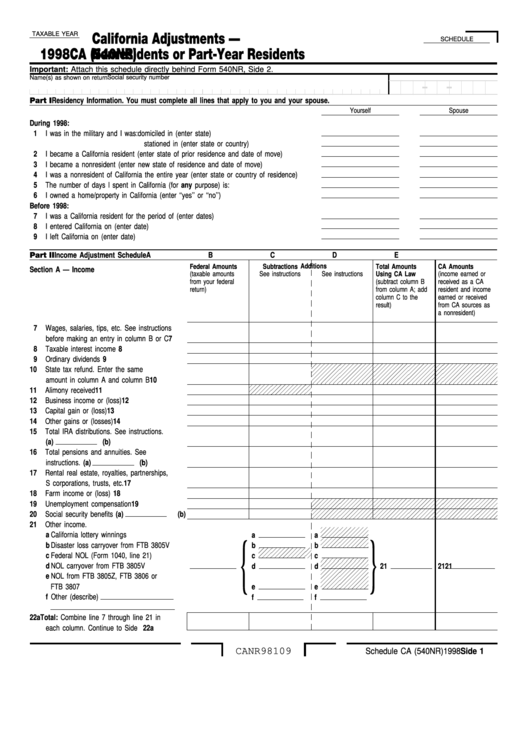

TAXABLE YEAR

California Adjustments —

SCHEDULE

1998

Nonresidents or Part-Year Residents

CA (540NR)

Important: Attach this schedule directly behind Form 540NR, Side 2.

Social security number

Name(s) as shown on return

Part I

Residency Information. You must complete all lines that apply to you and your spouse.

Yourself

Spouse

During 1998:

1

I was in the military and I was: domiciled in (enter state) . . . . . . . . . . . . . . . . . . .

stationed in (enter state or country) . . . . . . . . . . . . .

2

I became a California resident (enter state of prior residence and date of move) . . . . . . .

3

I became a nonresident (enter new state of residence and date of move) . . . . . . . . . . .

4

I was a nonresident of California the entire year (enter state or country of residence) . . . .

5

The number of days I spent in California (for any purpose) is: . . . . . . . . . . . . . . . . .

6

I owned a home/property in California (enter ‘‘yes’’ or ‘‘no’’) . . . . . . . . . . . . . . . . . . .

Before 1998:

7

I was a California resident for the period of (enter dates) . . . . . . . . . . . . . . . . . . . .

8

I entered California on (enter date) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

I left California on (enter date) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Part II Income Adjustment Schedule

A

B

C

D

E

Federal Amounts

Subtractions

Additions

Total Amounts

CA Amounts

Section A — Income

(taxable amounts

See instructions

See instructions

Using CA Law

(income earned or

from your federal

(subtract column B

received as a CA

return)

from column A; add

resident and income

column C to the

earned or received

result)

from CA sources as

a nonresident)

7

Wages, salaries, tips, etc. See instructions

before making an entry in column B or C

7

8

Taxable interest income . . . . . . . . . .

8

9

Ordinary dividends . . . . . . . . . . . . .

9

10

State tax refund. Enter the same

amount in column A and column B . . . .

10

11

Alimony received . . . . . . . . . . . . . .

11

12

Business income or (loss) . . . . . . . . .

12

13

Capital gain or (loss) . . . . . . . . . . . .

13

14

Other gains or (losses). . . . . . . . . . .

14

15

Total IRA distributions. See instructions.

(a)

. . . . . . . . . . . . .

(b)

16

Total pensions and annuities. See

instructions. (a)

. . . . . .

(b)

17

Rental real estate, royalties, partnerships,

S corporations, trusts, etc.. . . . . . . . .

17

18

Farm income or (loss) . . . . . . . . . . .

18

19

Unemployment compensation . . . . . . .

19

20

Social security benefits (a)

(b)

21

Other income.

a California lottery winnings

a

a

}

{

b Disaster loss carryover from FTB 3805V

b

b

c Federal NOL (Form 1040, line 21)

c

c

d NOL carryover from FTB 3805V

21

d

d

21

21

e NOL from FTB 3805Z, FTB 3806 or

FTB 3807

e

e

f Other (describe)

f

f

22a Total: Combine line 7 through line 21 in

each column. Continue to Side 2. . . .

22a

CANR98109

Schedule CA (540NR) 1998 Side 1

1

1 2

2