Arizona Form 120es Draft - Corporation Estimated Tax Payment - 2009, Arizona Form 120w Draft - Estimated Tax Worksheet For Corporations - 2009 Page 2

ADVERTISEMENT

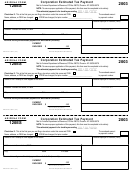

Arizona Form 120ES

Taxpayers whose Arizona corporate income tax liability for the

When to Make Estimated Tax Payments

preceding taxable year was less than $20,000 may elect voluntary

Calendar year and fi scal year basis taxpayers are required to make

participation in the electronic funds transfer program. Voluntary

their Arizona corporate estimated tax payments by the 15th day of the

participants in the program must complete the department’s electronic

4th, 6th, 9th, and 12th months of the taxable year. If the installment due

funds transfer authorization agreement at least 30 days prior to the

date falls on a weekend or legal holiday, the payment is considered

fi rst applicable transaction.

timely if made on the next business day.

Obtain additional information concerning the Arizona electronic funds

transfer program by contacting the EFT Helpline at (602) 542-2040

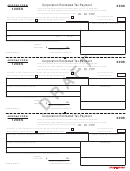

Computation of Required Installments of

in Phoenix or at (800) 572-7037 (toll-free). The FAX line is

Estimated Tax on Form 120W

(602) 716-7986.

Taxpayers should use Form 120W, Estimated Tax Worksheet for

Estimated Tax Payments via the Internet.

Corporations, to compute the amount of the required installments of

estimated tax.

Taxpayers must be licensed by the Department of Revenue before

they can register to pay taxes online. Visit to register

Underpayment of Required Installments of

and make estimated tax payments over the internet. If the taxpayer

Estimated Tax

makes its estimated tax payments via the internet, the taxpayer

If the taxpayer is required to make Arizona corporate estimated tax

should not submit Form 120ES to the department.

payments, a penalty will be imposed on any required installment that

is late or underpaid.

Electronic payment from checking or savings account

Estimated tax payments can be made electronically from a checking

Recomputing

Required

Installments

of

or savings account. Visit and choose the e-check

Estimated Tax

option. There is no fee to use this method. This payment method will

If the taxpayer, after paying one or more required installments of

debit the amount from the specifi ed checking or savings account on

estimated tax, fi nds that its tax liability for the taxable year will be

the date specifi ed. If an electronic payment is made from a checking

more or less than originally estimated, the taxpayer should recompute

or savings account, a confi rmation number will be generated. Please

its required installments. If earlier installments were underpaid, the

keep this confi rmation number as proof of payment.

taxpayer may be subject to a penalty for underpayment of estimated

tax.

Credit card payment

Estimated tax payments can be made via American Express, Discover,

If a new estimate is made, the required installments payable on or

MasterCard or VISA credit cards. Visit ww.aztaxes.gov and choose

after the date of the new estimate should be adjusted. An immediate

the credit card option. This will take you to the website of the credit

“catch-up” payment should be made to reduce the amount of any

card payment service provider. The service provider will charge a

penalty resulting from the underpayment of any earlier installments,

convenience fee based on the amount of the tax payment. The service

whether caused by a change in estimate, failure to make a payment,

provider will disclose the amount of the convenience fee during the

or a mistake.

transaction and the option to continue or cancel the transaction will be

Completing Form 120ES

presented. If you accept the convenience fee and complete the credit

card transaction, a confi rmation number will be generated. Please

Complete the form in its entirety to ensure the proper application of the

keep this confi rmation number as proof of payment.

estimated tax payment.

Who Is Required To Make Estimated Tax

Enter the following information on Form 120ES:

Payments

•

ending date of the taxable year for which the payment is made;

Entities fi ling Forms 99T, 120, 120A, and 120S that expect an Arizona

•

sequence number of the estimated tax payment;

tax liability for the taxable year of at least $1,000 are required to make

•

taxpayer name, address and employer identifi cation number

Arizona estimated tax payments.

(EIN) as it will appear on the tax return;

•

amount of the estimated tax payment (in whole dollars).

A unitary group of corporations fi ling a combined return on Form 120

must make estimated tax payments on a combined basis. Therefore, a

Check the applicable box on the form if the estimated tax payment

unitary group, as a single taxpayer, must make estimated tax payments

applies to a taxable year for which:

if its Arizona tax liability for the taxable year is at least $1,000.

•

the taxpayer will fi le an initial return under the name and EIN

An Arizona affi liated group fi ling a consolidated return pursuant to

listed; or

ARS § 43-947 on Form 120 must make estimated tax payments on a

•

the name, address or EIN listed is different from the name,

consolidated basis. Therefore, an Arizona affi liated group, as a single

address or EIN under which the preceding taxable year’s return

taxpayer, must make estimated tax payments if its Arizona tax liability

was fi led. If the EIN has changed, list the prior EIN.

for the taxable year is at least $1,000.

Rounding Dollar Amounts

Taxpayers must round amounts to the nearest whole dollar. If 50

cents or more, round up to the next dollar. If less than 50 cents, round

down.

DRAFT 8/20/08

DRAFT 8/20/08

ADOR 91-0027 (08)

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4