Form 593-E Draft - Real Estate Withholding - Computation Of Estimated Gain Or Loss - 2008

ADVERTISEMENT

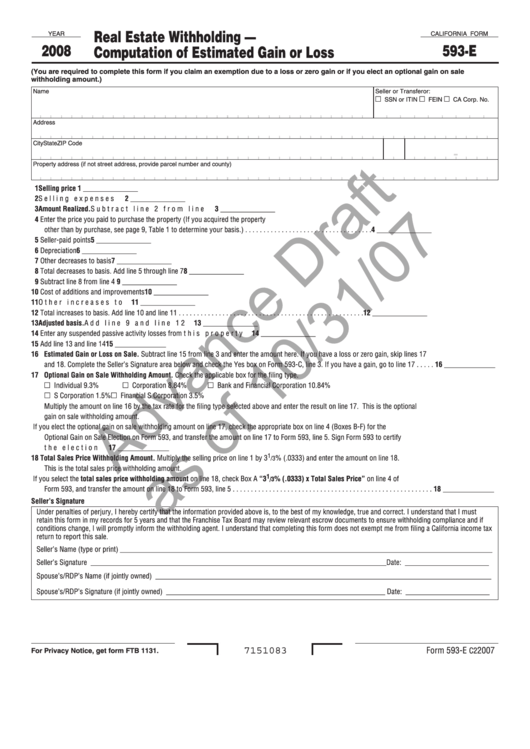

Real Estate Withholding —

YEAR

CALIFORNIA FORM

2008

593-E

Computation of Estimated Gain or Loss

(You are required to complete this form if you claim an exemption due to a loss or zero gain or if you elect an optional gain on sale

withholding amount.)

Name

Seller or Transferor:

SSN or ITIN

FEIN

CA Corp. No.

Address

City

State

ZIP Code

-

Property address (if not street address, provide parcel number and county)

Selling price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________

Selling expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________

Amount Realized. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________

4 Enter the price you paid to purchase the property (If you acquired the property

other than by purchase, see page 9, Table 1 to determine your basis.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 _______________

5 Seller-paid points . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 _______________

6 Depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 _______________

7 Other decreases to basis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 _______________

8 Total decreases to basis. Add line 5 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 _______________

9 Subtract line 8 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 _______________

0 Cost of additions and improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 _______________

Other increases to basis. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________

Total increases to basis. Add line 10 and line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________

Adjusted basis. Add line 9 and line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________

4 Enter any suspended passive activity losses from this property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 _______________

5 Add line 13 and line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 ______________

6 Estimated Gain or Loss on Sale. Subtract line 15 from line 3 and enter the amount here. If you have a loss or zero gain, skip lines 17

and 18. Complete the Seller’s Signature area below and check the Yes box on Form 593-C, line 3. If you have a gain, go to line 17 . . . . . 6 ______________

7 Optional Gain on Sale Withholding Amount. Check the applicable box for the filing type.

Individual 9.3%

Corporation 8.84%

Bank and Financial Corporation 10.84%

S Corporation 1.5%

Financial S Corporation 3.5%

Multiply the amount on line 16 by the tax rate for the filing type selected above and enter the result on line 17. This is the optional

gain on sale withholding amount.

If you elect the optional gain on sale withholding amount on line 17, check the appropriate box on line 4 (Boxes B-F) for the

Optional Gain on Sale Election on Form 593, and transfer the amount on line 17 to Form 593, line 5. Sign Form 593 to certify

the election . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 ______________

1 /3

8 Total Sales Price Withholding Amount. Multiply the selling price on line 1 by 3

% (.0333) and enter the amount on line 18.

This is the total sales price withholding amount.

/

If you select the total sales price withholding amount on line 18, check Box A “

% (.0) x Total Sales Price” on line 4 of

Form 593, and transfer the amount on line 18 to Form 593, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 ______________

Seller’s Signature

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. I understand that I must

retain this form in my records for 5 years and that the Franchise Tax Board may review relevant escrow documents to ensure withholding compliance and if

conditions change, I will promptly inform the withholding agent. I understand that completing this form does not exempt me from filing a California income tax

return to report this sale.

Seller’s Name (type or print) ______________________________________________________________________________________________________

Seller’s Signature _________________________________________________________________________________ Date: _______________________

Spouse’s/RDP’s Name (if jointly owned) ____________________________________________________________________________________________

Spouse’s/RDP’s Signature (if jointly owned) ____________________________________________________________ Date: _______________________

Form 593-E

2007

7151083

C2

For Privacy Notice, get form FTB 1131.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1