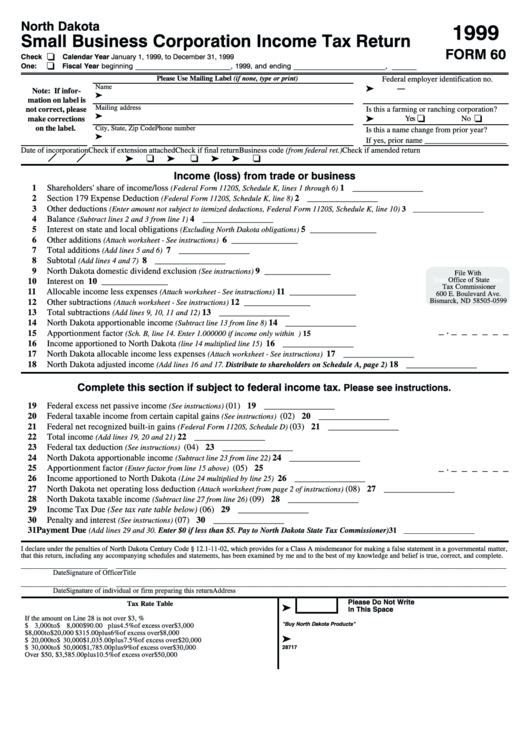

Form 60 - Small Business Corporation Income Tax Return 1999

ADVERTISEMENT

North Dakota

1999

Small Business Corporation Income Tax Return

FORM 60

❏

Check

Calendar Year January 1, 1999, to December 31, 1999

❏

One:

Fiscal Year beginning ___________________________, 1999, and ending __________________________, _______

Please Use Mailing Label (if none, type or print)

Federal employer identification no.

➤

Name

—

Note: If infor-

➤

mation on label is

Mailing address

Is this a farming or ranching corporation?

not correct, please

➤

➤

Yes ❏

No ❏

make corrections

on the label.

City, State, Zip Code

Phone number

Is this a name change from prior year?

➤

If yes, prior name _____________________

Date of incorporation

Check if extension attached

Check if final return

Business code (from federal ret.)

Check if amended return

➤

❏

➤

❏

➤

➤

❏

Income (loss) from trade or business

1

Shareholders' share of income/loss

1 ________________

(Federal Form 1120S, Schedule K, lines 1 through 6) ........................................

2

Section 179 Expense Deduction

2 ________________

(Federal Form 1120S, Schedule K, line 8) ..............................................................

3

Other deductions

(Enter amount not subject to itemized deductions, Federal Form 1120S, Schedule K, line 10) .......

3 __________________

4

Balance

4 ________________

(Subtract lines 2 and 3 from line 1) ....................................................................................................................

5

Interest on state and local obligations

5 _______________

(Excluding North Dakota obligations) ...............

6

Other additions

6 _______________

(Attach worksheet - See instructions) ........................................................

7

Total additions

7 ________________

(Add lines 5 and 6) .................................................................................................................................

8

Subtotal

8 ________________

(Add lines 4 and 7) .............................................................................................................................................

9

North Dakota domestic dividend exclusion

9 _______________

(See instructions) .......................................

File With

File With

State Tax Commissioner

Office of State

10

Interest on U.S. obligations .....................................................................................

10 _______________

Tax Commissioner

State Capitol

11

Allocable income less expenses

11 _______________

(Attach worksheet - See instructions) ...........................

600 E. Boulevard Ave.

600 E. Boulevard Ave.

Bismarck, ND 58505-0599

Bismarck, ND 58505-0599

12

Other subtractions

12 _______________

(Attach worksheet - See instructions) ...................................................

13

Total subtractions

13 ________________

(Add lines 9, 10, 11 and 12) ..............................................................................................................

14

North Dakota apportionable income

14 ________________

(Subtract line 13 from line 8) ............................................................................

_ . _ _ _ _ _ _

15

Apportionment factor

(Sch. B, line 14. Enter 1.000000 if income only within N.D.) ....................................................

15

16

Income apportioned to North Dakota

16 ________________

(line 14 multiplied line 15) ..............................................................................

17

North Dakota allocable income less expenses

17 ________________

(Attach worksheet - See instructions) ...............................................

18

North Dakota adjusted income

18 ________________

(Add lines 16 and 17. Distribute to shareholders on Schedule A, page 2) ..............

Complete this section if subject to federal income tax.

Please see instructions.

19

Federal excess net passive income

(01) 19 ________________

(See instructions) .......................................................................................

20

Federal taxable income from certain capital gains

(02) 20 ________________

(See instructions) ............................................................

21

Federal net recognized built-in gains

(03) 21 ________________

(Federal Form 1120S, Schedule D) ......................................................

22

Total income

22 ________________

(Add lines 19, 20 and 21) ...............................................................................................................

23

Federal tax deduction

(04) 23 ________________

(See instructions) .............................................................................................................

24

North Dakota apportionable income

24 ________________

(Subtract line 23 from line 22) ...............................................................

_ . _ _ _ _ _ _

25

Apportionment factor

(05) 25

(Enter factor from line 15 above) ....................................................................................

26

Income apportioned to North Dakota

26 ________________

(Line 24 multiplied by line 25) .............................................................

27

North Dakota net operating loss deduction

(08) 27 ________________

(Attach worksheet from page 2 of instructions) ..........................

28

North Dakota taxable income

(09) 28 ________________

(Subtract line 27 from line 26) ...........................................................................

29

Income Tax Due (See tax rate table below) ........................................................................................... (06) 29 ________________

30

Penalty and interest

(07) 30 ________________

(See instructions) .................................................................................................................

31

Payment Due

(Add lines 29 and 30. Enter $0 if less than $5. Pay to North Dakota State Tax Commissioner)

31 __________________

I declare under the penalties of North Dakota Century Code § 12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a governmental matter,

that this return, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is true, correct, and complete.

________________________

________________________________________________________

____________________________________________________

Date

Signature of Officer

Title

________________________

________________________________________________________

____________________________________________________

Date

Signature of individual or firm preparing this return

Address

Please Do Not Write

Tax Rate Table

➤

In This Space

If the amount on Line 28 is not over $3,000 ................................................................... 3%

"Buy North Dakota Products"

$ 3,000 to $ 8,000 ....

$

90.00 plus

4.5%

of excess over

$

3,000

$ 8,000 to $ 20,000 ....

$

315.00 plus

6%

of excess over

$

8,000

➤

$ 20,000 to $ 30,000 ....

$ 1,035.00 plus

7.5%

of excess over

$ 20,000

$ 30,000 to $ 50,000 ....

$ 1,785.00 plus

9%

of excess over

$ 30,000

28717

Over $50,000 .....................

$ 3,585.00 plus 10.5%

of excess over

$ 50,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2