Clear Form

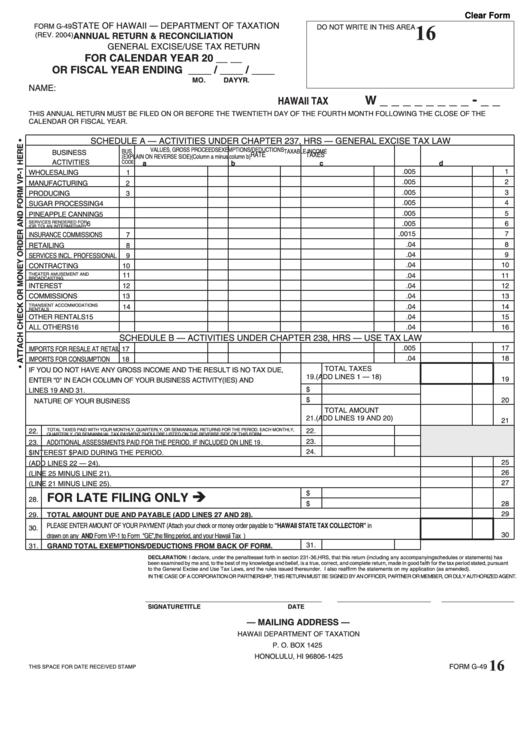

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM G-49

DO NOT WRITE IN THIS AREA

16

(REV. 2004)

ANNUAL RETURN & RECONCILIATION

GENERAL EXCISE/USE TAX RETURN

FOR CALENDAR YEAR 20 __ __

OR FISCAL YEAR ENDING ____ / ____ / ____

MO.

DAY

YR.

NAME:

_ _ _ _ _ _ _ _ - _ _

W

HAWAII TAX I.D. NO.

THIS ANNUAL RETURN MUST BE FILED ON OR BEFORE THE TWENTIETH DAY OF THE FOURTH MONTH FOLLOWING THE CLOSE OF THE

CALENDAR OR FISCAL YEAR.

SCHEDULE A — ACTIVITIES UNDER CHAPTER 237, HRS — GENERAL EXCISE TAX LAW

VALUES, GROSS PROCEEDS

EXEMPTIONS/DEDUCTIONS

BUS.

TAXABLE INCOME

BUSINESS

RATE

TAXES

ACT.

OR GROSS INCOME

(EXPLAIN ON REVERSE SIDE)

(Column a minus column b)

ACTIVITIES

CODE

a

b

c

d

.005

1

WHOLESALING

1

.005

2

MANUFACTURING

2

.005

3

PRODUCING

3

.005

4

SUGAR PROCESSING

4

.005

5

PINEAPPLE CANNING

5

SERVICES RENDERED FOR

6

.005

6

(OR TO) AN INTERMEDIARY

.0015

7

INSURANCE COMMISSIONS

7

.04

8

RETAILING

8

.04

9

SERVICES INCL. PROFESSIONAL

9

.04

10

CONTRACTING

10

THEATER AMUSEMENT AND

11

.04

11

BROADCASTING

INTEREST

12

.04

12

COMMISSIONS

13

.04

13

TRANSIENT ACCOMMODATIONS

14

.04

14

RENTALS

OTHER RENTALS

15

.04

15

ALL OTHERS

16

.04

16

SCHEDULE B — ACTIVITIES UNDER CHAPTER 238, HRS — USE TAX LAW

.005

17

IMPORTS FOR RESALE AT RETAIL 17

.04

18

IMPORTS FOR CONSUMPTION

18

TOTAL TAXES

IF YOU DO NOT HAVE ANY GROSS INCOME AND THE RESULT IS NO TAX DUE,

19.

(ADD LINES 1 — 18)

19

ENTER “0" IN EACH COLUMN OF YOUR BUSINESS ACTIVITY(IES) AND

20a. PENALTY $

LINES 19 AND 31.

20b. INTEREST $

20

NATURE OF YOUR BUSINESS

TOTAL AMOUNT

21.

(ADD LINES 19 AND 20)

21

TOTAL TAXES PAID WITH YOUR MONTHLY, QUARTERLY, OR SEMIANNUAL RETURNS FOR THE PERIOD. EACH MONTHLY,

22.

22.

QUARTERLY, OR SEMIANNUAL TAX PAYMENT SHOULD BE LISTED ON THE REVERSE SIDE OF THIS FORM.

23.

23.

ADDITIONAL ASSESSMENTS PAID FOR THE PERIOD, IF INCLUDED ON LINE 19.

24.

24.

PENALTIES $

INTEREST $

PAID DURING THE PERIOD.

25

25.

TOTAL PAYMENTS MADE (ADD LINES 22 — 24).

26

26.

CREDIT TO BE REFUNDED (LINE 25 MINUS LINE 21).

27

27.

TAXES DUE AND PAYABLE (LINE 21 MINUS LINE 25).

è

28a. PENALTY $

FOR LATE FILING ONLY

28.

28b. INTEREST $

28

29

29.

TOTAL AMOUNT DUE AND PAYABLE (ADD LINES 27 AND 28).

PLEASE ENTER AMOUNT OF YOUR PAYMENT (Attach your check or money order payable to “HAWAII STATE TAX COLLECTOR” in U.S. dollars

30.

30

drawn on any U.S. bank AND Form VP-1 to Form G-49. Write “GE”, the filing period, and your Hawaii Tax I.D. No. on your check or money order.)

31.

31.

GRAND TOTAL EXEMPTIONS/DEDUCTIONS FROM BACK OF FORM.

DECLARATION: I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has

been examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith for the tax period stated, pursuant

to the General Excise and Use Tax Laws, and the rules issued thereunder. I also reaffirm the statements on my application (as amended).

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

SIGNATURE

TITLE

DATE

— MAILING ADDRESS —

HAWAII DEPARTMENT OF TAXATION

P. O. BOX 1425

HONOLULU, HI 96806-1425

16

FORM G-49

THIS SPACE FOR DATE RECEIVED STAMP

1

1 2

2