Form Il-1040-X - Amended Individual Income Tax Return - 2000

ADVERTISEMENT

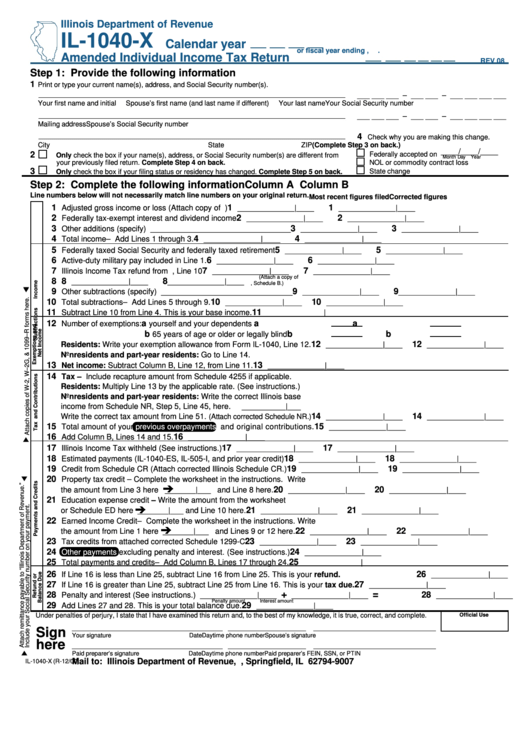

Illinois Department of Revenue

IL-1040-X

Calendar year

Amended Individual Income Tax Return

or fiscal year ending

,

.

REV 08

Step 1: Provide the following information

1

Print or type your current name(s), address, and Social Security number(s).

___ ___ ___ – ___ ___ – ___ ___ ___ ___

Your first name and initial

Spouse’s first name (and last name if different)

Your last name

Your Social Security number

___ ___ ___ – ___ ___ – ___ ___ ___ ___

Mailing address

Spouse’s Social Security number

4

Check why you are making this change.

City

State

ZIP

(Complete Step 3 on back.)

____/____/____

2

Federally accepted on

Only check the box if your name(s), address, or Social Security number(s) are different from

Month

Day

Year

your previously filed return. Complete Step 4 on back.

NOL or commodity contract loss

3

State change

Only check the box if your filing status or residency has changed. Complete Step 5 on back.

Step 2: Complete the following information

Column A

Column B

Line numbers below will not necessarily match line numbers on your original return.

Most recent figures filed

Corrected figures

1

1

1

Adjusted gross income or loss (Attach copy of U.S. 1040 or 1040X.)

_____________|____

_____________|____

2

2

2

Federally tax-exempt interest and dividend income

_____________|____

_____________|____

3

3

3

Other additions (specify) ________________________________

_____________|____

_____________|____

4

4

4

Total income – Add Lines 1 through 3.

_____________|____

_____________|____

5

5

5

Federally taxed Social Security and federally taxed retirement

_____________|____

_____________|____

6

6

6

Active-duty military pay included in Line 1.

_____________|____

_____________|____

7

7

7

Illinois Income Tax refund from U.S. 1040, Line 10

_____________|____

_____________|____

(Attach a copy of

8

8

8

U.S. government obligations and U.S. agency income

_____________|____

_____________|____

U.S. 1040, Schedule B.)

9

9

9

Other subtractions (specify) ______________________________

_____________|____

_____________|____

10

10

10

Total subtractions – Add Lines 5 through 9.

_____________|____

_____________|____

11

11

Subtract Line 10 from Line 4. This is your base income.

_____________|____

12

a

a

a

Number of exemptions:

yourself and your dependents

b

b

b

65 years of age or older or legally blind

12

12

Residents: Write your exemption allowance from Form IL-1040, Line 12.

_____________|____

_____________|____

Nonresidents and part-year residents: Go to Line 14.

13

13

Net income: Subtract Column B, Line 12, from Line 11.

_____________|____

14

Tax – Include recapture amount from Schedule 4255 if applicable.

Residents: Multiply Line 13 by the applicable rate. (See instructions.)

Nonresidents and part-year residents: Write the correct Illinois base

income from Schedule NR, Step 5, Line 45, here.

__________|___

14

14

Write the correct tax amount from Line 51.

(Attach corrected Schedule NR.)

_____________|____

_____________|____

15

15

Total amount of your

previous overpayments,

and original contributions.

_____________|____

16

16

Add Column B, Lines 14 and 15.

_____________|____

17

17

17

Illinois Income Tax withheld (See instructions.)

_____________|____

_____________|____

18

18

18

Estimated payments (IL-1040-ES, IL-505-I, and prior year credit)

_____________|____

_____________|____

19

19

19

Credit from Schedule CR (Attach corrected Illinois Schedule CR.)

_____________|____

_____________|____

20

Property tax credit – Complete the worksheet in the instructions. Write

20

20

the amount from Line 3 here

_______|___ and Line 8 here.

_____________|____

_____________|____

21

Education expense credit – Write the amount from the worksheet

21

21

or Schedule ED here

_______|___ and Line 10 here.

_____________|____

_____________|____

22

Earned Income Credit – Complete the worksheet in the instructions. Write

22

22

the amount from Line 1 here

_______|___ and Lines 9 or 12 here.

_____________|____

_____________|____

23

23

23

Tax credits from attached corrected Schedule 1299-C

_____________|____

_____________|____

24

24

Other payments

excluding penalty and interest. (See instructions.)

_____________|____

25

25

T otal payments and credits – Add Column B, Lines 17 through 24.

_____________|____

26

26

If Line 16 is less than Line 25, subtract Line 16 from Line 25. This is your refund.

_____________|____

27

27

If Line 16 is greater than Line 25, subtract Line 25 from Line 16. This is your tax due.

_____________|____

+

=

28

28

Penalty and interest (See instructions.) _____________|____

_____________|____

_____________|____

Penalty amount

Interest amount

29

29

Add Lines 27 and 28. This is your total balance due.

_____________|____

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

Official Use

Sign

Your signature

Date

Daytime phone number

Spouse’s signature

here

Paid preparer’s signature

Date

Daytime phone number

Paid preparer’s FEIN, SSN, or PTIN

Mail to: Illinois Department of Revenue, P.O. Box 19007, Springfield, IL 62794-9007

IL-1040-X (R-12/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2