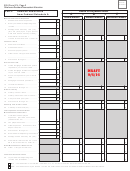

2016 Form 574 - Page 2

Oklahoma Resident/Nonresident Allocation

Part II:

Itemized Deductions

Round to the nearest dollar

A

=

B

+

C

from Federal Schedule A

Federal Amount

Resident Amount

Nonresident Amount

Medical and Dental Expenses

00

1

Medical and dental expenses ..........

1

2

Enter your Federal adjusted gross

00

income .............................................

2

3

Multiply line 2 above by 10% (.10)

[Or 7.5% (.075) if you or your spouse

were born before January 2, 1952] ..

00

3

4

Subtract line 3 from line 1.

If line 3 is more than line 1, enter “0”.

00

00

00

4

4

4

Taxes You Paid

00

5

5

State and local taxes .......................

00

6

6

Real estate taxes .............................

00

7

Personal property taxes .................

7

8

Other taxes: List type and amount:

00

___________________________ ..

8

00

00

00

9

9

9

9

Add lines 5 through 8 ......................

Interest You Paid

10

Home mortgage interest and points

00

reported to you on Form 1098 .........

10

Draft

11

Home mortgage interest not reported

00

to you on Form 1098 .......................

11

9/6/16

12

Points not reported to you on Form

00

1098 ................................................

12

00

13

Mortgage insurance premiums ........

13

00

14

Investment interest ..........................

14

00

00

00

15

Add lines 10 through 14 ..................

15

15

15

Gifts to Charity

00

16

Gifts by cash or check .....................

16

00

17

Gifts by other than cash or check ....

17

00

18

Carryover from prior year ................

18

00

00

00

19

Add lines 16 through 18 ..................

19

19

19

Casualty and Theft Losses

00

00

00

20

Casualty or theft loss(es) ................

20

20

20

Job Expenses and Most Other

Miscellaneous Deductions

21

Unreimbursed employee

expenses - job travel, union dues,

00

job education, etc. ...........................

21

00

22

Tax preparation fees ........................

22

23

Other expenses - investment, safe

00

deposit box, etc. ..............................

23

00

24

Add lines 21 through 23 ..................

24

00

25

Enter Federal adjusted gross income

25

00

26

Multiply line 25 above by 2% (.02) ..

26

27

Subtract line 26 from line 24. If line

00

00

00

26 is more than line 24, enter “0” ....

27

27

27

Other Miscellaneous Deductions

28

Other. List type and amount:

____________________________ .

00

00

00

28

28

28

Total Itemized Deductions

29

Is your Federal adjusted gross

income over $155,650? ...................

00

00

00

29

29

29

No: Your deduction is not limited. Add lines 4, 9, 15, 19, 20, 27 and 28. Enter the total on line 29.

Yes: Your deduction may be limited. On line 29, enter the amount from the Federal Itemized Deductions Worksheet.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3