Instructions For Form Ftb 3523 - Research Credit

ADVERTISEMENT

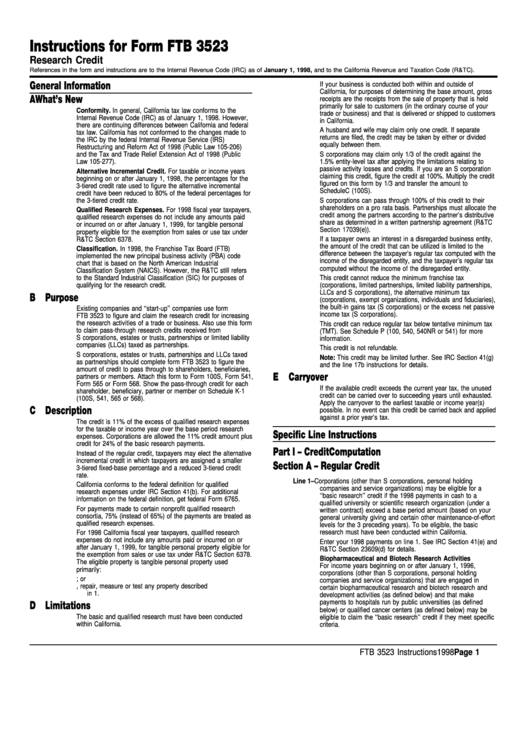

Instructions for Form FTB 3523

Research Credit

References in the form and instructions are to the Internal Revenue Code (IRC) as of January 1, 1998, and to the California Revenue and Taxation Code (R&TC).

General Information

If your business is conducted both within and outside of

California, for purposes of determining the base amount, gross

A What’s New

receipts are the receipts from the sale of property that is held

primarily for sale to customers (in the ordinary course of your

Conformity. In general, California tax law conforms to the

trade or business) and that is delivered or shipped to customers

Internal Revenue Code (IRC) as of January 1, 1998. However,

in California.

there are continuing differences between California and federal

A husband and wife may claim only one credit. If separate

tax law. California has not conformed to the changes made to

returns are filed, the credit may be taken by either or divided

the IRC by the federal Internal Revenue Service (IRS)

equally between them.

Restructuring and Reform Act of 1998 (Public Law 105-206)

and the Tax and Trade Relief Extension Act of 1998 (Public

S corporations may claim only 1/3 of the credit against the

Law 105-277).

1.5% entity-level tax after applying the limitations relating to

passive activity losses and credits. If you are an S corporation

Alternative Incremental Credit. For taxable or income years

claiming this credit, figure the credit at 100%. Multiply the credit

beginning on or after January 1, 1998, the percentages for the

figured on this form by 1/3 and transfer the amount to

3-tiered credit rate used to figure the alternative incremental

Schedule C (100S).

credit have been reduced to 80% of the federal percentages for

the 3-tiered credit rate.

S corporations can pass through 100% of this credit to their

shareholders on a pro rata basis. Partnerships must allocate the

Qualified Research Expenses. For 1998 fiscal year taxpayers,

credit among the partners according to the partner’s distributive

qualified research expenses do not include any amounts paid

share as determined in a written partnership agreement (R&TC

or incurred on or after January 1, 1999, for tangible personal

Section 17039(e)).

property eligible for the exemption from sales or use tax under

R&TC Section 6378.

If a taxpayer owns an interest in a disregarded business entity,

the amount of the credit that can be utilized is limited to the

Classification. In 1998, the Franchise Tax Board (FTB)

difference between the taxpayer’s regular tax computed with the

implemented the new principal business activity (PBA) code

income of the disregarded entity, and the taxpayer’s regular tax

chart that is based on the North American Industrial

computed without the income of the disregarded entity.

Classification System (NAICS). However, the R&TC still refers

This credit cannot reduce the minimum franchise tax

to the Standard Industrial Classification (SIC) for purposes of

qualifying for the research credit.

(corporations, limited partnerships, limited liability partnerships,

LLCs and S corporations), the alternative minimum tax

B Purpose

(corporations, exempt organizations, individuals and fiduciaries),

the built-in gains tax (S corporations) or the excess net passive

Existing companies and ‘‘start-up’’ companies use form

income tax (S corporations).

FTB 3523 to figure and claim the research credit for increasing

the research activities of a trade or business. Also use this form

This credit can reduce regular tax below tentative minimum tax

to claim pass-through research credits received from

(TMT). See Schedule P (100, 540, 540NR or 541) for more

S corporations, estates or trusts, partnerships or limited liability

information.

companies (LLCs) taxed as partnerships.

This credit is not refundable.

S corporations, estates or trusts, partnerships and LLCs taxed

Note: This credit may be limited further. See IRC Section 41(g)

as partnerships should complete form FTB 3523 to figure the

and the line 17b instructions for details.

amount of credit to pass through to shareholders, beneficiaries,

E Carryover

partners or members. Attach this form to Form 100S, Form 541,

Form 565 or Form 568. Show the pass-through credit for each

If the available credit exceeds the current year tax, the unused

shareholder, beneficiary, partner or member on Schedule K-1

credit can be carried over to succeeding years until exhausted.

(100S, 541, 565 or 568).

Apply the carryover to the earliest taxable or income year(s)

C Description

possible. In no event can this credit be carried back and applied

against a prior year’s tax.

The credit is 11% of the excess of qualified research expenses

for the taxable or income year over the base period research

Specific Line Instructions

expenses. Corporations are allowed the 11% credit amount plus

credit for 24% of the basic research payments.

Part I – Credit Computation

Instead of the regular credit, taxpayers may elect the alternative

incremental credit in which taxpayers are assigned a smaller

Section A – Regular Credit

3-tiered fixed-base percentage and a reduced 3-tiered credit

rate.

Line 1 – Corporations (other than S corporations, personal holding

California conforms to the federal definition for qualified

companies and service organizations) may be eligible for a

research expenses under IRC Section 41(b). For additional

‘‘basic research’’ credit if the 1998 payments in cash to a

information on the federal definition, get federal Form 6765.

qualified university or scientific research organization (under a

For payments made to certain nonprofit qualified research

written contract) exceed a base period amount (based on your

consortia, 75% (instead of 65%) of the payments are treated as

general university giving and certain other maintenance-of-effort

qualified research expenses.

levels for the 3 preceding years). To be eligible, the basic

research must have been conducted within California.

For 1998 California fiscal year taxpayers, qualified research

expenses do not include any amounts paid or incurred on or

Enter your 1998 payments on line 1. See IRC Section 41(e) and

after January 1, 1999, for tangible personal property eligible for

R&TC Section 23609(d) for details.

the exemption from sales or use tax under R&TC Section 6378.

Biopharmaceutical and Biotech Research Activities

The eligible property is tangible personal property used

For income years beginning on or after January 1, 1996,

primarily:

corporations (other than S corporations, personal holding

1. In teleproduction or other postproduction services; or

companies and service organizations) that are engaged in

2. To maintain, repair, measure or test any property described

certain biopharmaceutical research and biotech research and

in 1.

development activities (as defined below) and that make

payments to hospitals run by public universities (as defined

D Limitations

below) or qualified cancer centers (as defined below) may be

The basic and qualified research must have been conducted

eligible to claim the ‘‘basic research’’ credit if they meet specific

within California.

criteria.

FTB 3523 Instructions 1998

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3