Instructions For Preparing The Amusement Tax Return - 7511

ADVERTISEMENT

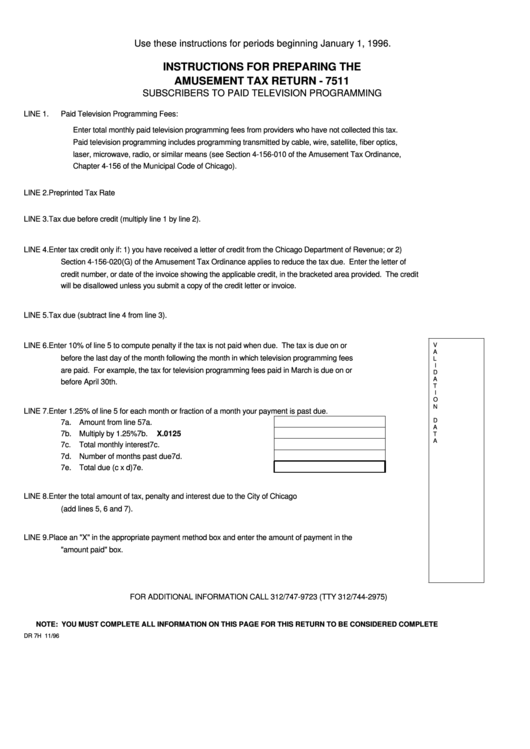

Use these instructions for periods beginning January 1, 1996.

INSTRUCTIONS FOR PREPARING THE

AMUSEMENT TAX RETURN - 7511

SUBSCRIBERS TO PAID TELEVISION PROGRAMMING

LINE 1.

Paid Television Programming Fees:

Enter total monthly paid television programming fees from providers who have not collected this tax.

Paid television programming includes programming transmitted by cable, wire, satellite, fiber optics,

laser, microwave, radio, or similar means (see Section 4-156-010 of the Amusement Tax Ordinance,

Chapter 4-156 of the Municipal Code of Chicago).

LINE 2.

Preprinted Tax Rate

LINE 3.

Tax due before credit (multiply line 1 by line 2).

LINE 4.

Enter tax credit only if: 1) you have received a letter of credit from the Chicago Department of Revenue; or 2)

Section 4-156-020(G) of the Amusement Tax Ordinance applies to reduce the tax due. Enter the letter of

credit number, or date of the invoice showing the applicable credit, in the bracketed area provided. The credit

will be disallowed unless you submit a copy of the credit letter or invoice.

LINE 5.

Tax due (subtract line 4 from line 3).

LINE 6.

Enter 10% of line 5 to compute penalty if the tax is not paid when due. The tax is due on or

V

A

before the last day of the month following the month in which television programming fees

L

I

are paid. For example, the tax for television programming fees paid in March is due on or

D

A

before April 30th.

T

I

O

N

LINE 7.

Enter 1.25% of line 5 for each month or fraction of a month your payment is past due.

D

7a. Amount from line 5 . . . . . . . . . . . . . . . . . . 7a.

A

7b. Multiply by 1.25%

. . . . . . . . . . . . . . . . . . 7b.

X

.0125

T

A

7c.

Total monthly interest

. . . . . . . . . . . . . . . . 7c.

7d. Number of months past due . . . . . . . . . . . . . 7d.

7e. Total due (c x d) . . . . . . . . . . . . . . . . . . . 7e.

LINE 8.

Enter the total amount of tax, penalty and interest due to the City of Chicago

(add lines 5, 6 and 7).

LINE 9.

Place an "X" in the appropriate payment method box and enter the amount of payment in the

"amount paid" box.

FOR ADDITIONAL INFORMATION CALL 312/747-9723 (TTY 312/744-2975)

NOTE: YOU MUST COMPLETE ALL INFORMATION ON THIS PAGE FOR THIS RETURN TO BE CONSIDERED COMPLETE

DR 7H 11/96

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1