Instructions For Employer'S Return Of Income Tax Withheld - City Of Ionia Income Tax Division

ADVERTISEMENT

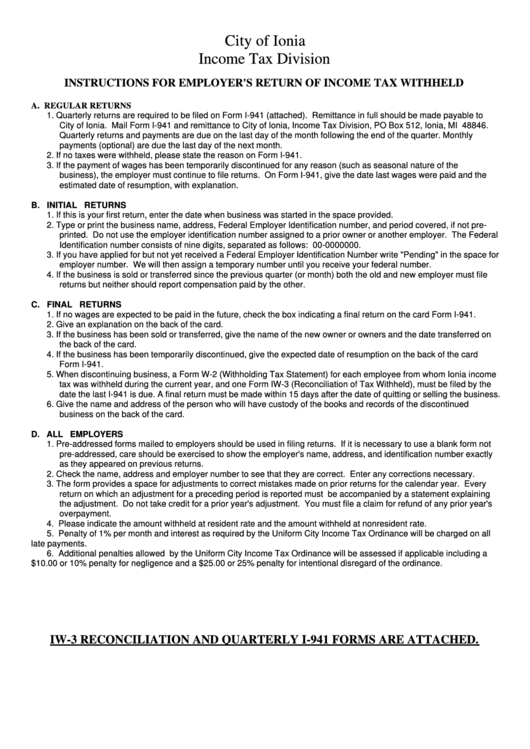

City of Ionia

Income Tax Division

INSTRUCTIONS FOR EMPLOYER'S RETURN OF INCOME TAX WITHHELD

A. REGULAR RETURNS

1. Quarterly returns are required to be filed on Form I-941 (attached). Remittance in full should be made payable to

City of Ionia. Mail Form I-941 and remittance to City of Ionia, Income Tax Division, PO Box 512, Ionia, MI 48846.

Quarterly returns and payments are due on the last day of the month following the end of the quarter. Monthly

payments (optional) are due the last day of the next month.

2. If no taxes were withheld, please state the reason on Form I-941.

3. If the payment of wages has been temporarily discontinued for any reason (such as seasonal nature of the

business), the employer must continue to file returns. On Form I-941, give the date last wages were paid and the

estimated date of resumption, with explanation.

B. INITIAL RETURNS

1. If this is your first return, enter the date when business was started in the space provided.

2. Type or print the business name, address, Federal Employer Identification number, and period covered, if not pre-

printed. Do not use the employer identification number assigned to a prior owner or another employer. The Federal

Identification number consists of nine digits, separated as follows: 00-0000000.

3. If you have applied for but not yet received a Federal Employer Identification Number write "Pending" in the space for

employer number. We will then assign a temporary number until you receive your federal number.

4. If the business is sold or transferred since the previous quarter (or month) both the old and new employer must file

returns but neither should report compensation paid by the other.

C. FINAL RETURNS

1. If no wages are expected to be paid in the future, check the box indicating a final return on the card Form I-941.

2. Give an explanation on the back of the card.

3. If the business has been sold or transferred, give the name of the new owner or owners and the date transferred on

the back of the card.

4. If the business has been temporarily discontinued, give the expected date of resumption on the back of the card

Form I-941.

5. When discontinuing business, a Form W-2 (Withholding Tax Statement) for each employee from whom Ionia income

tax was withheld during the current year, and one Form IW-3 (Reconciliation of Tax Withheld), must be filed by the

date the last I-941 is due. A final return must be made within 15 days after the date of quitting or selling the business.

6. Give the name and address of the person who will have custody of the books and records of the discontinued

business on the back of the card.

D. ALL EMPLOYERS

1. Pre-addressed forms mailed to employers should be used in filing returns. If it is necessary to use a blank form not

pre-addressed, care should be exercised to show the employer's name, address, and identification number exactly

as they appeared on previous returns.

2. Check the name, address and employer number to see that they are correct. Enter any corrections necessary.

3. The form provides a space for adjustments to correct mistakes made on prior returns for the calendar year. Every

return on which an adjustment for a preceding period is reported must be accompanied by a statement explaining

the adjustment. Do not take credit for a prior year's adjustment. You must file a claim for refund of any prior year's

overpayment.

4. Please indicate the amount withheld at resident rate and the amount withheld at nonresident rate.

5. Penalty of 1% per month and interest as required by the Uniform City Income Tax Ordinance will be charged on all

late payments.

6. Additional penalties allowed by the Uniform City Income Tax Ordinance will be assessed if applicable including a

$10.00 or 10% penalty for negligence and a $25.00 or 25% penalty for intentional disregard of the ordinance.

IW-3 RECONCILIATION AND QUARTERLY I-941 FORMS ARE ATTACHED.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1