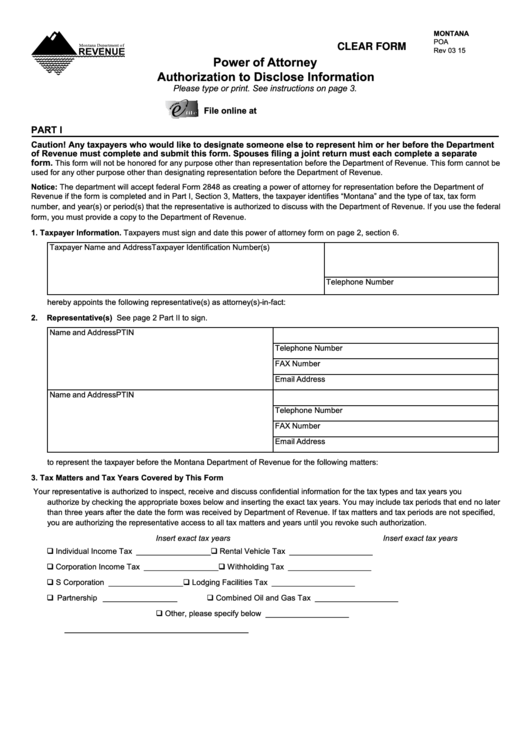

MONTANA

POA

CLEAR FORM

Rev 03 15

Power of Attorney

Authorization to Disclose Information

Please type or print. See instructions on page 3.

File online at revenue.mt.gov on TAP.

PART I

Caution! Any taxpayers who would like to designate someone else to represent him or her before the Department

of Revenue must complete and submit this form. Spouses filing a joint return must each complete a separate

form.

This form will not be honored for any purpose other than representation before the Department of Revenue. This form cannot be

used for any other purpose other than designating representation before the Department of Revenue.

Notice: The department will accept federal Form 2848 as creating a power of attorney for representation before the Department of

Revenue if the form is completed and in Part I, Section 3, Matters, the taxpayer identifies “Montana” and the type of tax, tax form

number, and year(s) or period(s) that the representative is authorized to discuss with the Department of Revenue. If you use the federal

form, you must provide a copy to the Department of Revenue.

1.

Taxpayer Information. Taxpayers must sign and date this power of attorney form on page 2, section 6.

Taxpayer Name and Address

Taxpayer Identification Number(s)

Telephone Number

hereby appoints the following representative(s) as attorney(s)-in-fact:

2.

Representative(s) See page 2 Part II to sign.

Name and Address

PTIN

Telephone Number

FAX Number

Email Address

Name and Address

PTIN

Telephone Number

FAX Number

Email Address

to represent the taxpayer before the Montana Department of Revenue for the following matters:

3.

Tax Matters and Tax Years Covered by This Form

Your representative is authorized to inspect, receive and discuss confidential information for the tax types and tax years you

authorize by checking the appropriate boxes below and inserting the exact tax years. You may include tax periods that end no later

than three years after the date the form was received by Department of Revenue. If tax matters and tax periods are not specified,

you are authorizing the representative access to all tax matters and years until you revoke such authorization.

Insert exact tax years

Insert exact tax years

q Individual Income Tax

_________________

Rental Vehicle Tax

___________________

q

q Corporation Income Tax

_________________

Withholding Tax

___________________

q

q S Corporation

_________________

Lodging Facilities Tax

___________________

q

q Partnership

_________________

Combined Oil and Gas Tax

___________________

q

Other, please specify below ___________________

q

__________________________________________

1

1 2

2