Form Ar1000dc - Disabled Individual Certificate - 2010

ADVERTISEMENT

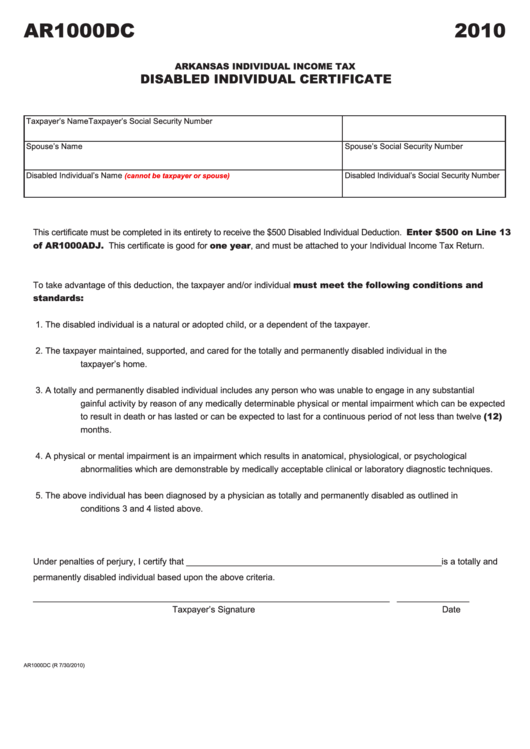

AR1000DC

2010

ARKANSAS INDIVIDUAL INCOME TAX

DISABLED INDIVIDUAL CERTIFICATE

Taxpayer’s Name

Taxpayer’s Social Security Number

Spouse’s Name

Spouse’s Social Security Number

Disabled Individual’s Name

Disabled Individual’s Social Security Number

(cannot be taxpayer or spouse)

This certificate must be completed in its entirety to receive the $500 Disabled Individual Deduction. Enter $500 on Line 13

of AR1000ADJ. This certificate is good for one year, and must be attached to your Individual Income Tax Return.

To take advantage of this deduction, the taxpayer and/or individual must meet the following conditions and

standards:

1. The disabled individual is a natural or adopted child, or a dependent of the taxpayer.

2. The taxpayer maintained, supported, and cared for the totally and permanently disabled individual in the

taxpayer’s home.

3. A totally and permanently disabled individual includes any person who was unable to engage in any substantial

gainful activity by reason of any medically determinable physical or mental impairment which can be expected

to result in death or has lasted or can be expected to last for a continuous period of not less than twelve (12)

months.

4. A physical or mental impairment is an impairment which results in anatomical, physiological, or psychological

abnormalities which are demonstrable by medically acceptable clinical or laboratory diagnostic techniques.

5. The above individual has been diagnosed by a physician as totally and permanently disabled as outlined in

conditions 3 and 4 listed above.

Under penalties of perjury, I certify that _____________________________________________________is a totally and

permanently disabled individual based upon the above criteria.

__________________________________________________________________________

_______________

Taxpayer’s Signature

Date

AR1000DC (R 7/30/2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1