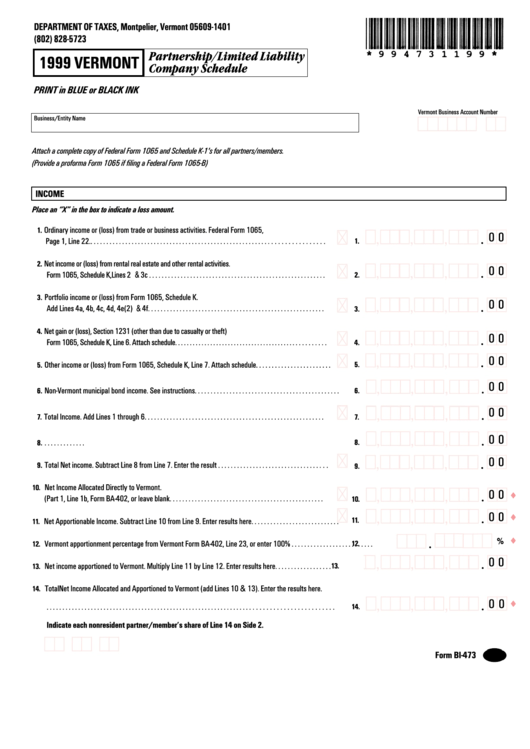

Form Bi-473 - Partnership/limited Liability Company Schedule - 1999

ADVERTISEMENT

DEPARTMENT OF TAXES, Montpelier, Vermont 05609-1401

(802) 828-5723

Partnership/Limited Liability

1999 VERMONT

Company Schedule

PRINT in BLUE or BLACK INK

Vermont Business Account Number

Business/Entity Name

Attach a complete copy of Federal Form 1065 and Schedule K-1’s for all partners/members.

(Provide a proforma Form 1065 if filing a Federal Form 1065-B)

INCOME

Place an “X” in the box to indicate a loss amount.

Ordinary income or (loss) from trade or business activities. Federal Form 1065,

1.

0 0

Page 1, Line 22.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

Net income or (loss) from rental real estate and other rental activities.

2.

0 0

Form 1065, Schedule K, Lines 2 & 3c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

Portfolio income or (loss) from Form 1065, Schedule K.

3.

0 0

Add Lines 4a, 4b, 4c, 4d, 4e(2) & 4f. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Net gain or (loss), Section 1231 (other than due to casualty or theft)

4.

0 0

Form 1065, Schedule K, Line 6. Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

0 0

Other income or (loss) from Form 1065, Schedule K, Line 7. Attach schedule. . . . . . . . . . . . . . . . . . . . . . . .

5.

5.

0 0

Non-Vermont municipal bond income. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

6.

0 0

Total Income. Add Lines 1 through 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

7.

0 0

U.S. Government interest included in Line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

8.

0 0

Total Net income. Subtract Line 8 from Line 7. Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

9.

Net Income Allocated Directly to Vermont.

10.

0 0

(Part 1, Line 1b, Form BA-402, or leave blank . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

0 0

11.

Net Apportionable Income. Subtract Line 10 from Line 9. Enter results here. . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

%

Vermont apportionment percentage from Vermont Form BA-402, Line 23, or enter 100% . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

12.

0 0

Net income apportioned to Vermont. Multiply Line 11 by Line 12. Enter results here. . . . . . . . . . . . . . . . . .

13.

13.

Total Net Income Allocated and Apportioned to Vermont (add Lines 10 & 13). Enter the results here.

14.

0 0

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

Indicate each nonresident partner/member’s share of Line 14 on Side 2.

1

Form BI-473

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2